In today's fast-paced financial world, understanding the total stocks in the US is crucial for investors and market enthusiasts. This article provides a comprehensive overview of the current state of the US stock market, including key statistics, major indices, and notable trends.

Understanding the Total Stocks in the US

The total number of stocks in the US refers to the total number of shares issued by all publicly traded companies. As of the latest data, there are over 3,800 companies listed on the New York Stock Exchange (NYSE) and the NASDAQ, totaling more than 7,500 stocks.

Major Stock Indices

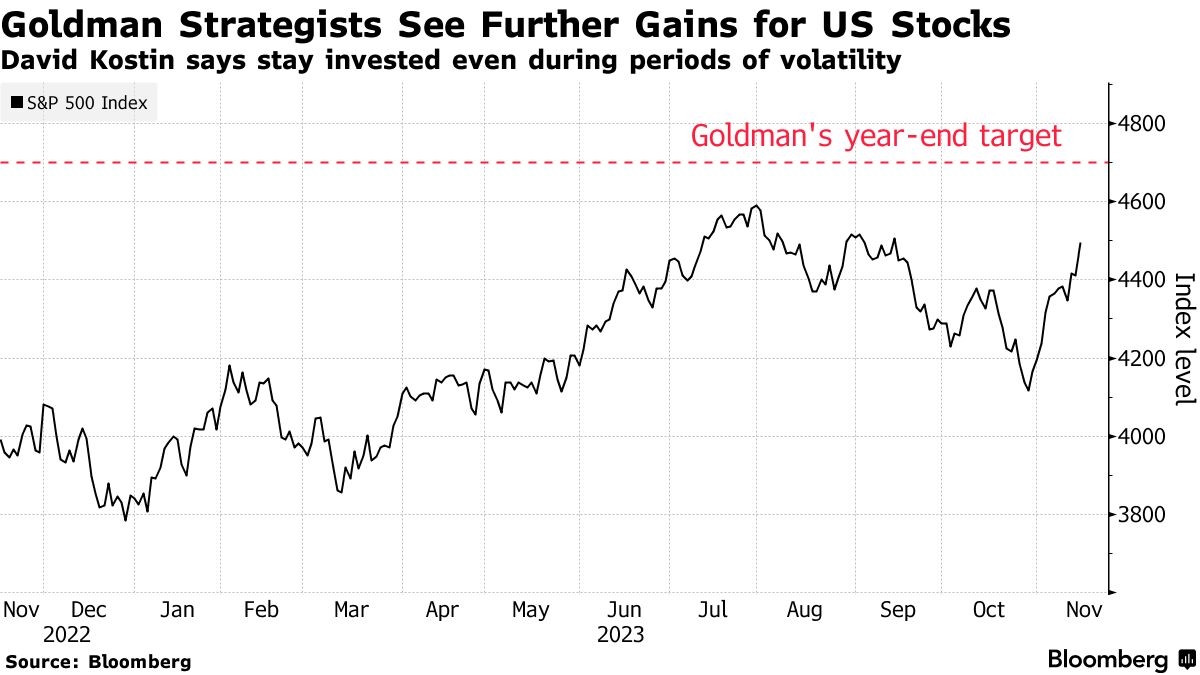

The performance of the US stock market is often measured by major stock indices such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices represent a broad range of companies across various sectors, making them valuable tools for investors to gauge the overall market's health.

S&P 500: This index includes the top 500 companies listed on the NYSE and NASDAQ, representing approximately 80% of the total market capitalization of all US stocks. The S&P 500 is widely considered a benchmark for the US stock market's performance.

Dow Jones Industrial Average (DJIA): This index consists of 30 large, publicly-owned companies and is often used as a gauge of the overall performance of the US stock market.

NASDAQ Composite: This index includes all domestic and international companies listed on the NASDAQ, making it one of the most comprehensive indices for technology stocks.

Recent Trends in the US Stock Market

Over the past few years, the US stock market has seen several notable trends:

Rising Market Capitalization: The total market capitalization of US stocks has reached an all-time high, with the S&P 500 surpassing $35 trillion in 2021.

Tech Stocks Leading the Charge: Technology stocks, particularly those listed on the NASDAQ, have been driving much of the growth in the US stock market. Companies like Apple, Microsoft, and Amazon have seen significant gains in recent years.

Dividend Yield: Dividend yields have been relatively low in recent years, as companies have focused on reinvesting profits back into their businesses rather than distributing them to shareholders.

Case Studies

Apple Inc.: As one of the largest companies in the world, Apple has been a significant driver of the US stock market's growth. Its market capitalization has surpassed $2 trillion, making it the first publicly traded company to reach that milestone.

Tesla, Inc.: Tesla has become a symbol of the rapid growth of the electric vehicle industry. Its stock has seen massive gains in recent years, with its market capitalization surpassing $1 trillion in 2021.

In conclusion, understanding the total stocks in the US is essential for anyone looking to invest or stay informed about the financial markets. With a diverse range of companies and indices, the US stock market offers numerous opportunities for investors to capitalize on various sectors and trends.

KYOCY Stock: A Deep Dive into the Investmen? Us stock information