In today's volatile financial markets, keeping a close eye on the stock prices of major US banks is crucial for investors and financial enthusiasts alike. The stock prices of these institutions can reflect a variety of factors, from economic conditions to regulatory changes. This article delves into a comprehensive analysis of the US banks stock prices, providing insights and an outlook for the future.

Understanding the Factors Influencing Stock Prices

The stock prices of US banks are influenced by a multitude of factors. One of the most significant factors is the overall economic health of the country. During periods of economic growth, banks tend to see an increase in their stock prices as they benefit from higher lending and investment activities. Conversely, during economic downturns, bank stock prices may decline due to reduced lending and increased defaults.

Another critical factor is the regulatory environment. Changes in regulations, such as the implementation of the Dodd-Frank Act, can have a substantial impact on the profitability and stability of banks. Additionally, the Federal Reserve's policies, including interest rates and bank reserve requirements, can also affect stock prices.

Recent Trends in US Banks Stock Prices

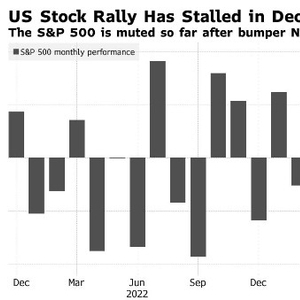

In recent years, the stock prices of US banks have experienced significant fluctuations. For instance, in the aftermath of the 2008 financial crisis, many bank stocks plummeted as investors lost confidence in the industry. However, since then, the stock prices of major banks have largely recovered, with some even reaching record highs.

One notable trend has been the increasing focus on technology within the banking sector. Many banks have been investing heavily in digital transformation initiatives, which have helped improve efficiency and customer satisfaction. As a result, investors have shown a growing interest in tech-savvy banks, leading to higher stock prices.

Case Study: JPMorgan Chase

To illustrate the impact of various factors on stock prices, let's consider the case of JPMorgan Chase, one of the largest banks in the United States. In 2019, JPMorgan Chase reported a strong quarterly earnings report, which included a significant increase in net income. As a result, the bank's stock price surged, reflecting the positive impact of the company's financial performance.

However, in 2020, the COVID-19 pandemic caused a sharp decline in the stock market, and JPMorgan Chase was no exception. The bank's stock price fell by approximately 30% during the first quarter of the year. This decline can be attributed to the uncertainty surrounding the economic outlook and the potential impact of the pandemic on the banking industry.

Outlook for the Future

Looking ahead, the stock prices of US banks are expected to be influenced by a variety of factors, including economic conditions, regulatory changes, and technological advancements. While the economic outlook remains uncertain, many experts believe that the US banking sector is well-positioned to navigate the challenges ahead.

One potential area of growth is in the area of digital banking. As consumers increasingly prefer digital banking solutions, banks that invest in technology and offer innovative services are likely to see higher stock prices. Additionally, as the economy continues to recover, banks that can effectively manage risk and generate strong earnings are expected to outperform their peers.

In conclusion, the stock prices of US banks are influenced by a complex interplay of economic, regulatory, and technological factors. By understanding these factors and analyzing recent trends, investors can gain valuable insights into the future of the banking industry.

Title: 1ST COLONIAL BANCORP INC: A Pivotal ? Us stock information