In the world of financial markets, the Dow Jones Weekly Chart is a cornerstone for investors and traders seeking to understand the broader market trends. This article delves into the significance of this chart, its construction, and how it can be used to make informed investment decisions.

Understanding the Dow Jones Weekly Chart

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. The Dow Jones Weekly Chart is a visual representation of the DJIA's performance over a seven-day period, providing investors with a snapshot of the market's overall health.

Constructing the Dow Jones Weekly Chart

The Dow Jones Weekly Chart is constructed using closing prices of the DJIA components for each trading day within the week. This chart typically includes a line graph that plots the closing prices, as well as various technical indicators that can help investors identify trends and potential trading opportunities.

Key Components of the Dow Jones Weekly Chart

Closing Prices: The most fundamental component of the Dow Jones Weekly Chart is the closing prices of the DJIA components. These prices represent the last transaction price for each stock on the final day of the trading week.

Moving Averages: Moving averages are a popular technical indicator used to smooth out price data over a specific period. They can help identify the direction of the market and provide signals for potential buying or selling opportunities.

Bollinger Bands: Bollinger Bands are another technical indicator that consists of a middle band, upper band, and lower band. These bands are calculated based on the standard deviation of the closing prices. They can help identify overbought or oversold conditions in the market.

Volume: Volume represents the number of shares traded during a specific period. High volume often indicates strong market sentiment, while low volume may suggest indecision or a lack of interest.

Analyzing the Dow Jones Weekly Chart

Analyzing the Dow Jones Weekly Chart involves examining various aspects of the chart, including:

Trends: Look for upward or downward trends in the closing prices. Upward trends may indicate a bullish market, while downward trends may suggest a bearish market.

Support and Resistance Levels: Identify key support and resistance levels on the chart. These levels represent price levels where the market has historically reversed direction.

Technical Indicators: Utilize technical indicators, such as moving averages and Bollinger Bands, to identify potential trading opportunities and confirm market trends.

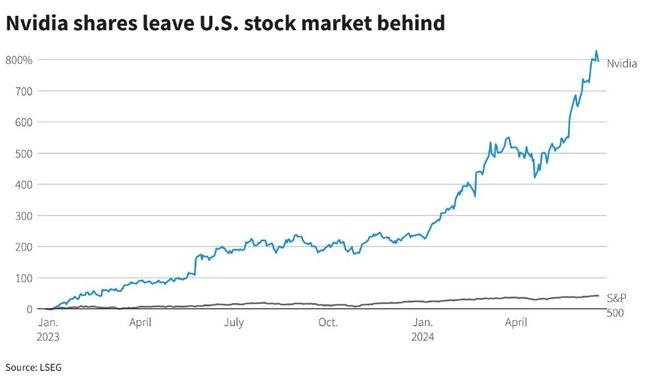

Case Study: The 2020 Stock Market Crash

One notable example of the Dow Jones Weekly Chart in action is the 2020 stock market crash. The chart clearly shows the sharp decline in the DJIA's closing prices during the early months of the year, followed by a subsequent recovery. By analyzing the chart during this period, investors could have identified the potential for a bearish trend and taken appropriate action.

Conclusion

The Dow Jones Weekly Chart is a valuable tool for investors and traders seeking to understand the broader market trends. By analyzing the chart's various components and indicators, investors can make more informed decisions and potentially increase their chances of success in the financial markets.

Artius II Acquisition Inc. RightsListing Re? Us stock information