In the vast and dynamic world of investing, arms stocks have always been a topic of intrigue and speculation. These stocks represent companies that are involved in the manufacturing, distribution, and sales of firearms, ammunition, and related accessories. With the ever-changing landscape of gun laws and regulations in the United States, understanding the potential of these stocks is crucial for investors looking to diversify their portfolios. In this article, we'll delve into the intricacies of arms stocks in the US, including their market trends, risks, and potential opportunities.

Understanding Arms Stocks

Arms stocks are typically categorized into two main segments: firearms manufacturers and ammunition producers. Companies like Sturm, Ruger & Company and Smith & Wesson Holding Corporation are renowned for their firearm production, while Olin Corporation and Alliant Techsystems Inc. are major players in the ammunition industry. These companies often operate under strict regulatory frameworks, which can influence their market performance.

Market Trends

Over the past few years, the arms industry in the US has experienced a surge in demand, primarily driven by factors such as:

- Rising Crime Rates: As crime rates have increased, so has the demand for firearms and ammunition for self-defense.

- Political Tensions: The political climate in the US has led to heightened concerns about gun rights, further boosting the arms industry.

- Economic Factors: In times of economic uncertainty, individuals often turn to firearms and ammunition as a form of investment.

These trends have resulted in a significant increase in the value of arms stocks, with many investors seeing them as a reliable source of long-term growth.

Risks and Challenges

While arms stocks may offer promising opportunities, investors should be aware of the risks and challenges associated with these investments:

- Regulatory Changes: The arms industry is highly regulated, and any changes in gun laws and regulations can significantly impact the performance of arms stocks.

- Public Perception: The arms industry is often subject to criticism and controversy, which can affect investor sentiment and stock prices.

- Economic Downturns: During economic downturns, the demand for firearms and ammunition may decrease, potentially impacting the performance of arms stocks.

Case Study: Sturm, Ruger & Company

To illustrate the potential of arms stocks, let's take a look at Sturm, Ruger & Company, one of the leading firearm manufacturers in the US. In the past five years, the company's stock has seen significant growth, with a total return of over 100%. This success can be attributed to factors such as:

- Strong Product Portfolio: Sturm, Ruger offers a wide range of firearms, catering to various market segments.

- Effective Marketing: The company has been successful in promoting its products through various channels, including social media and firearms expos.

- Strategic Acquisitions: Sturm, Ruger has acquired several smaller companies in the firearms industry, expanding its market presence.

Conclusion

Investing in arms stocks can be a lucrative opportunity, but it's essential to conduct thorough research and understand the risks involved. By analyzing market trends, regulatory changes, and company performance, investors can make informed decisions and potentially reap the rewards of this dynamic industry.

Key Takeaways:

- Arms stocks represent companies involved in the manufacturing and distribution of firearms and ammunition.

- Market trends, such as rising crime rates and political tensions, have driven the growth of arms stocks.

- Investors should be aware of the risks and challenges associated with arms stocks, such as regulatory changes and public perception.

- Sturm, Ruger & Company serves as an example of a successful arms stock investment.

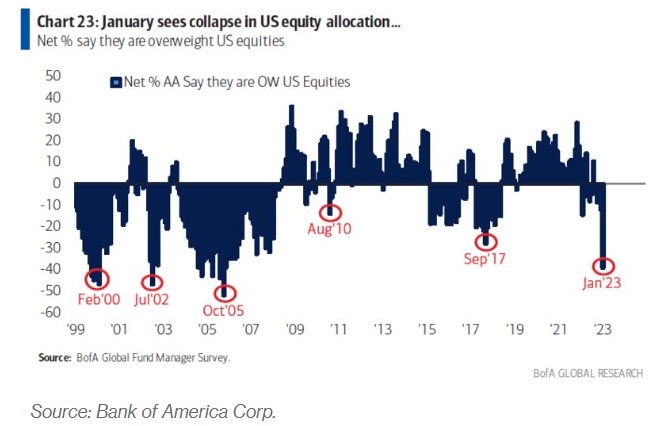

AA Mission Acquisition Corp. Class A Ordina? Us stocks plummet