In the ever-evolving landscape of the stock market, consumer discretionary stocks have always been a beacon for investors seeking high growth and profitability. These companies cater to the wants and needs of consumers, often leading the charge in economic recoveries. In this article, we will delve into the top consumer discretionary stocks in the US, offering insights into their potential for growth and investment opportunities.

Luxury Fashion Brands: The Ultimate Status Symbol

One of the most sought-after sectors within the consumer discretionary space is luxury fashion. Brands such as Louis Vuitton, Gucci, and Burberry have long been at the forefront of this industry. As the global economy recovers, these companies are expected to see a surge in demand for their high-end products. Louis Vuitton, for instance, has seen a significant increase in sales, driven by a strong brand image and a growing middle class in emerging markets.

Home Improvement: A Home for Growth

Home improvement stocks have also been a hot ticket item in the consumer discretionary sector. With the housing market on the rise, companies like Home Depot and Lowe's have seen a surge in sales. As homeowners invest in home renovations and upgrades, these companies stand to benefit greatly. Home Depot has been particularly impressive, with its expansion into international markets and a focus on online sales.

Automotive: The Wheels of Progress

The automotive industry is another key player in the consumer discretionary space. With the rise of electric vehicles (EVs) and autonomous driving technology, companies like Tesla and Ford are at the forefront of innovation. Tesla, in particular, has been a game-changer, revolutionizing the automotive industry with its cutting-edge technology and strong brand presence. As the world transitions to EVs, these companies are poised for significant growth.

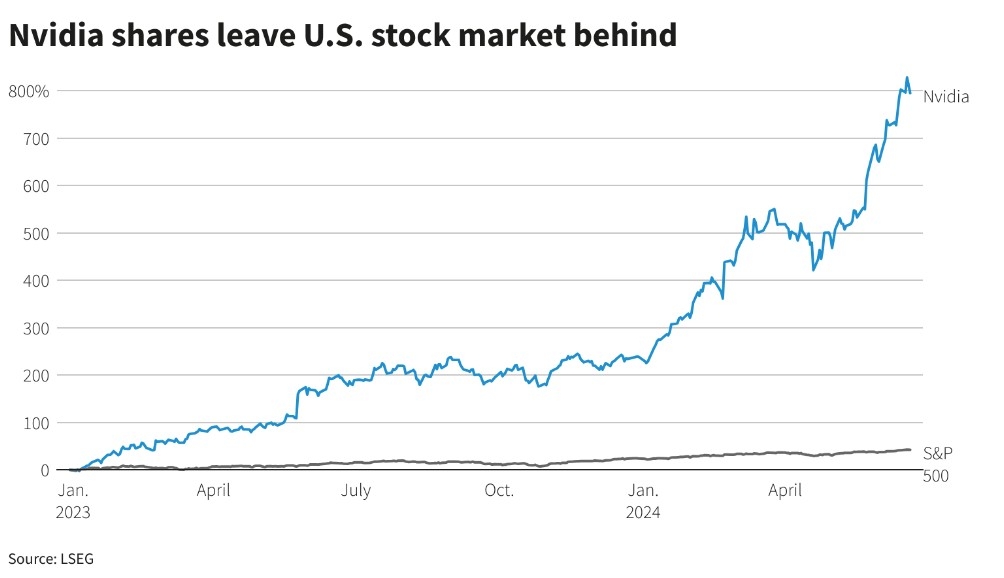

Technology: The Future is Now

In the tech sector, companies like Apple and Amazon have become synonymous with consumer discretionary stocks. These companies have not only revolutionized the way we live, but have also created a culture of brand loyalty and customer satisfaction. Apple, with its line of iPhones, iPads, and Macs, has become an essential part of our daily lives. Similarly, Amazon has transformed the retail industry with its innovative approach to online shopping and logistics.

Case Study: Netflix – The Streaming Giant

One notable example of a successful consumer discretionary stock is Netflix. The streaming giant has disrupted the entertainment industry, replacing traditional cable and satellite TV with its vast library of original content. As more consumers embrace the convenience of streaming, Netflix has seen a steady increase in subscribers, making it one of the most valuable companies in the world.

In conclusion, investing in the top consumer discretionary stocks in the US can offer significant growth potential. From luxury fashion brands to home improvement and technology companies, these sectors are poised for continued success as the global economy recovers. As always, it's important to do thorough research and consult with a financial advisor before making any investment decisions.

Artius II Acquisition Inc. Class A Ordinary? Us stock information