In the ever-evolving financial landscape, the Royal Bank of Scotland (RBS) has remained a key player in the United States. For investors looking to dive into the world of banking stocks, understanding the current RBS US stock price is crucial. This article delves into the factors influencing the stock price, recent trends, and potential future movements.

Understanding the Royal Bank of Scotland (RBS)

Established in 1727, the Royal Bank of Scotland is one of the oldest banks in the world. With a strong presence in the UK and a significant footprint in the US, RBS has been a staple in the financial industry. The bank offers a range of services, including retail banking, corporate banking, and investment banking.

Factors Influencing the RBS US Stock Price

Several factors can influence the RBS US stock price. Here are some of the key drivers:

Economic Conditions: The overall economic climate plays a significant role in the stock price. Factors such as GDP growth, inflation rates, and unemployment rates can impact the bank's performance.

Regulatory Changes: The financial industry is heavily regulated, and changes in regulations can have a significant impact on the bank's profitability. For instance, stricter capital requirements or increased fines can lead to a decline in the stock price.

Financial Performance: The bank's financial performance, including revenue, earnings, and return on equity, is a crucial factor. Investors closely monitor these metrics to gauge the bank's health.

Market Sentiment: The sentiment in the financial markets can also affect the stock price. Positive news or strong earnings reports can lead to an increase in the stock price, while negative news or poor performance can lead to a decline.

Recent Trends in the RBS US Stock Price

Over the past few years, the RBS US stock price has exhibited several trends:

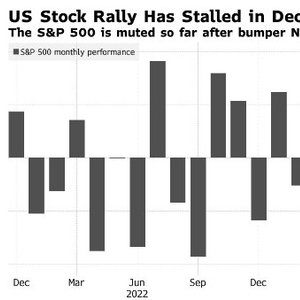

Volatility: The stock has been quite volatile, with significant price swings in a short period. This volatility can be attributed to various factors, including economic conditions and market sentiment.

Recovery: After the financial crisis of 2008, the stock price experienced a significant decline. However, it has since recovered and is currently trading at higher levels.

Dividends: RBS has maintained a consistent dividend policy, which has been a positive for investors. The bank has paid dividends throughout the years, providing a steady income stream.

Potential Future Movements

The future movement of the RBS US stock price depends on various factors, including:

Economic Recovery: A strong economic recovery can lead to higher profitability for the bank, potentially driving up the stock price.

Regulatory Changes: Changes in regulations can impact the bank's profitability and, subsequently, the stock price.

Competition: Increased competition in the banking industry can affect the bank's market share and profitability.

Case Study: Royal Bank of Scotland's Acquisition of Citizens Financial Group

In 2015, RBS announced its intention to acquire Citizens Financial Group, a US-based bank. This acquisition was seen as a strategic move to expand RBS's presence in the US. However, the deal faced regulatory hurdles and was eventually abandoned. This case highlights the impact of regulatory changes on the bank's strategic decisions and, by extension, the stock price.

In conclusion, the RBS US stock price is influenced by various factors, including economic conditions, regulatory changes, and the bank's financial performance. Understanding these factors can help investors make informed decisions. While the stock has exhibited volatility and recovered from previous lows, the future movement depends on various external factors. As always, it is crucial for investors to conduct thorough research before making investment decisions.

CHRYSOS CORP LTD: Revolutionizing the Indus? Us stocks plummet