In the ever-evolving world of investments, the question of whether it's a good time to buy US stocks is a topic that often sparks debate among investors and financial experts. With the stock market's unpredictable nature, making an informed decision is crucial. In this article, we'll explore the current market conditions, key factors to consider, and provide insights to help you determine if now is the right time to invest in US stocks.

Understanding the Current Market Conditions

The stock market is influenced by a variety of factors, including economic indicators, geopolitical events, and corporate earnings reports. As of the latest data, the US stock market has experienced a rollercoaster of emotions in recent years. To evaluate the current market conditions, let's consider the following aspects:

- Economic Indicators: The US economy has shown signs of recovery post-pandemic, with low unemployment rates and strong consumer spending. However, inflation remains a concern, with the Federal Reserve implementing measures to control it.

- Geopolitical Events: Tensions between major economies, such as the US and China, have created uncertainty in the market. Additionally, political events, such as elections, can also impact investor sentiment.

- Corporate Earnings: Many companies have reported strong earnings, driven by factors such as increased demand and cost-cutting measures. However, some sectors may face challenges due to supply chain disruptions and rising costs.

Key Factors to Consider Before Investing in US Stocks

Before deciding to invest in US stocks, it's essential to consider the following factors:

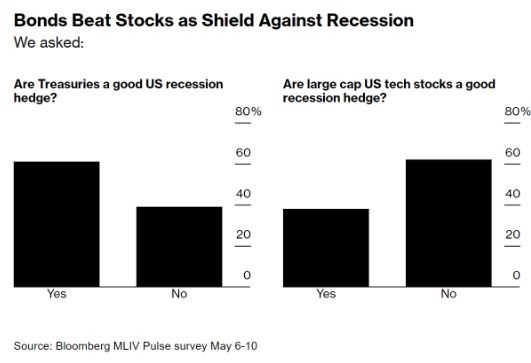

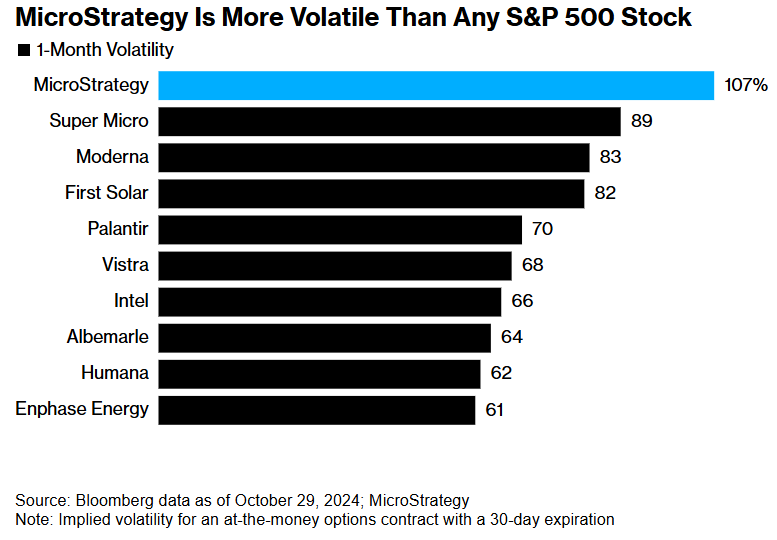

- Risk Tolerance: Your risk tolerance will determine the type of stocks you should invest in. If you're risk-averse, consider blue-chip companies with stable earnings and low volatility. On the other hand, if you're comfortable with higher risk, you may explore growth stocks or small-cap companies.

- Investment Goals: Your investment goals will influence the duration of your investment. If you're looking for short-term gains, consider high-growth stocks. For long-term investments, a diversified portfolio of stocks across various sectors may be more suitable.

- Market Trends: Stay updated with market trends and economic indicators to make informed decisions. Utilize financial news, reports, and analysis to gain insights into market movements.

Case Study: Tech Stocks

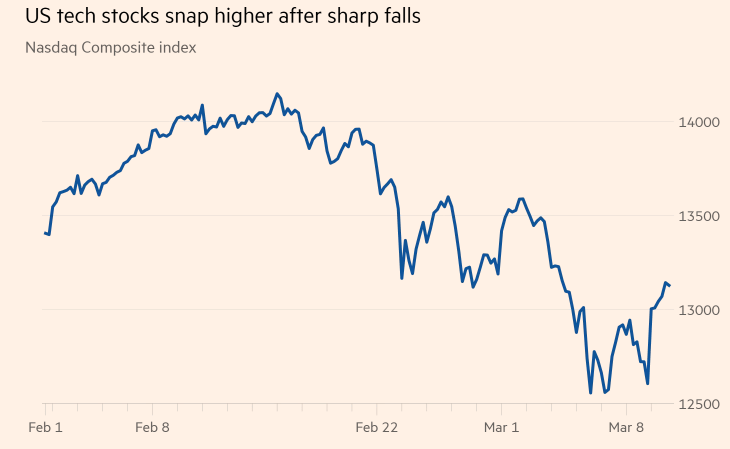

One sector that has gained significant attention in recent years is the technology sector. Companies like Apple, Microsoft, and Amazon have seen substantial growth, making them attractive investment options. However, it's important to note that tech stocks can be highly volatile and may not be suitable for all investors.

For instance, let's consider Apple Inc. (AAPL). Over the past five years, the company has experienced significant growth, with its stock price nearly doubling. However, the stock has also faced periods of volatility, making it crucial for investors to stay informed and adapt their strategies accordingly.

Conclusion

Determining whether it's a good time to buy US stocks requires careful consideration of various factors. While the current market conditions present both opportunities and challenges, investors should focus on their risk tolerance, investment goals, and market trends to make informed decisions. By staying informed and adapting to market changes, you can increase your chances of success in the stock market.

IIDA GROUP HLDGS CO ORD: A Comprehensive Ov? Us stocks plummet