In recent years, the US stock market has become an increasingly popular destination for international investors. One such group of investors is those interested in Russian stocks. Trading Russian stocks in the US offers a unique opportunity to diversify a portfolio and gain exposure to the dynamic Russian economy. This article provides a comprehensive guide to trading Russian stocks in the US, including the benefits, risks, and key considerations.

Understanding Russian Stocks

Russian stocks are shares of companies listed on the Moscow Exchange, the largest stock exchange in Russia. The market is home to a variety of industries, including energy, mining, finance, and telecommunications. Some of the most well-known Russian companies include Gazprom, Rosneft, and Sberbank.

Benefits of Trading Russian Stocks in the US

1. Diversification: Investing in Russian stocks can provide diversification to a US-based portfolio, as the Russian market often moves independently of the US market.

2. Access to High-Growth Companies: The Russian market is known for its high-growth companies, particularly in the energy and commodities sectors.

3. Currency Exposure: Investing in Russian stocks can provide exposure to the Russian ruble, which can be beneficial if the currency strengthens against the US dollar.

Risks of Trading Russian Stocks in the US

1. Political Risk: Russia's political environment can be unpredictable, which can impact the performance of Russian stocks.

2. Regulatory Risk: Russian companies may face regulatory challenges, which can affect their operations and financial performance.

3. Currency Risk: Fluctuations in the Russian ruble can impact the returns on Russian stocks.

Key Considerations for Trading Russian Stocks in the US

1. Research: Conduct thorough research on Russian companies and the market before investing. Consider factors such as financial health, management quality, and market trends.

2. Brokerage: Choose a brokerage that offers access to Russian stocks. Some brokers specialize in international stocks and can provide valuable resources and support.

3. Risk Management: Implement risk management strategies to protect your investment. This may include diversifying your portfolio, setting stop-loss orders, and staying informed about market developments.

Case Studies

1. Gazprom: Gazprom is one of the largest natural gas companies in the world and is listed on the Moscow Exchange. The company has faced political and regulatory challenges, but has also experienced significant growth over the years.

2. Sberbank: Sberbank is Russia's largest bank and is listed on the Moscow Exchange. The bank has a strong presence in the Russian market and has been able to weather economic downturns and political uncertainty.

Conclusion

Trading Russian stocks in the US can offer a unique opportunity for investors looking to diversify their portfolios and gain exposure to the dynamic Russian economy. However, it is important to conduct thorough research, understand the risks, and implement effective risk management strategies. By doing so, investors can potentially benefit from the growth and opportunities offered by Russian stocks.

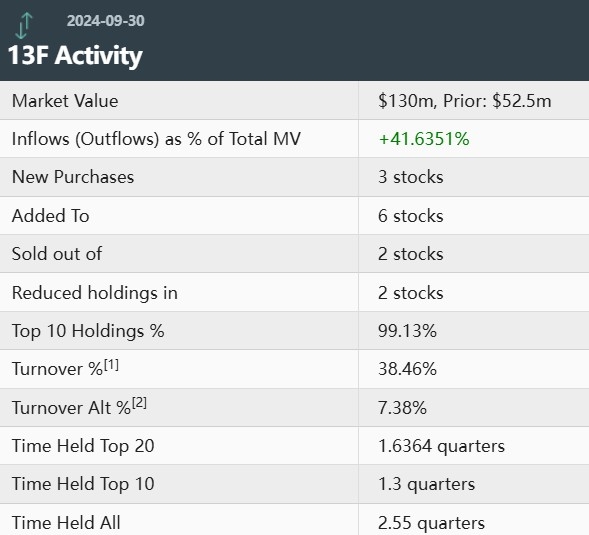

NORTHFIELD CAPITAL CP A Stock Channels: A C? Us stock information