In the fast-paced world of financial markets, the NASDAQ Open is a term that has gained significant attention. But what exactly is it, and how does it compare to other market openings? This article delves into the intricacies of the NASDAQ Open, highlighting its unique features and benefits, and comparing it with other market openings.

Understanding the NASDAQ Open

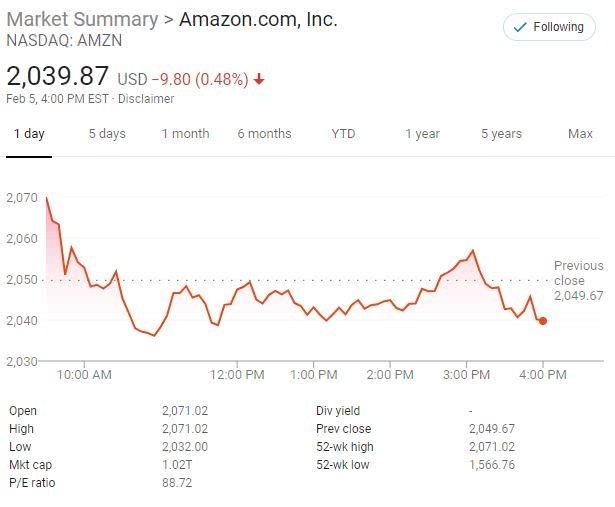

The NASDAQ Open is the opening session of the NASDAQ Stock Market. It commences at 9:30 AM (ET) and runs until 12:00 PM (ET). During this period, investors can trade stocks listed on the NASDAQ. The NASDAQ Open is known for its high trading volume and liquidity, making it a popular choice among traders and investors.

Unique Features of the NASDAQ Open

One of the key features of the NASDAQ Open is its extended trading hours. This allows investors to capitalize on market movements and execute trades before the regular trading session begins. Additionally, the NASDAQ Open offers a level playing field for all participants, ensuring fair and transparent trading.

Comparing the NASDAQ Open with Other Market Openings

When comparing the NASDAQ Open with other market openings, several factors come into play. Let's take a look at some of the key differences:

Trading Hours: The NASDAQ Open starts at 9:30 AM (ET) and ends at 12:00 PM (ET), whereas the regular trading session begins at 9:30 AM (ET) and concludes at 4:00 PM (ET). This extended trading window provides investors with more opportunities to execute trades.

Market Liquidity: The NASDAQ Open is known for its high liquidity, making it easier for investors to enter and exit positions. This is due to the large number of participants and the high trading volume during this period.

Market Impact: The NASDAQ Open can have a significant impact on the overall market sentiment. As one of the largest stock exchanges in the world, the NASDAQ has the power to influence market trends and movements.

Investor Access: The NASDAQ Open is open to all investors, including retail and institutional traders. This ensures a level playing field for all participants.

Case Study: NASDAQ Open vs. NYSE Opening

Let's consider a hypothetical scenario to understand the difference between the NASDAQ Open and the New York Stock Exchange (NYSE) opening. Suppose a major tech company announces its earnings during the NASDAQ Open. This announcement can have a significant impact on the stock's price, as the NASDAQ Open offers a larger trading window for investors to react to the news.

In contrast, if the same announcement were made during the NYSE opening, the impact on the stock's price might be less pronounced. This is because the NYSE opening has a shorter trading window, and investors have less time to react to the news.

Conclusion

The NASDAQ Open is a unique market opening that offers several advantages to investors. Its extended trading hours, high liquidity, and significant market impact make it a popular choice among traders and investors. By understanding the key differences between the NASDAQ Open and other market openings, investors can make informed decisions and capitalize on market opportunities.

SFES Stock: The Ultimate Guide to Understan? Us stock information