Investing in the stock market can be a lucrative venture for individuals around the world. However, for non-US citizens, navigating the complexities of the US stock market can be daunting. This guide will provide a comprehensive overview of stock investing for non-US citizens, covering everything from opening a brokerage account to understanding the tax implications.

Opening a Brokerage Account

The first step in investing in the US stock market is opening a brokerage account. Non-US citizens have several options when it comes to choosing a brokerage firm. Many major brokerage firms, such as Charles Schwab, Fidelity, and TD Ameritrade, offer accounts for international investors. It's important to research and compare different brokerage firms to find one that meets your needs and complies with the regulations of your home country.

Understanding the Tax Implications

One of the most important aspects of investing for non-US citizens is understanding the tax implications. The US government requires non-resident aliens to report their US-source income, including dividends and interest from US stocks. The tax rate for non-residents is generally 30%, although it may be reduced under certain tax treaties.

Types of Stocks Available to Non-US Citizens

Non-US citizens have access to a wide range of stocks, including US-listed stocks and foreign stocks. US-listed stocks are those that are traded on US exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq. Foreign stocks are those of companies based in other countries and are typically traded on foreign exchanges.

Investing Strategies for Non-US Citizens

Just like US citizens, non-US citizens can employ various investment strategies when investing in the stock market. Some popular strategies include:

- Diversification: Investing in a variety of stocks across different sectors and countries can help reduce risk.

- Value Investing: This strategy involves identifying undervalued stocks and holding them for the long term.

- Growth Investing: This strategy focuses on investing in companies with high growth potential.

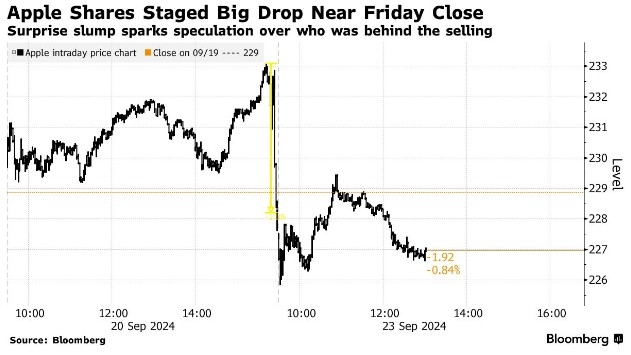

Case Study: Investing in Apple (AAPL)

Let's say a non-US citizen is interested in investing in Apple (AAPL), one of the most valuable companies in the world. They would need to open a brokerage account that allows them to trade US-listed stocks. Once the account is set up, they can purchase Apple shares just like any other investor.

Conclusion

Investing in the US stock market can be a rewarding experience for non-US citizens. By understanding the process and taking the necessary precautions, you can start building a diversified portfolio of stocks. Remember to research and compare brokerage firms, understand the tax implications, and choose a strategy that aligns with your investment goals.

CONVIVIO: The Art of Modern Dining Experien? Us stock information