The stock market has always been a rollercoaster ride, with its ups and downs reflecting the economic and political landscapes of the world. Lately, there has been a growing concern about the possibility of a stock market crash in the United States. This article delves into the current state of the US stock market, the factors contributing to this concern, and the potential implications if a crash were to occur.

Understanding the Current State of the US Stock Market

The US stock market, as represented by the S&P 500, has been on a steady uptrend for the past few years. However, recent months have seen a significant correction, with the market experiencing its worst performance since the financial crisis of 2008. Several factors have contributed to this:

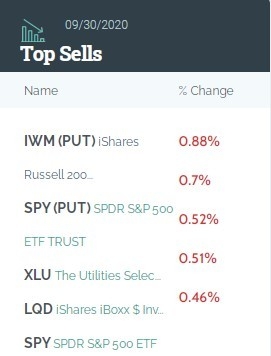

- Rising Interest Rates: The Federal Reserve has been increasing interest rates to combat inflation, which has had a negative impact on stocks, especially those in sectors sensitive to interest rates, such as real estate and utilities.

- Global Economic Concerns: The slowing growth in China and the European Union has raised concerns about global economic stability, which has spilled over into the US stock market.

- Corporate Earnings: Many companies have reported lower-than-expected earnings, which has added to the uncertainty in the market.

Factors Contributing to the Concern of a Stock Market Crash

Several factors have contributed to the growing concern of a potential stock market crash:

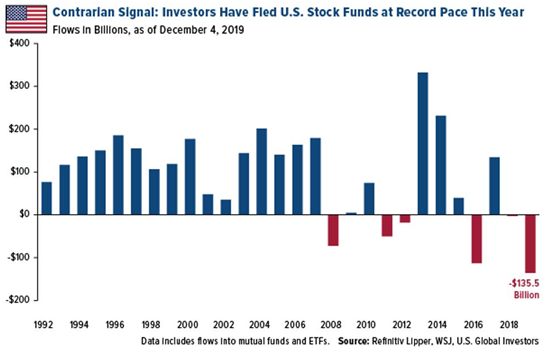

- High Valuations: The US stock market is currently trading at valuations that are considered to be on the high side. This means that stocks are priced higher than their intrinsic value, making them more vulnerable to a correction.

- High Debt Levels: Many companies and individuals have accumulated high levels of debt, which can become unsustainable in the event of a market downturn.

- Political Uncertainty: The ongoing political uncertainty in the United States and around the world has added to the market's volatility.

The Potential Implications of a Stock Market Crash

If a stock market crash were to occur, the implications could be far-reaching:

- Economic Slowdown: A stock market crash could lead to a broader economic slowdown, as businesses cut back on investment and consumers reduce their spending.

- Rising Unemployment: A slowdown in economic activity could lead to higher unemployment rates as companies lay off workers.

- Decreased Consumer Confidence: A stock market crash could lead to a decrease in consumer confidence, which could further slow economic activity.

Case Studies: Historical Stock Market Crashes

To put the current situation into perspective, let's look at some historical stock market crashes:

- 1929 Stock Market Crash: This is the most famous stock market crash in history, leading to the Great Depression.

- 2008 Financial Crisis: The stock market crash of 2008 was triggered by the subprime mortgage crisis and led to a global financial crisis.

While the current situation is not as dire as these historical events, it is important to remain vigilant and prepared for any potential market downturn.

In conclusion, while there are concerns about a potential stock market crash in the United States, it is important to understand the factors contributing to this concern and the potential implications if a crash were to occur. By staying informed and prepared, investors can navigate the ups and downs of the stock market with confidence.

Market Hours: The Key to Maximizing Your Tr? Us stocks plummet