In the fast-paced world of stock trading, intraday trading US stocks has emerged as a popular strategy among investors looking to capitalize on short-term market movements. This article delves into the intricacies of intraday trading, offering valuable insights and strategies to help you navigate this dynamic market effectively.

Understanding Intraday Trading

Before diving into the strategies, it's crucial to have a clear understanding of what intraday trading entails. Intraday trading refers to the buying and selling of stocks within the same trading day. Traders engage in this activity to profit from small price fluctuations that occur throughout the trading day.

Benefits of Intraday Trading

One of the primary benefits of intraday trading is the potential for high returns. By focusing on short-term market movements, traders can capitalize on small price changes to generate significant profits. Additionally, intraday trading allows for higher liquidity and flexibility, as traders can enter and exit positions quickly.

Strategies for Intraday Trading

Technical Analysis: This approach involves analyzing historical price and volume data to predict future price movements. Traders use various technical indicators, such as moving averages, RSI, and MACD, to identify potential trading opportunities.

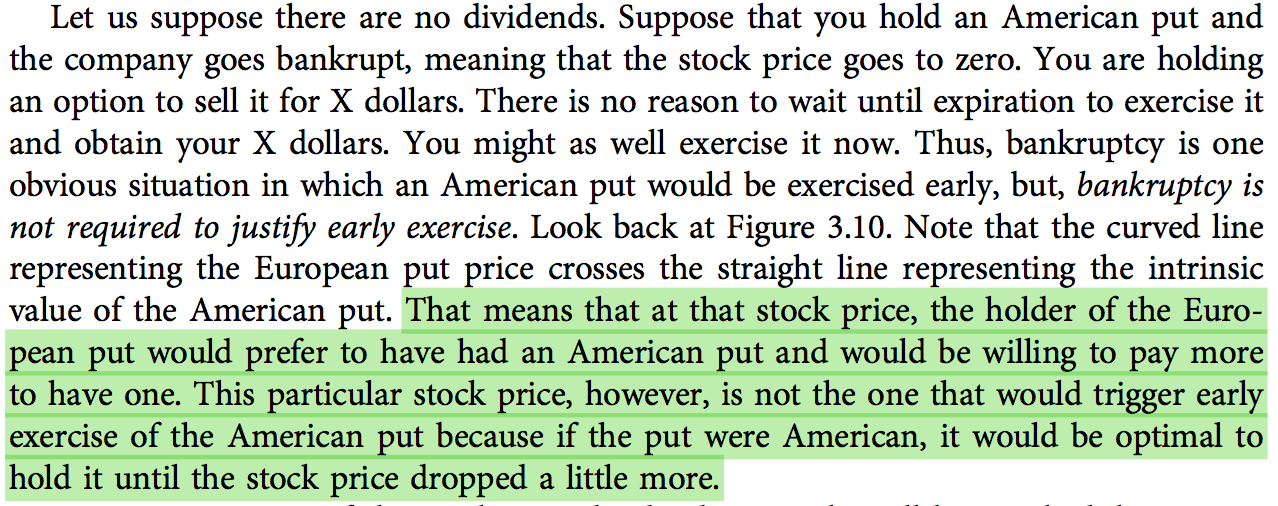

Fundamental Analysis: This strategy involves analyzing a company's financial statements, earnings reports, and other relevant information to determine its intrinsic value. By identifying undervalued or overvalued stocks, traders can profit from price corrections.

Market Analysis: Understanding the broader market trends and economic indicators can provide valuable insights for intraday trading. Traders often monitor factors such as interest rates, inflation, and geopolitical events to make informed trading decisions.

Risk Management: One of the key aspects of successful intraday trading is managing risk effectively. Traders use various risk management techniques, such as setting stop-loss orders and diversifying their portfolios, to minimize potential losses.

Time Management: Intraday trading requires a significant amount of time and attention. Traders must stay informed about market news and trends, and be prepared to make quick decisions.

Case Studies

To illustrate the effectiveness of these strategies, let's consider a few case studies:

Technical Analysis: A trader using technical analysis identified a stock with a strong upward trend and entered a long position. By utilizing a stop-loss order, the trader managed to limit potential losses while capitalizing on the stock's price appreciation.

Fundamental Analysis: A trader using fundamental analysis identified an undervalued tech company with strong growth prospects. By purchasing shares at a low price and holding onto them until the stock reached its intrinsic value, the trader generated significant profits.

Market Analysis: A trader monitoring market trends noticed a sudden surge in oil prices. By purchasing oil-related stocks, the trader profited from the subsequent price increase.

Conclusion

Intraday trading US stocks can be a lucrative strategy for investors looking to capitalize on short-term market movements. By understanding the intricacies of this approach and implementing effective strategies, traders can increase their chances of success. Remember to stay informed, manage risk effectively, and practice disciplined trading to maximize your potential returns.

Artius II Acquisition Inc. Class A Ordinary? Us stocks plummet