The year 2020 was a tumultuous one for the global economy, and the United States stock market was no exception. From the COVID-19 pandemic to the subsequent market crashes and recoveries, the year presented investors with unprecedented challenges and opportunities. In this article, we'll take a comprehensive look at the 2020 US stock market, analyzing key trends, major events, and the impact on various sectors.

COVID-19 Pandemic and Market Crash

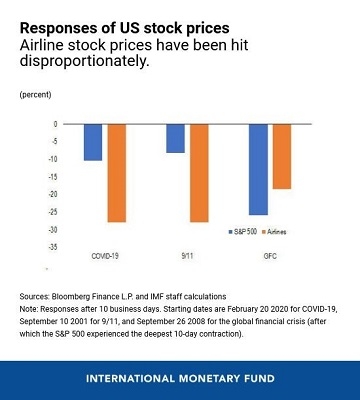

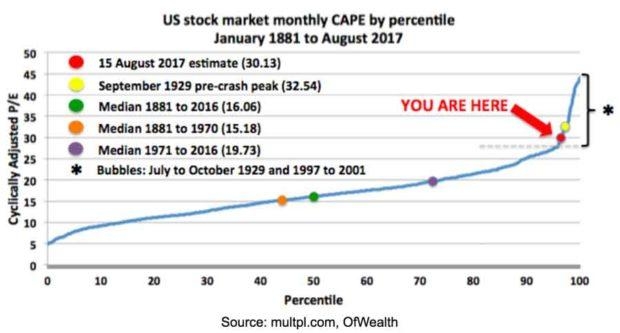

The outbreak of the COVID-19 pandemic in early 2020 sent shockwaves through the global economy. The US stock market, which had been on a bull run for years, suffered its worst drop in history. The S&P 500 index plummeted by over 30% from its all-time high in February to its lowest point in March.

Government Stimulus and Market Recovery

Amidst the chaos, the US government stepped in with unprecedented stimulus measures. The Federal Reserve lowered interest rates to near-zero and launched a series of bond buying programs to stabilize the market. These measures, along with widespread vaccination campaigns, helped the US stock market recover significantly by the end of the year.

Technology Stocks Dominate

One of the most notable trends in the 2020 US stock market was the rise of technology stocks. Companies like Apple, Amazon, and Microsoft saw their share prices soar as more people worked from home and turned to digital services. The technology sector accounted for over 30% of the S&P 500's total market value by the end of the year.

Value Stocks Make a Comeback

In contrast to the technology sector, value stocks, which had been underperforming for years, made a comeback in 2020. This was partly due to the Fed's stimulus measures, which benefited companies with high debt levels and significant cash reserves. Companies like Johnson & Johnson and Procter & Gamble saw their share prices rise significantly.

Sector Performance

Several sectors performed exceptionally well in 2020. The healthcare sector, driven by the demand for COVID-19 vaccines and treatments, saw its share prices surge. The consumer discretionary sector also performed well, as consumers spent more on home goods and electronics during the pandemic.

Major Events

Several major events impacted the US stock market in 2020. The death of George Floyd sparked widespread protests against racial injustice, leading to a surge in interest in social justice and ESG (environmental, social, and governance) investing. The presidential election in November also played a significant role, with market volatility rising in the weeks leading up to the results.

Conclusion

The 2020 US stock market was a rollercoaster ride, marked by significant volatility and unprecedented events. Despite the challenges, the market managed to recover significantly, driven by government stimulus and the rise of technology stocks. As investors look forward to the new year, it remains to be seen how the US stock market will perform in the face of ongoing uncertainties.

CYBERLUX CORP: Revolutionizing the Future o? Us stocks plummet