In the world of global investments, the performance of stocks from different countries often sparks debates and discussions. One of the most popular comparisons is between China stocks and US stocks. This article aims to provide a comprehensive analysis of the performance of these two stock markets, highlighting key factors that might influence their respective growth and stability.

Understanding the Chinese Stock Market

The Chinese stock market, often referred to as the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), has been experiencing significant growth over the past few years. Driven by the country's rapid economic development and increasing consumer spending, Chinese stocks have become a popular choice for investors seeking high returns.

Performance of Chinese Stocks

In the past decade, Chinese stocks have shown impressive growth. For instance, the SSE Composite Index, which represents the overall performance of stocks listed on the Shanghai Stock Exchange, has seen a remarkable increase. However, it's important to note that this growth has been accompanied by volatility, with several periods of sharp declines.

One of the main factors contributing to the volatility in the Chinese stock market is the country's regulatory environment. The Chinese government has been implementing various policies to regulate the market, which can sometimes lead to sudden changes in market dynamics.

Understanding the US Stock Market

On the other hand, the US stock market, represented by indices like the S&P 500 and the NASDAQ, has a long history of stability and growth. The US stock market is known for its liquidity, diversity, and regulatory framework, which makes it a preferred destination for investors worldwide.

Performance of US Stocks

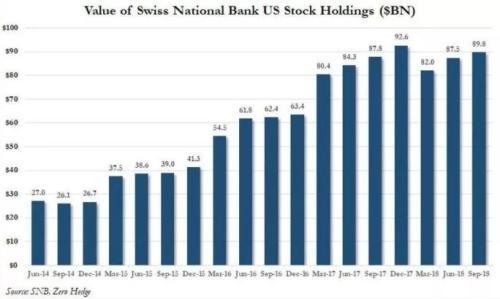

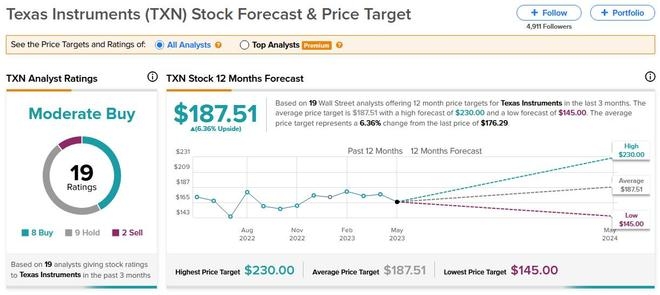

Over the past few years, US stocks have consistently outperformed their Chinese counterparts. The S&P 500, for example, has seen significant growth, with companies like Apple, Amazon, and Microsoft leading the charge. This growth can be attributed to the strong economic fundamentals of the US, including low unemployment rates, robust consumer spending, and a stable political environment.

Comparative Analysis

When comparing the performance of China stocks vs US stocks, several factors come into play. One of the most significant differences is the regulatory environment. The US stock market is known for its transparency and regulatory framework, which helps to mitigate risks and ensure stability. In contrast, the Chinese stock market is subject to more frequent regulatory changes, which can lead to volatility.

Another key factor is the economic environment. The US has a stable and diversified economy, which has been a major driver of its stock market's growth. China, on the other hand, is still in the process of economic transition, which can lead to fluctuations in market performance.

Case Studies

To better understand the performance of China stocks vs US stocks, let's look at some case studies. For instance, in 2018, the SSE Composite Index experienced a sharp decline of over 20%, primarily due to regulatory changes and concerns about the country's economic growth. In contrast, the S&P 500 saw minimal impact from these global events, maintaining its growth trajectory.

Conclusion

In conclusion, while both the Chinese and US stock markets offer unique opportunities for investors, their performance and stability vary significantly. Understanding the factors that influence these markets can help investors make informed decisions. Whether you prefer the volatility of the Chinese market or the stability of the US market, it's important to conduct thorough research and consider your investment goals before making any decisions.

GS YUASA CORP ORD: Revolutionizing the Batt? Us stock information