In the dynamic world of finance, accurately estimating stock prices is a critical skill for investors and analysts alike. Whether you're a seasoned trader or just starting out, understanding the various methods to estimate stock prices can significantly impact your investment decisions. This article delves into the most effective strategies for stock price estimation, ensuring you make informed choices in the stock market.

Understanding the Basics

Before diving into the different methods, it's essential to understand the basic principles behind stock price estimation. Stock prices are influenced by various factors, including company fundamentals, market sentiment, and economic indicators. By analyzing these factors, investors can make more accurate predictions about a stock's future performance.

1. Fundamental Analysis

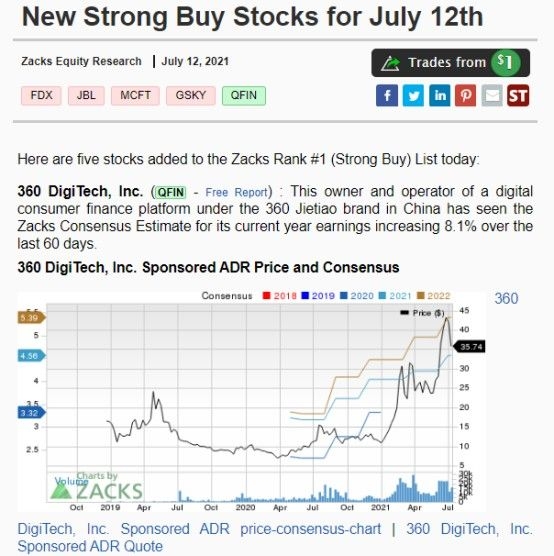

One of the most popular methods for estimating stock prices is fundamental analysis. This approach involves analyzing a company's financial statements, including its income statement, balance sheet, and cash flow statement. Key metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) are crucial in this analysis.

Example:

Let's say you're analyzing a tech company with an EPS of

2. Technical Analysis

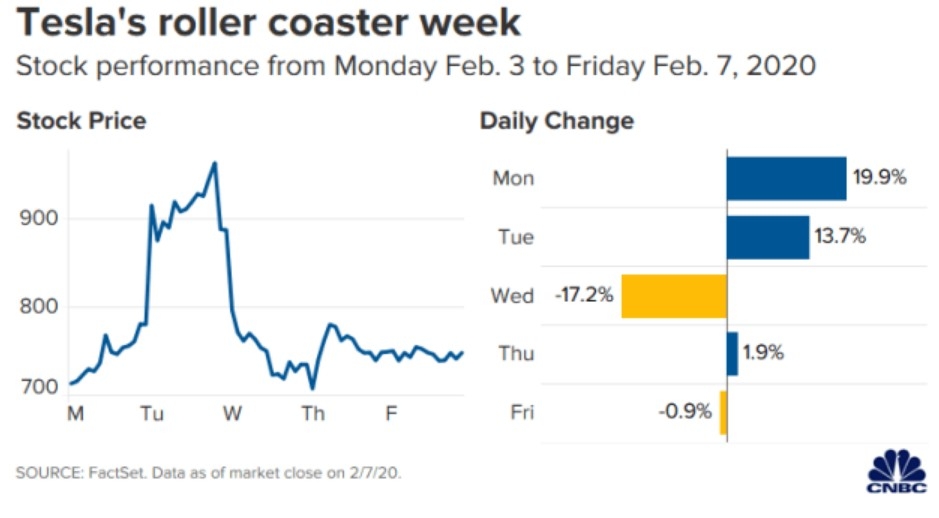

Technical analysis involves studying historical price and volume data to identify patterns and trends that can predict future price movements. Chart patterns, technical indicators, and oscillators are commonly used in this approach.

Example:

Consider a stock that has been forming a bullish trendline over the past few months. By analyzing the trendline and identifying key support and resistance levels, you can estimate potential price targets for the stock.

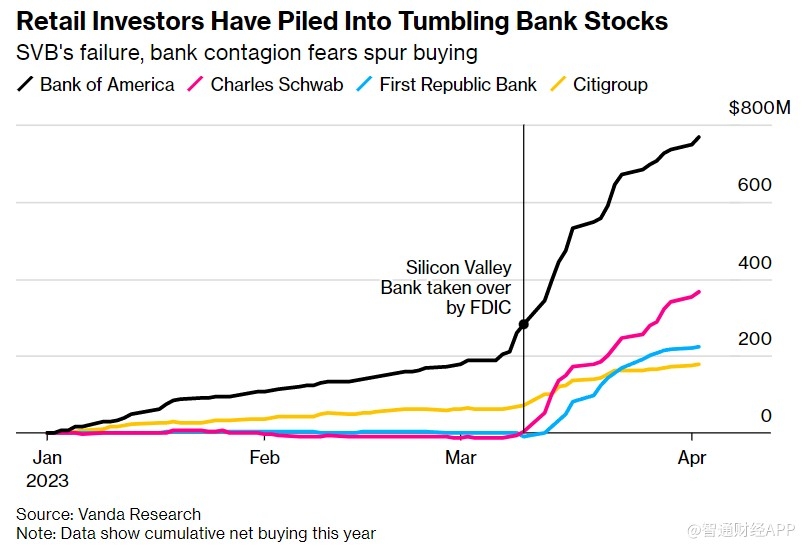

3. Market Sentiment Analysis

Market sentiment analysis involves gauging the overall mood of the market and its impact on stock prices. This can be done through various methods, including news analysis, social media sentiment, and investor surveys.

Example:

If a significant number of investors are bullish on a particular stock, it could lead to increased demand and, subsequently, a higher stock price.

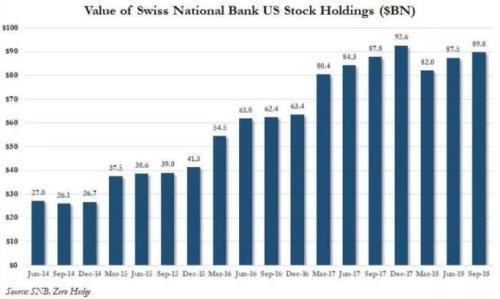

4. Discounted Cash Flow (DCF) Analysis

DCF analysis is a valuation method that estimates the present value of a company's future cash flows. This method is particularly useful for evaluating stocks with stable cash flow and predictable growth prospects.

Example:

To perform a DCF analysis, you would estimate the company's future cash flows, discount them back to the present using an appropriate discount rate, and then sum the present values to determine the intrinsic value of the stock.

Conclusion

Estimating stock prices is a complex task that requires a thorough understanding of various methodologies. By utilizing fundamental analysis, technical analysis, market sentiment analysis, and DCF analysis, investors can make more informed decisions and potentially achieve better returns. Remember, it's crucial to stay up-to-date with market trends and continuously refine your estimation techniques to stay ahead in the competitive world of finance.

ATA Creativity Global American Depositary S? Us stock information