Introduction

Investing in stocks has become an increasingly popular way for Americans to grow their wealth. With the rise of online brokerage platforms and the ease of access to financial markets, more and more people are jumping into the stock market. But just how many Americans are investing in stocks? In this article, we'll explore the number of people in the US who invest in stocks, the reasons behind this trend, and the impact it has on the financial landscape.

The Growing Number of Stock Investors

According to recent data, the number of Americans investing in stocks has been on the rise. A report by the Investment Company Institute (ICI) revealed that as of 2021, there were approximately 54.5 million U.S. households that owned stocks, either directly or through mutual funds, ETFs, or retirement accounts. This number has been steadily increasing over the years, with the number of investors growing by about 1.3 million annually.

Why Are More Americans Investing in Stocks?

There are several reasons why the number of stock investors in the U.S. has been on the rise:

Increased Financial Literacy: With more people becoming financially literate, they are more aware of the potential benefits of investing in stocks. They understand that investing can offer higher returns than traditional savings accounts and bonds.

Access to Online Brokers: Online brokerage platforms have made it easier for individuals to invest in stocks. Platforms like Robinhood, TD Ameritrade, and E*TRADE have lowered the barriers to entry by offering low or no minimum investment requirements and user-friendly interfaces.

Retirement Savings: As Americans become more focused on saving for retirement, they are turning to the stock market to grow their nest eggs. Many employers offer retirement plans like 401(k)s, which allow employees to invest in a mix of stocks and bonds.

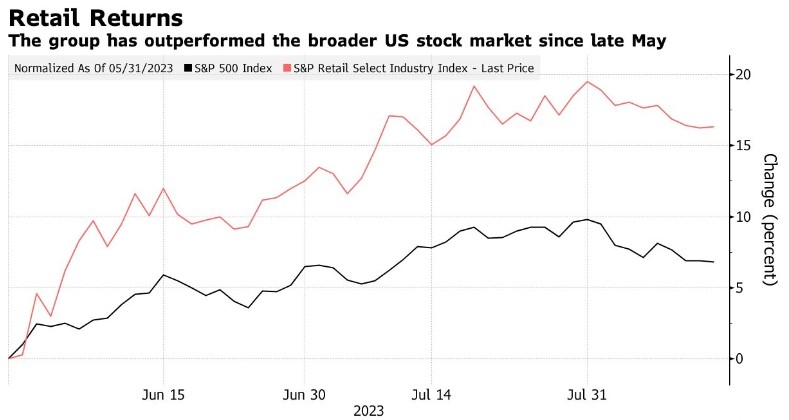

Market Performance: The stock market has experienced significant growth over the past few years, which has incentivized more people to invest. The S&P 500, for example, has seen a strong performance, with the index reaching new all-time highs.

Impact on the Financial Landscape

The growing number of stock investors has had a profound impact on the financial landscape:

Increased Market Liquidity: More investors mean more liquidity in the market, which can lead to more efficient price discovery and lower trading costs.

Diversification: As more people invest in stocks, the market becomes more diversified, reducing the risk of a major downturn affecting the entire market.

Economic Growth: Increased investment in the stock market can lead to higher levels of economic growth, as companies use the capital to expand and create jobs.

Case Study: The Rise of Millennial Investors

One interesting case study is the rise of millennial investors. This generation has been particularly active in the stock market, with many attributing their interest to the rise of online brokers and the influence of social media. A report by Charles Schwab found that 45% of millennials consider themselves investors, compared to just 28% of Gen Xers and 22% of Baby Boomers.

Conclusion

The number of people in the U.S. investing in stocks has been steadily increasing, driven by factors such as financial literacy, access to online brokers, and market performance. This trend has had a significant impact on the financial landscape, leading to increased market liquidity, diversification, and economic growth. As more Americans continue to invest in stocks, it's clear that the stock market will continue to play a crucial role in the financial well-being of individuals and the overall economy.

SDCLF Stock: A Comprehensive Analysis? Us stock information