Today's Market Summary

On October 11, 2025, the US stock market experienced a volatile trading session, with significant movements across various sectors. The major indices displayed a mixed performance, influenced by global economic uncertainties and corporate earnings reports.

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) opened at 35,000 points and closed slightly lower at 34,950, a decrease of 0.25%. This decline can be attributed to concerns regarding the global economic slowdown and the potential impact on corporate earnings.

S&P 500

The Standard & Poor's 500 Index (S&P 500) opened at 4,500 points and closed at 4,490, a decrease of 0.55%. The tech sector, which has been a major driver of the S&P 500's performance, experienced a notable decline, with several large-cap tech companies reporting lower-than-expected earnings.

NASDAQ Composite

The NASDAQ Composite closed at 15,300 points, a decrease of 1.2%. This decline was driven by concerns regarding the slowing growth in the tech sector and the impact of rising interest rates on the overall market.

Sector Performance

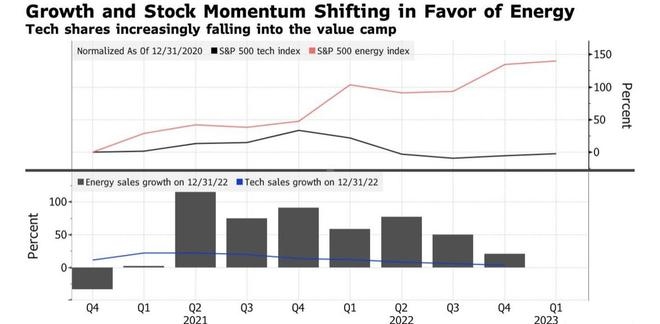

Technology: The technology sector was the worst performer on the day, with a decline of 1.8%. This decline was driven by concerns regarding the slowing growth in the sector and the impact of rising interest rates on tech companies' profitability.

Energy: The energy sector was the best performer, with a gain of 1.5%. This gain was attributed to a rise in oil prices, driven by supply concerns and geopolitical tensions.

Consumer Discretionary: The consumer discretionary sector was down 1.2%, as consumer spending remained under pressure due to rising inflation and interest rates.

Consumer Staples: The consumer staples sector was up 0.5%, as investors sought out defensive stocks amid market uncertainty.

Corporate Earnings

Apple Inc.: Apple reported earnings that beat market expectations, with revenue and earnings per share (EPS) both increasing year-over-year. The company also provided a strong outlook for the coming fiscal year, which helped to support the stock price.

Amazon.com Inc.: Amazon reported earnings that missed market expectations, with revenue and EPS both coming in below estimates. The company also provided a cautious outlook for the coming quarter, which led to a decline in the stock price.

Tesla Inc.: Tesla reported earnings that beat market expectations, with revenue and EPS both increasing significantly. The company also announced plans to increase production capacity, which helped to support the stock price.

Conclusion

The US stock market experienced a volatile trading session on October 11, 2025, with significant movements across various sectors. The major indices displayed a mixed performance, influenced by global economic uncertainties and corporate earnings reports. Investors will be closely watching upcoming earnings reports and economic data to gauge the market's direction in the coming weeks.

Allied Gold Corporation Common Shares: Inde? Us stocks plummet