The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most widely followed stock market indices in the world. Over the years, it has seen numerous peaks and troughs, with some periods being particularly memorable. In this article, we delve into the question, "What was the Dow Jones high?" by examining its historical highs and analyzing the factors that contributed to these milestones.

Historical Highs: A Timeline

The Dow Jones Industrial Average was first published on May 26, 1896, with an initial value of 40.94 points. Since then, it has reached several all-time highs, each representing significant milestones in the market's history.

- 1906 High: The first major high for the Dow came in 1906, reaching 120.76 points. This period was marked by the rapid expansion of the railroad industry and the growth of the U.S. economy.

- 1929 High: The Dow's next major high occurred in 1929, reaching a peak of 381.17 points. This period was known as the Roaring Twenties, characterized by an unprecedented economic boom and a surge in stock prices.

- 1972 High: The Dow reached another significant milestone in 1972, hitting 1,003.16 points. This period was marked by the end of the Vietnam War and the beginning of an era of economic stability.

- 1999 High: The Dow's next major high came in 1999, reaching an all-time peak of 11,722.98 points. This period was characterized by the rapid growth of the technology sector, particularly the dot-com bubble.

- 2007 High: The Dow reached another significant high in 2007, hitting 14,164.53 points. This period was marked by a strong economic recovery and a surge in consumer spending.

Factors Contributing to Highs

Several factors have contributed to the Dow Jones' high points throughout history.

- Economic Growth: The overall growth of the U.S. economy has played a significant role in driving the Dow higher. As the economy expands, companies generate more revenue, leading to higher stock prices.

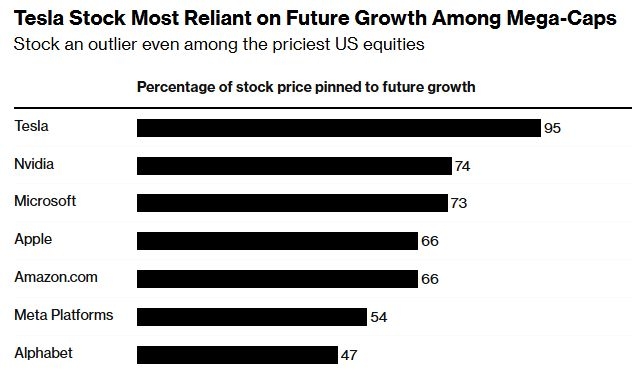

- Technological Advancements: The rise of technology has been a major driver of the Dow's growth. Companies in the technology sector, such as Apple and Microsoft, have contributed significantly to the index's performance.

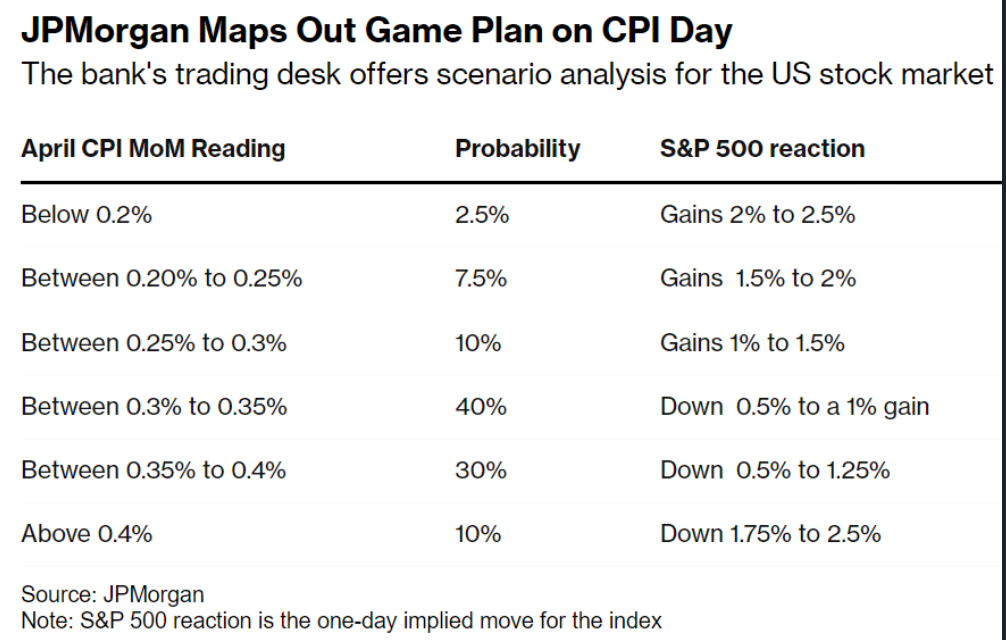

- Monetary Policy: The Federal Reserve's monetary policy has also played a crucial role in the Dow's highs. Lower interest rates and easy access to credit can stimulate economic growth and boost stock prices.

- Market Sentiment: Investor confidence and market sentiment can also drive the Dow higher. When investors are optimistic about the market's future, they are more likely to buy stocks, leading to higher prices.

Case Study: The Dot-Com Bubble

One of the most notable instances of the Dow reaching a high was during the dot-com bubble in 1999. At the time, investors were excited about the potential of the internet and technology companies. This excitement led to a surge in stock prices, pushing the Dow to an all-time high of 11,722.98 points.

However, the bubble eventually burst in 2000, leading to a significant decline in stock prices. This event serves as a reminder of the importance of conducting thorough research and avoiding excessive optimism when investing.

In conclusion, the Dow Jones Industrial Average has reached several historical highs throughout its existence. These highs have been driven by various factors, including economic growth, technological advancements, and market sentiment. By understanding the factors that contribute to these milestones, investors can better navigate the stock market and make informed decisions.

Blackrock MuniYield New York Quality Fund I? Us stock information