In the dynamic world of finance, lifting your stock investments can be the key to achieving significant growth and securing your financial future. Whether you're a seasoned investor or just starting out, understanding how to effectively lift stock can make all the difference. This article delves into proven strategies and techniques for maximizing your investment portfolio's potential.

1. Diversify Your Portfolio

One of the most critical aspects of lifting stock is diversification. Diversifying your investments across various asset classes can help mitigate risk and increase the likelihood of profitable returns. Consider spreading your investments across stocks, bonds, real estate, and other assets. This approach can help balance out the volatility of the stock market and protect your portfolio from significant losses.

2. Conduct Thorough Research

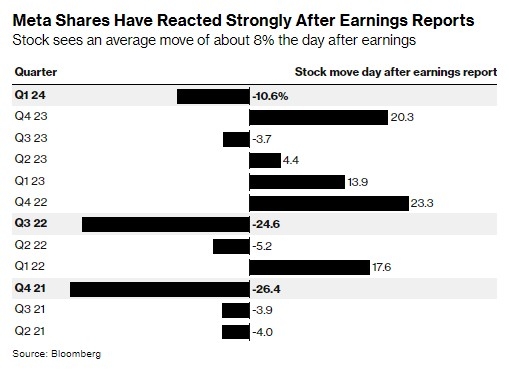

Before investing in any stock, it's crucial to conduct thorough research. Analyze the company's financial statements, earnings reports, and other relevant data to gain insights into its financial health and growth potential. Additionally, stay informed about industry trends and market conditions that could impact the company's performance.

3. Utilize Stop-Loss Orders

To protect your investments from sudden market downturns, consider using stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a specified price. By setting a stop-loss order, you can limit potential losses and avoid making impulsive decisions during market volatility.

4. Invest in Dividend-Paying Stocks

Investing in stocks that pay dividends can be an effective way to boost your investment returns. Dividends provide a regular income stream and can contribute significantly to the growth of your portfolio over time. Look for companies with a strong history of paying dividends and a consistent track record of increasing their dividend payments.

5. Consider Blue-Chip Stocks

Blue-chip stocks are shares of well-established, financially stable companies with a long history of reliable performance. These stocks often offer lower volatility and higher dividend yields compared to smaller, less established companies. Investing in blue-chip stocks can provide a solid foundation for your investment portfolio and potentially generate steady returns.

6. Stay Disciplined and Patient

Investing in stocks requires discipline and patience. Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on your long-term investment strategy and stay committed to your plan. This approach can help you navigate market volatility and avoid unnecessary risks.

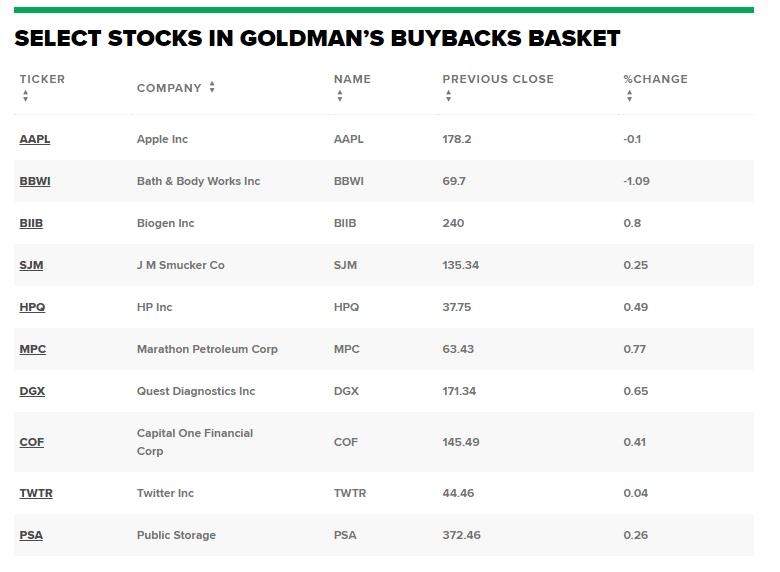

Case Study: Apple (AAPL)

Consider Apple, one of the world's most valuable companies. By investing in Apple stock and adopting a diversified approach, investors have seen significant growth in their portfolios. Apple's consistent dividend payments and strong financial performance have made it a popular choice among investors looking to lift their stock investments.

In conclusion, lifting stock investments requires a well-thought-out strategy and a disciplined approach. By diversifying your portfolio, conducting thorough research, and staying patient, you can maximize your investment returns and secure your financial future. Remember to stay informed about market trends and adjust your strategy as needed to adapt to changing conditions.

SUBARU CORPORATION ORD: A Deep Dive into Su? Us stocks plummet