The US stock market has always been a bellwether for global financial trends. As we dive into 2023, understanding the current US stock market trends is crucial for investors and financial analysts alike. This article will provide an in-depth look at the latest developments, highlighting key sectors, and offering insights into what might lie ahead.

Tech Sector Resurgence

One of the most notable trends in the current US stock market is the resurgence of the technology sector. Companies like Apple, Microsoft, and Google have seen a strong recovery, driven by increased demand for their products and services. This trend is attributed to the ongoing shift towards remote work and digitalization, which has accelerated due to the global pandemic.

E-commerce and Online Retail Growth

The e-commerce sector has also seen significant growth, with companies like Amazon and Shopify leading the charge. This trend is expected to continue as consumers increasingly prefer online shopping over traditional brick-and-mortar stores. The pandemic has accelerated this shift, and it appears that this trend is here to stay.

Energy Sector Recovery

The energy sector has experienced a remarkable recovery, thanks to the rise in oil prices and the increasing demand for natural gas. Companies like ExxonMobil and Chevron have seen their stock prices soar. This trend is a result of the global economy's recovery and the increasing focus on energy efficiency.

Healthcare Sector Stability

The healthcare sector has remained relatively stable, with companies like Johnson & Johnson and Pfizer seeing consistent growth. This trend is driven by the ongoing need for medical supplies and pharmaceuticals, especially in the wake of the pandemic. Additionally, the sector is benefiting from increased research and development in biotechnology and genetic engineering.

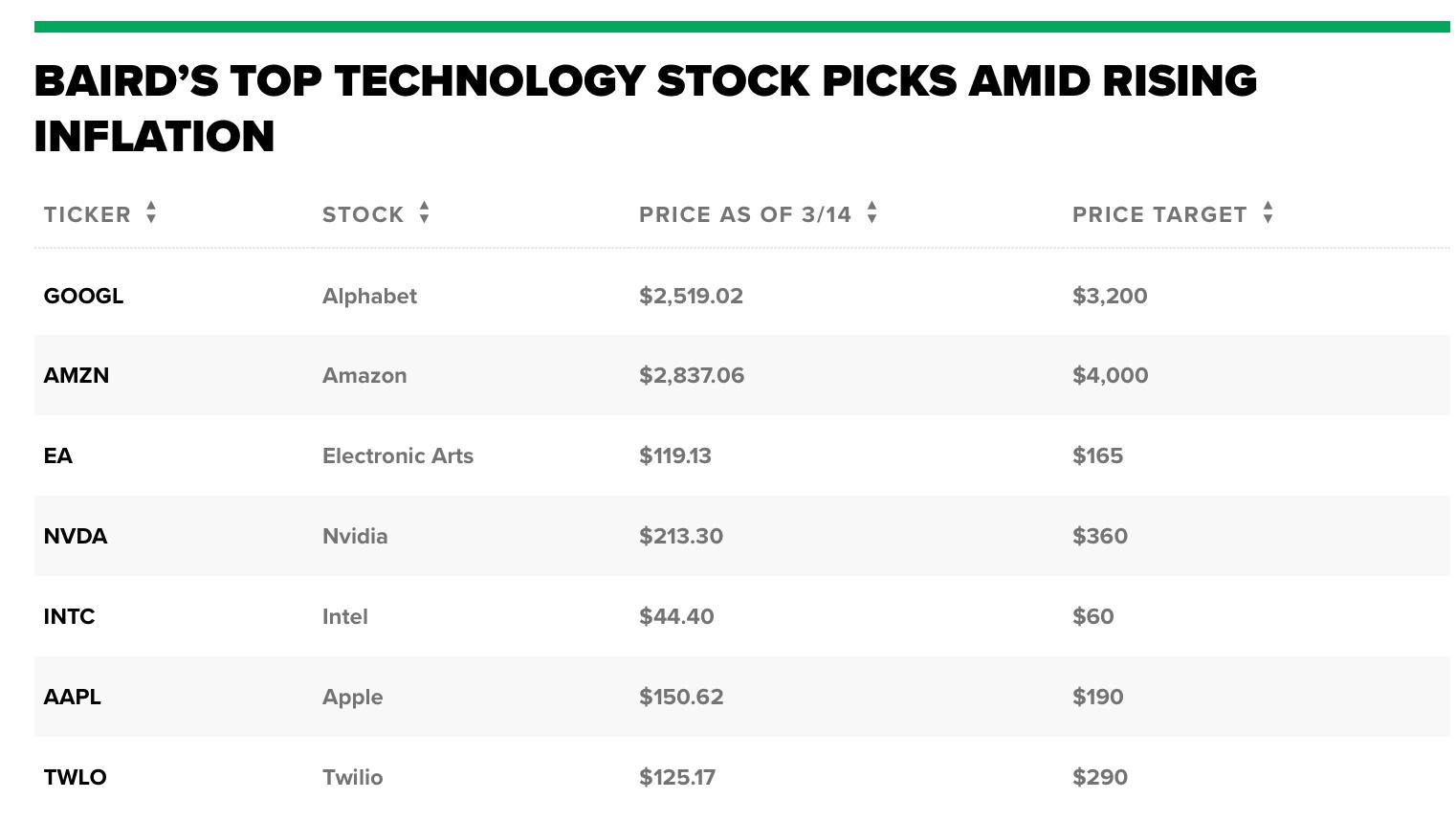

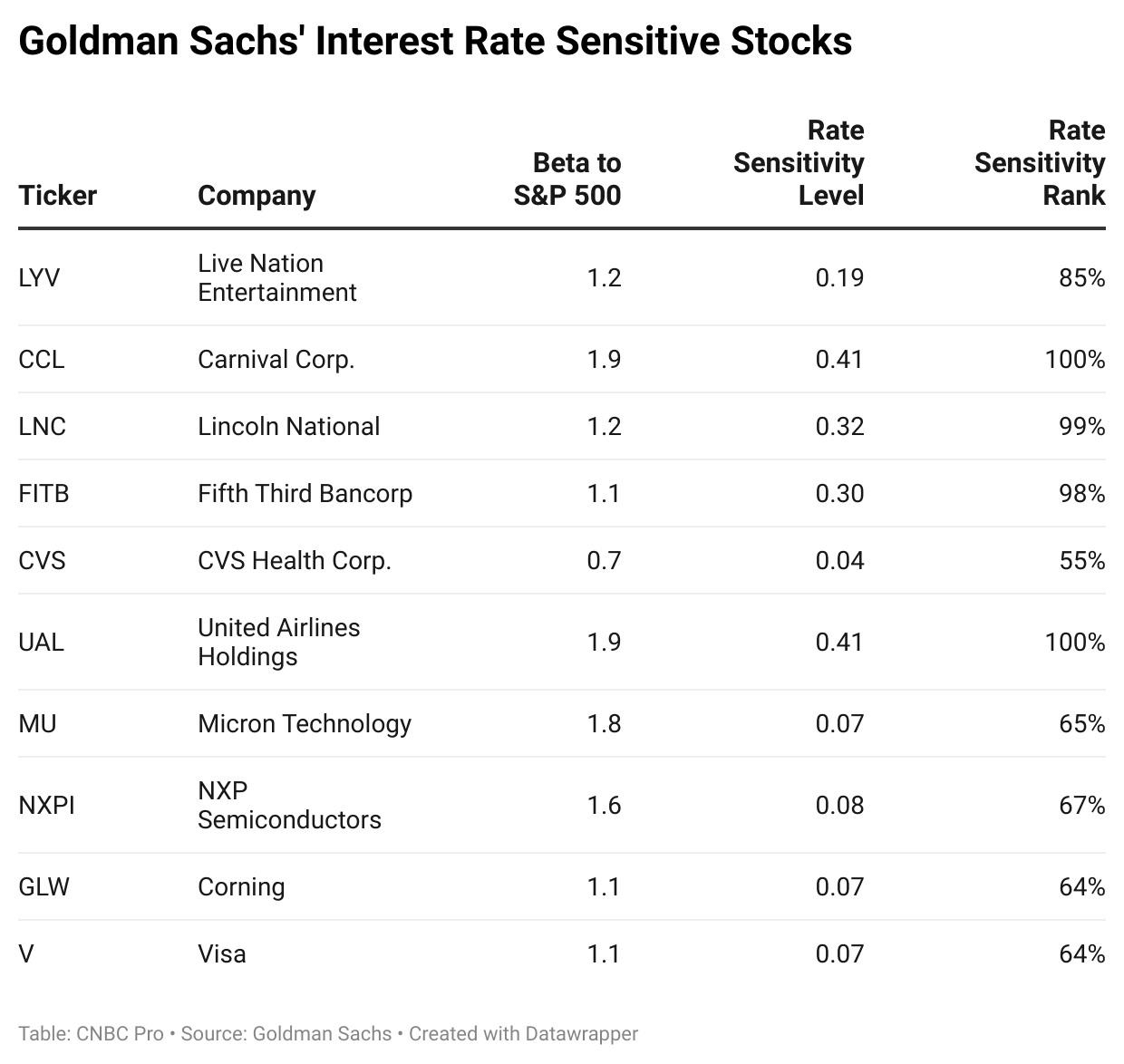

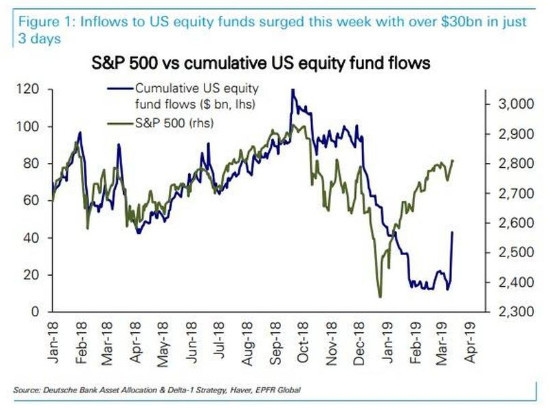

Impact of Inflation on the Stock Market

Inflation has been a major concern for the US stock market in recent months. The Federal Reserve's response to inflation has been closely watched by investors, as any changes in monetary policy can significantly impact stock prices. So far, the market has shown resilience in the face of rising inflation, but the situation remains fluid.

Case Study: Tesla’s Stock Performance

A prime example of the volatility in the current US stock market is the case of Tesla. The electric vehicle manufacturer has seen its stock price fluctuate dramatically, reaching record highs and lows in quick succession. This volatility is often attributed to market speculation and the company's unconventional business practices.

Conclusion

In conclusion, the current US stock market trends are shaped by a variety of factors, including technological advancements, changes in consumer behavior, and global economic conditions. As investors, it is crucial to stay informed and adapt to these trends to make informed decisions. By understanding the key sectors and their drivers, one can navigate the complex landscape of the US stock market with greater confidence.

AINSWORTH GAME TECH LTD: Revolutionizing th? Us stocks plummet