As we navigate through the complexities of the financial landscape, it's crucial to have a clear understanding of the market outlook for US stocks in 2025. This article delves into the projected trends, potential risks, and opportunities that investors should be aware of as they plan their portfolios for the upcoming year.

Economic Growth and Corporate Earnings

One of the primary factors influencing the US stock market is economic growth. Experts predict that the US economy will continue to grow at a moderate pace in 2025, driven by factors such as low unemployment rates, strong consumer spending, and robust business investment. This economic growth is expected to translate into higher corporate earnings, which will likely boost stock prices.

Sector Performance

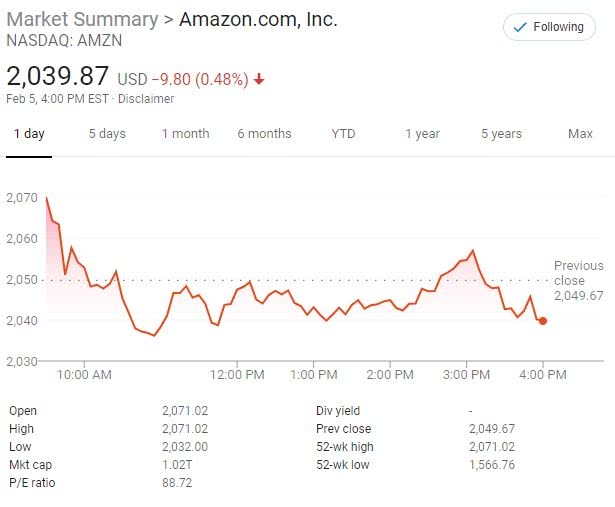

Different sectors are poised to perform differently in 2025. Technology stocks, particularly those in the cloud computing and artificial intelligence space, are expected to see significant growth. Companies like Amazon and Microsoft are likely to benefit from increased demand for cloud services and AI solutions.

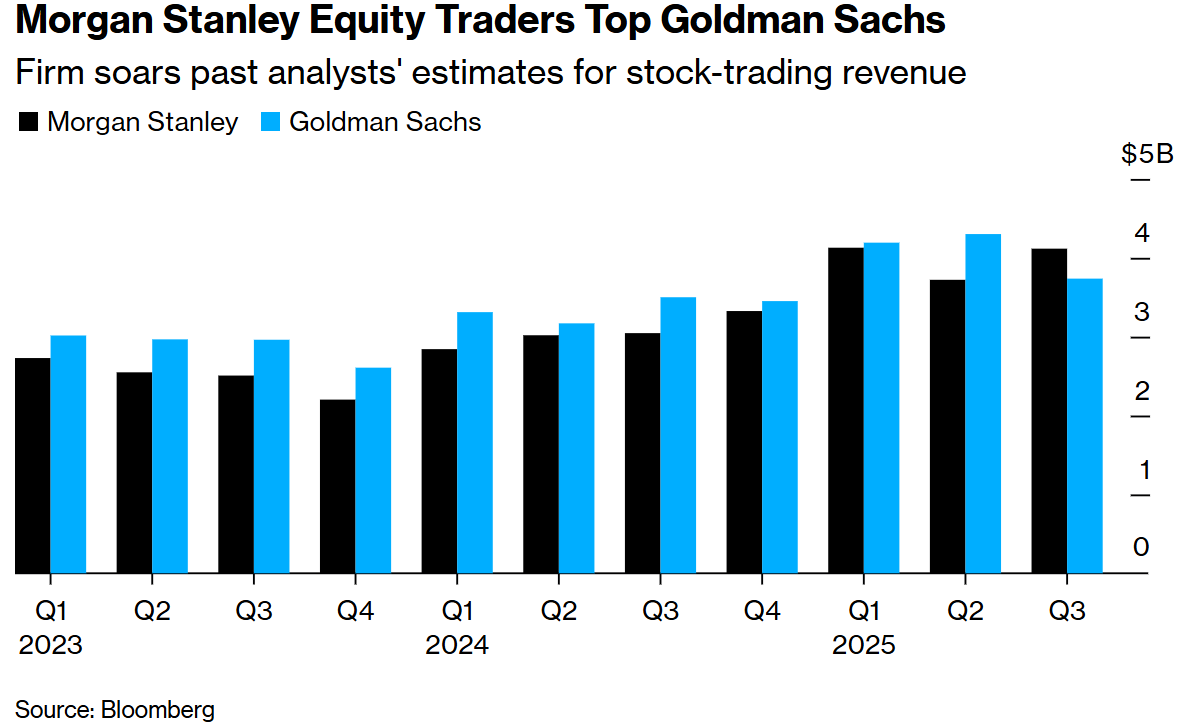

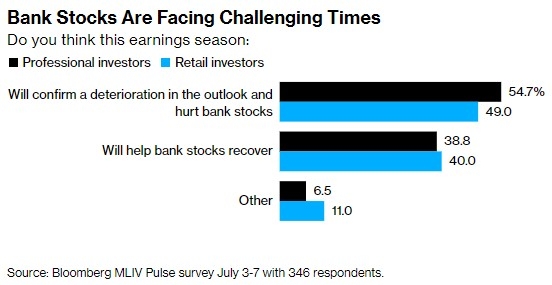

On the other hand, sectors like energy and financials may face challenges due to factors such as rising interest rates and geopolitical tensions. For instance, ExxonMobil and JPMorgan Chase may experience headwinds in the coming year.

Market Volatility

While the overall outlook for the US stock market in 2025 is positive, it's important to note that market volatility is likely to remain a factor. Factors such as trade tensions, political uncertainty, and changes in monetary policy can lead to significant market fluctuations. Investors should be prepared for these ups and downs and maintain a diversified portfolio to mitigate risk.

Investment Opportunities

Despite the potential challenges, there are several investment opportunities in the US stock market for 2025. One such opportunity lies in green energy stocks, as the transition to renewable energy continues to gain momentum. Companies like Tesla and SolarEdge are well-positioned to benefit from this trend.

Another promising area is biotechnology, with advancements in gene editing and personalized medicine. Companies like CRISPR Therapeutics and Vertex Pharmaceuticals are at the forefront of this field and could see significant growth in the coming years.

Case Study: Apple Inc.

A prime example of a company that is well-positioned for growth in 2025 is Apple Inc.. The tech giant has a strong track record of innovation and a diverse product portfolio, including smartphones, tablets, and computers. Apple's services segment, which includes Apple Music, iCloud, and Apple Pay, is also a significant source of revenue and growth.

In addition, Apple's strong financial position and commitment to returning value to shareholders through dividends and share buybacks make it an attractive investment for long-term investors.

Conclusion

The US stock market outlook for 2025 is promising, with opportunities in various sectors and investment opportunities. However, investors should remain vigilant about market volatility and be prepared to adjust their portfolios accordingly. By staying informed and making strategic investments, investors can position themselves for success in the coming year.

Buy Us Stocks from NSE: A Comprehensive Gui? Us stock information