When it comes to investing, one of the most crucial decisions investors face is choosing between European stocks and US stocks. Both markets offer unique opportunities and challenges. In this article, we will delve into a comprehensive analysis of European stocks versus US stocks, comparing their performance, market dynamics, and potential risks.

Market Performance

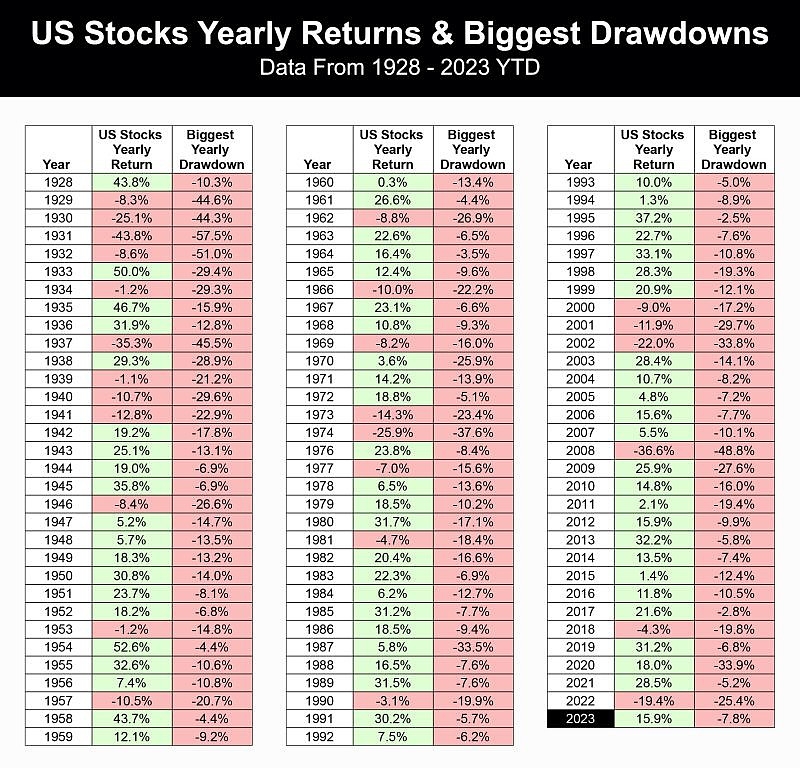

Over the past decade, both European and US stock markets have experienced periods of growth and decline. However, when it comes to long-term performance, the US market has generally outperformed its European counterpart. This can be attributed to several factors, including higher corporate earnings, technological innovation, and a more robust economy.

Market Dynamics

European Stocks:

The European stock market is characterized by its diversity and includes countries such as Germany, France, the United Kingdom, and Italy. This region offers a wide range of sectors, including automotive, healthcare, and technology. However, it also faces challenges such as political instability, economic uncertainty, and currency fluctuations.

US Stocks:

The US stock market is the largest and most influential in the world. It is home to some of the most successful companies, including Apple, Microsoft, and Google. The US market offers a wide range of sectors, including finance, healthcare, and technology. It is also known for its strong regulatory framework and innovation-driven economy.

Risk Factors

When investing in European stocks, investors should be aware of several risk factors:

- Political Instability: Countries such as Greece and Italy have experienced political turmoil, which can impact the stability of the European market.

- Economic Uncertainty: The European Union faces economic challenges such as high unemployment and slow growth.

- Currency Fluctuations: The value of the Euro can fluctuate, impacting the returns on European stocks.

Similarly, investing in US stocks comes with its own set of risks:

- Regulatory Changes: Changes in regulations can impact the profitability of companies.

- Political Instability: Although less common, political instability can still occur in the US, affecting the market.

- Market Volatility: The US market is known for its volatility, which can lead to significant fluctuations in stock prices.

Case Studies

To illustrate the differences between European and US stocks, let's consider two companies: Volkswagen (a German automotive company) and Tesla (an American electric vehicle manufacturer).

Volkswagen:

Volkswagen, a German automotive giant, has faced several challenges over the years, including the Dieselgate scandal and declining sales in Europe. Despite these challenges, Volkswagen has a strong presence in the European market and has been able to adapt to changing consumer preferences.

Tesla:

Tesla, an American electric vehicle manufacturer, has experienced rapid growth and has become a leader in the electric vehicle market. Its innovative technology and strong brand have contributed to its success in the US market.

Conclusion

In conclusion, both European stocks and US stocks offer unique opportunities and challenges. While the US market has generally outperformed its European counterpart, it is crucial for investors to conduct thorough research and understand the risks associated with each market. By doing so, investors can make informed decisions and potentially achieve their investment goals.

BNCPY Stock: Unveiling the Investment Oppor? Us stocks plummet