Investing in U.S. stocks within a Tax-Free Savings Account (TFSA) can be a smart move for Canadian investors looking to diversify their portfolios and potentially maximize returns. But what exactly does it mean to invest in U.S. stocks within a TFSA, and how can you go about doing it effectively? This article will delve into the intricacies of investing in U.S. stocks within a TFSA, providing you with the knowledge and tools you need to make informed decisions.

Understanding the TFSA

First, let's clarify what a TFSA is. A TFSA is a tax-advantaged savings account available to Canadian residents. Contributions to a TFSA are not tax-deductible, but any investment growth, dividends, or interest earned within the account is tax-free. This means that you can withdraw funds from your TFSA at any time without incurring taxes on the gains.

Investing in U.S. Stocks within a TFSA

Investing in U.S. stocks within a TFSA can offer several benefits. For one, the U.S. stock market is one of the largest and most diversified in the world, providing access to a wide range of industries and sectors. Additionally, investing in U.S. stocks can help diversify your portfolio, as the U.S. market often performs differently from the Canadian market.

Choosing U.S. Stocks for Your TFSA

When selecting U.S. stocks for your TFSA, it's important to conduct thorough research. Consider the following factors:

- Company Financials: Look for companies with strong financials, including revenue growth, profit margins, and debt levels.

- Industry and Sector: Invest in industries and sectors that you are familiar with and that have long-term growth potential.

- Dividend Yield: Consider companies that offer a competitive dividend yield, as dividends can provide a regular source of income within your TFSA.

Investing in U.S. Stocks through a Brokerage

To invest in U.S. stocks within your TFSA, you'll need to open a brokerage account that allows you to trade U.S. stocks. Many Canadian brokers offer access to U.S. stocks, so be sure to compare fees, trading platforms, and customer service before choosing a brokerage.

Example Case Study: Apple Inc.

Let's consider an example of investing in Apple Inc. (AAPL) within a TFSA. Apple is a well-known technology company with a strong financial track record and a competitive dividend yield. By purchasing shares of Apple within your TFSA, you can benefit from potential growth in the company's stock price and receive dividends tax-free.

Risks to Consider

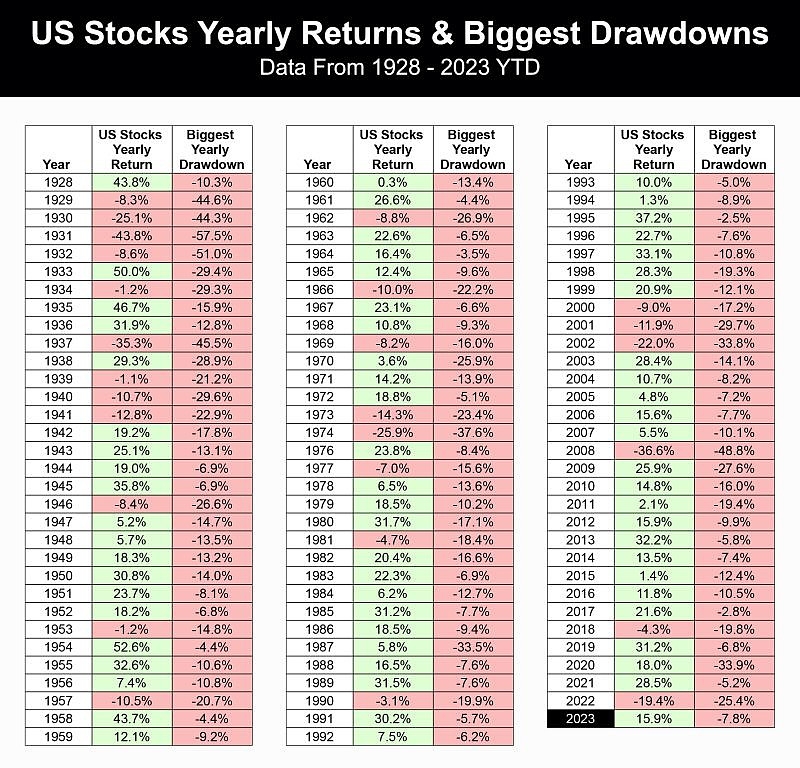

While investing in U.S. stocks within a TFSA can be beneficial, it's important to be aware of the risks involved. The U.S. stock market can be volatile, and investing in individual stocks carries the risk of loss. Additionally, currency fluctuations can impact the value of your investments when converting from U.S. dollars to Canadian dollars.

Conclusion

Investing in U.S. stocks within a TFSA can be a smart way to diversify your portfolio and potentially maximize returns. By conducting thorough research and choosing the right stocks, you can create a well-balanced TFSA portfolio that aligns with your investment goals and risk tolerance.

Trending US Stocks: What You Need to Know A? Us stock information