In the ever-evolving landscape of global investments, the mention of "Evergrande stock in US" has become a hot topic among investors. For those unfamiliar with this term, it refers to the shares of Evergrande Group, a Chinese real estate giant, that are traded on U.S. stock exchanges. This article aims to provide a comprehensive guide to understanding this investment opportunity, including its potential risks and rewards.

What is Evergrande Group?

Evergrande Group is one of the largest real estate developers in China, with a presence in various sectors such as property development, construction materials, and financial services. The company has a strong reputation in the industry, and its shares have been available for trading on U.S. stock exchanges, making it an attractive investment option for international investors.

Why Invest in Evergrande Stock in US?

There are several reasons why investors might consider investing in Evergrande stock in the US:

- Strong Market Position: Evergrande Group is one of the leading real estate developers in China, with a significant market share. This gives investors exposure to one of the fastest-growing real estate markets in the world.

- Potential for Growth: China's real estate market has shown strong growth in recent years, and Evergrande Group has been a major beneficiary of this trend. The company has a strong pipeline of projects and a solid financial position, which could lead to further growth in the future.

- Access to International Markets: By trading on U.S. stock exchanges, Evergrande Group offers international investors the opportunity to invest in a major Chinese company without having to navigate the complexities of the Chinese stock market.

Risks of Investing in Evergrande Stock in US

While investing in Evergrande stock in the US offers potential benefits, it also comes with certain risks:

- Economic and Political Risks: China's real estate market is subject to economic and political risks, which could impact the performance of Evergrande Group.

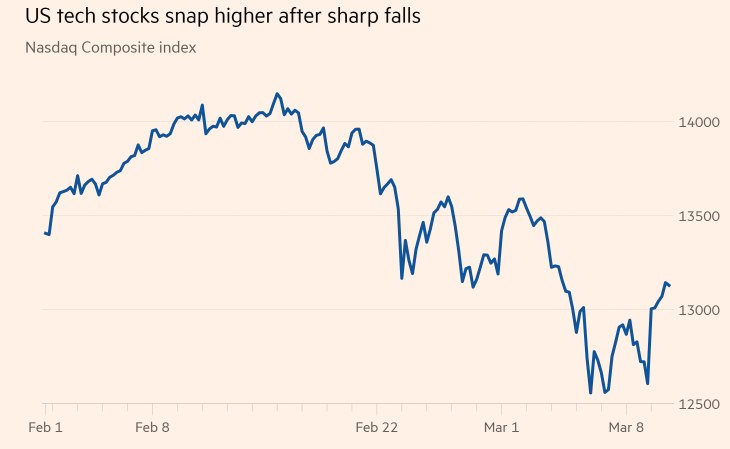

- Market Volatility: The stock market can be volatile, and Evergrande's stock is no exception. This means that investors could experience significant fluctuations in the value of their investment.

- Corporate Governance Issues: Evergrande Group has faced criticism regarding its corporate governance practices, which could impact the company's long-term performance.

Case Study: Evergrande's Impact on the Stock Market

In 2021, Evergrande Group faced a significant financial crisis, which led to a sharp decline in its stock price. This event highlighted the potential risks associated with investing in the company's stock. However, it also demonstrated the resilience of the Chinese real estate market, as other real estate companies continued to perform well despite the crisis.

Conclusion

Investing in Evergrande stock in the US offers a unique opportunity to gain exposure to the Chinese real estate market. However, it is important to understand the potential risks and rewards before making an investment decision. By conducting thorough research and considering the company's financial health and market conditions, investors can make informed decisions about whether to invest in Evergrande stock in the US.

IVRO Stock: Unveiling the Potential of a Ri? Us stocks plummet