The Dow Jones Industrials, often simply referred to as the "Dow," is one of the most closely watched stock market indices in the world. Tracking the performance of 30 large, publicly-owned companies in the United States, it serves as a barometer for the overall health of the American economy. In this article, we delve into the Dow Jones Industrials today graph, analyzing its recent trends and providing insights into what they could mean for the future.

Understanding the Dow Jones Industrials Today Graph

The Dow Jones Industrials today graph is a visual representation of the index's performance over a specific period. It typically shows the closing prices of the index on a daily basis, with a line connecting each day's close. This graph is a powerful tool for investors and analysts alike, as it allows them to quickly identify trends and patterns in the index's behavior.

Recent Trends in the Dow Jones Industrials

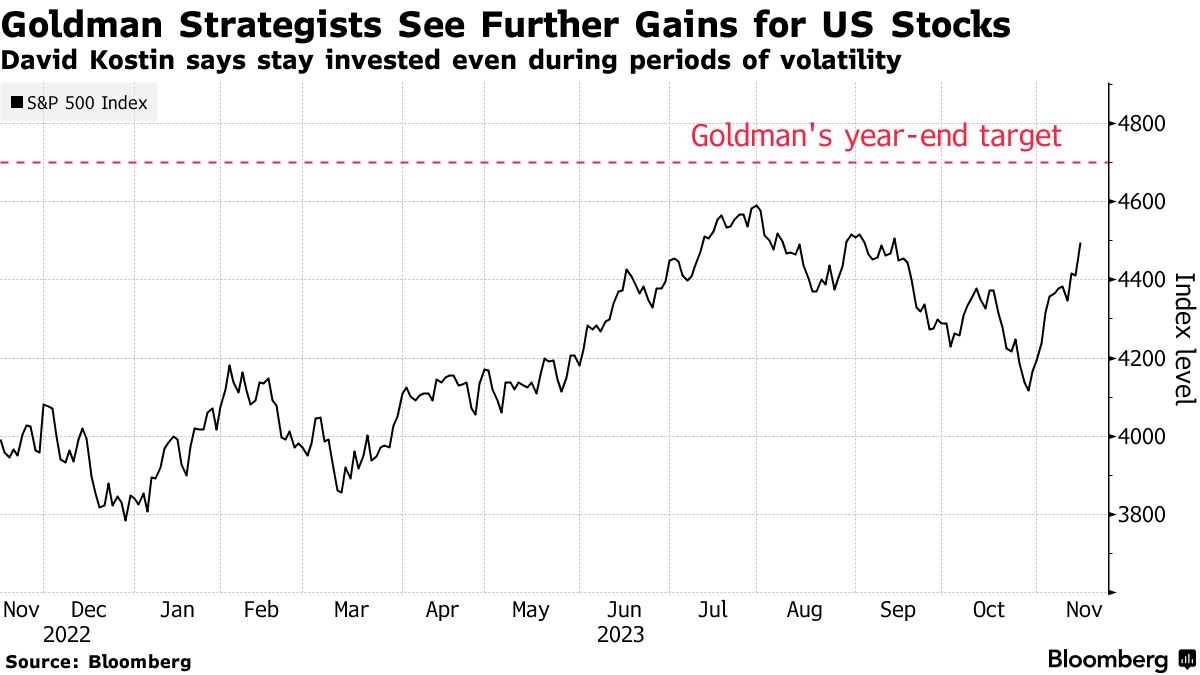

Over the past few months, the Dow Jones Industrials have experienced a rollercoaster of a ride. In the first half of the year, the index surged to record highs, fueled by strong corporate earnings and optimism about the economic recovery. However, as the year progressed, the index faced headwinds from rising inflation, supply chain disruptions, and concerns about the global economic outlook.

One particularly interesting trend in the Dow Jones Industrials today graph is the recent pullback. After reaching an all-time high of 36,796.92 in January 2022, the index has since fallen by nearly 10%. This decline has been driven by a variety of factors, including rising interest rates, concerns about corporate profitability, and geopolitical tensions.

Analyzing the Pullback

The pullback in the Dow Jones Industrials today graph can be attributed to several key factors. First, the Federal Reserve has been raising interest rates in an effort to combat inflation. Higher interest rates can make borrowing more expensive for companies, which can put a damper on their profitability and, by extension, their stock prices.

Second, supply chain disruptions have continued to affect the global economy, leading to higher prices for goods and services. This has put pressure on companies in the Dow Jones Industrials, which include a number of multinational corporations with significant global operations.

Finally, geopolitical tensions have been a significant source of uncertainty in the market. The ongoing conflict in Eastern Europe has raised concerns about the global economic outlook, leading to volatility in the stock market.

Case Studies: How Companies in the Dow Are Responding

To better understand the impact of these trends on the Dow Jones Industrials, let's look at a few case studies of companies within the index.

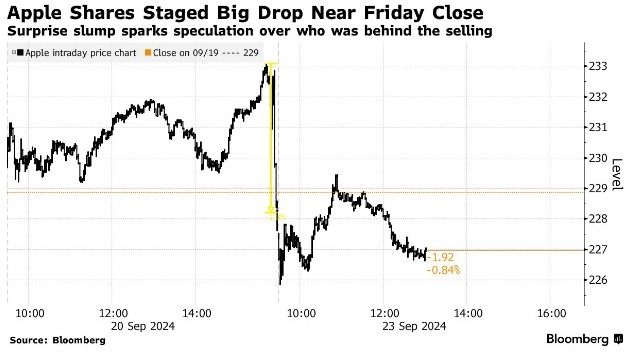

- Apple Inc.: As one of the largest companies in the Dow Jones Industrials, Apple has been a key driver of the index's performance. Despite the recent pullback, Apple has continued to report strong earnings and has been able to maintain its position as a market leader. This suggests that the company is well-positioned to weather the current economic challenges.

- Exxon Mobil Corporation: As an energy company, Exxon Mobil has been particularly affected by the recent rise in oil prices. However, the company has also been investing heavily in renewable energy, which could position it for future growth.

- Procter & Gamble: This consumer goods company has been able to maintain its position in the Dow Jones Industrials by focusing on cost-cutting and efficiency improvements. This has helped the company to offset some of the challenges posed by the current economic environment.

Conclusion

The Dow Jones Industrials today graph provides a valuable tool for investors and analysts to track the performance of the index and identify potential trends. While the recent pullback has been a concern for many, it's important to remember that the index has a history of resilience. By analyzing the factors driving the index's behavior and understanding the strategies of the companies within it, investors can make more informed decisions about their investments.

Advance Auto Parts Inc. Index Weighting Com? Us stock information