The ongoing China-US trade talks have been a hot topic in the financial world, particularly for those invested in stock futures. As the world's two largest economies, any developments in these negotiations can have significant ripple effects on global markets. This article delves into the impact of the China-US trade talks on stock futures, providing insights into how investors can navigate this volatile landscape.

The Current State of China-US Trade Talks

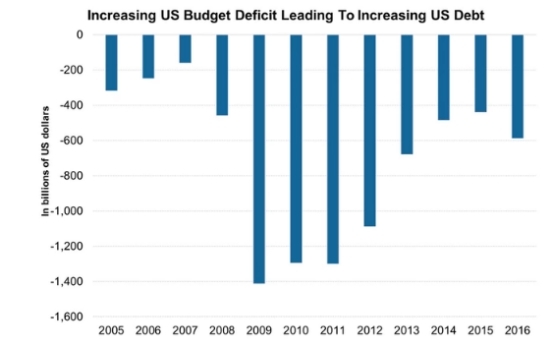

The trade war between China and the United States has been ongoing for over a year, with both sides imposing tariffs on each other's goods. The situation has been a source of uncertainty for investors, leading to fluctuations in stock futures. Recent talks have shown some progress, but there is still a long way to go before a comprehensive agreement can be reached.

Impact on Stock Futures

The China-US trade talks have had a significant impact on stock futures, with several key factors at play:

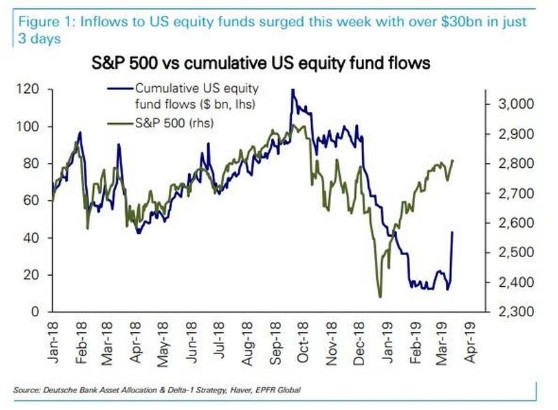

Equity Market Volatility: The uncertainty surrounding the trade negotiations has led to increased volatility in equity markets. This volatility has been particularly pronounced in sectors heavily reliant on trade, such as technology and consumer discretionary.

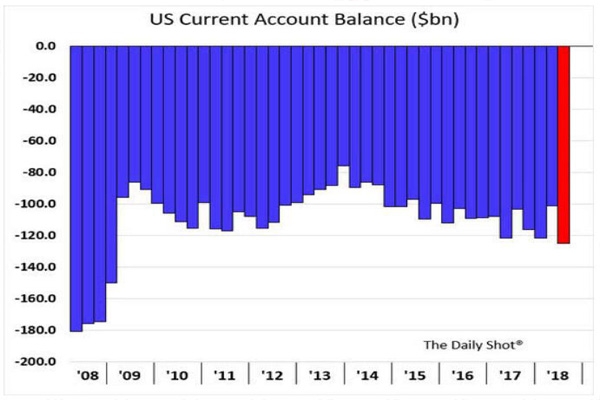

Currency Fluctuations: The trade talks have also influenced currency exchange rates, with the US dollar and the Chinese yuan experiencing significant movements. These fluctuations can have a direct impact on stock futures, as they affect the cost of imports and exports.

Sector Performance: Certain sectors have been more affected by the trade talks than others. For example, technology stocks have been hit hard due to the increased tariffs on Chinese imports. Conversely, sectors such as agriculture have seen opportunities arise, as the US looks to diversify its trade partnerships.

Case Studies

To illustrate the impact of the trade talks on stock futures, let's look at two case studies:

Apple Inc.: As one of the largest technology companies in the world, Apple has been significantly affected by the trade negotiations. The company's stock futures have seen volatility, with prices fluctuating based on the progress of the talks. Despite the challenges, Apple has managed to maintain its position as a market leader.

Caterpillar Inc.: Caterpillar, a major manufacturer of construction and mining equipment, has also been impacted by the trade talks. The company's stock futures have seen a decline due to the increased tariffs on Chinese imports. However, the company has diversified its supply chain, which has helped mitigate some of the negative effects.

Navigating the Volatile Landscape

Investors looking to navigate the volatile landscape of the China-US trade talks and stock futures should consider the following:

Diversification: Diversifying your portfolio can help mitigate the risks associated with the trade talks. Investing in sectors not directly affected by the negotiations can provide a level of stability.

Stay Informed: Keeping up-to-date with the latest developments in the trade talks is crucial. This will help you make informed decisions and adjust your portfolio accordingly.

Long-Term Perspective: While the short-term volatility can be unsettling, it's important to maintain a long-term perspective. The China-US trade talks are just one of many factors that can influence stock futures.

In conclusion, the China-US trade talks have had a significant impact on stock futures, leading to increased volatility and uncertainty. By staying informed and maintaining a diversified portfolio, investors can navigate this volatile landscape and potentially benefit from the opportunities that arise.

HELLENIQ ENGY HLDGS GDR: Unveiling the Powe? Us stock information