As we step into January 2025, the stock market is buzzing with activity and anticipation. Investors are keen to understand the year's outlook, trends, and potential opportunities. This article delves into the predicted trends for the stock market in January 2025, highlighting key sectors and factors that could influence market movements.

Economic Outlook and Predictions

The economic outlook for 2025 is cautiously optimistic. The global recovery from the pandemic is expected to continue, with a focus on sustainable growth and resilience. Key economic indicators such as GDP, inflation, and employment rates will play a crucial role in shaping market trends.

Trends to Watch

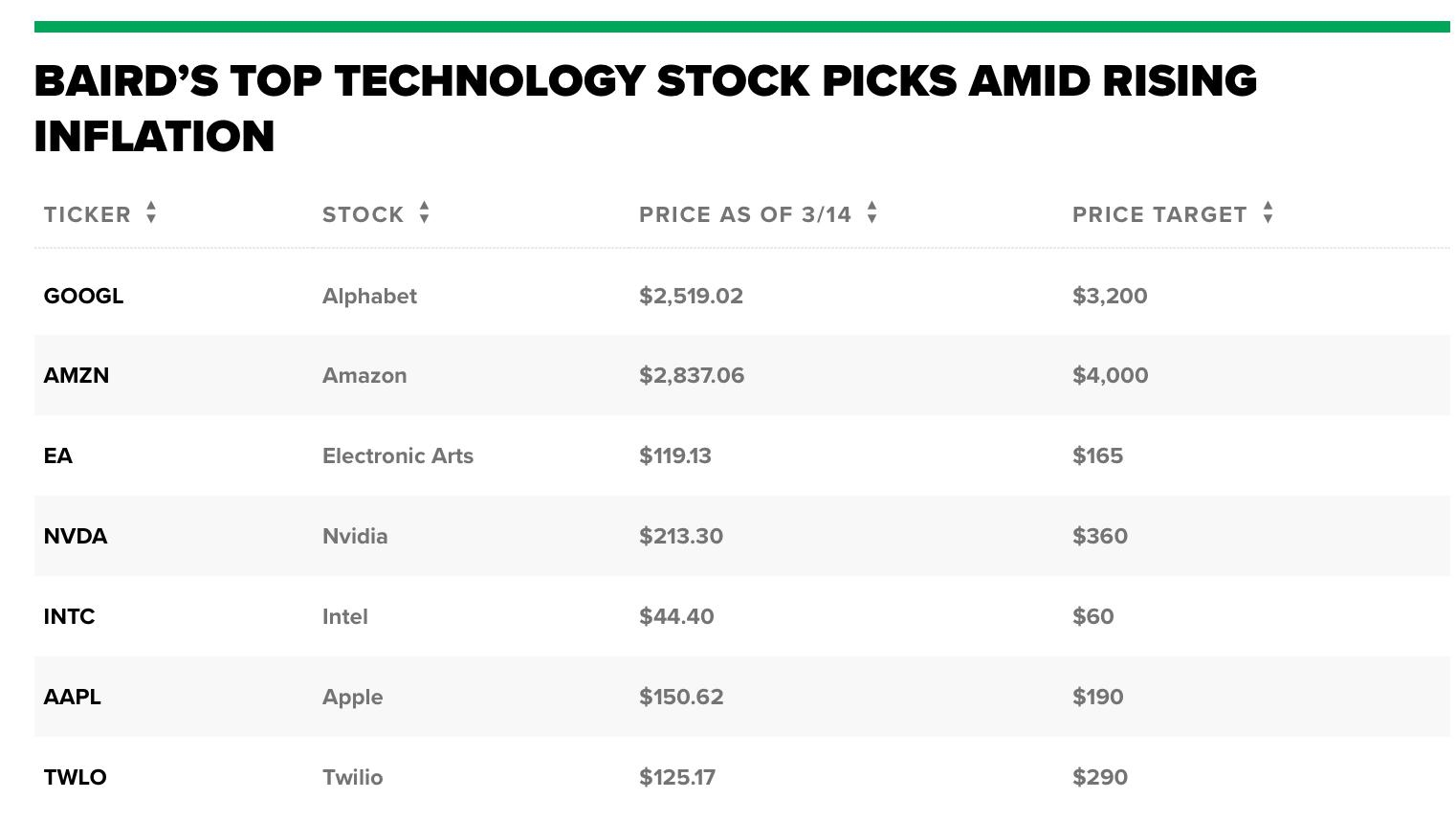

Tech Sector Boom: The technology sector is expected to remain a major driver of growth in 2025. Innovations in AI, cloud computing, and blockchain technology are likely to create new opportunities for investors.

Green Energy Transition: The shift towards renewable energy sources is gaining momentum. Companies involved in solar, wind, and hydroelectric power are likely to see significant growth.

Healthcare and Biotech: The healthcare sector is poised for growth, driven by advancements in medical technology and an aging population. Biotech companies focusing on personalized medicine and gene therapy are expected to perform well.

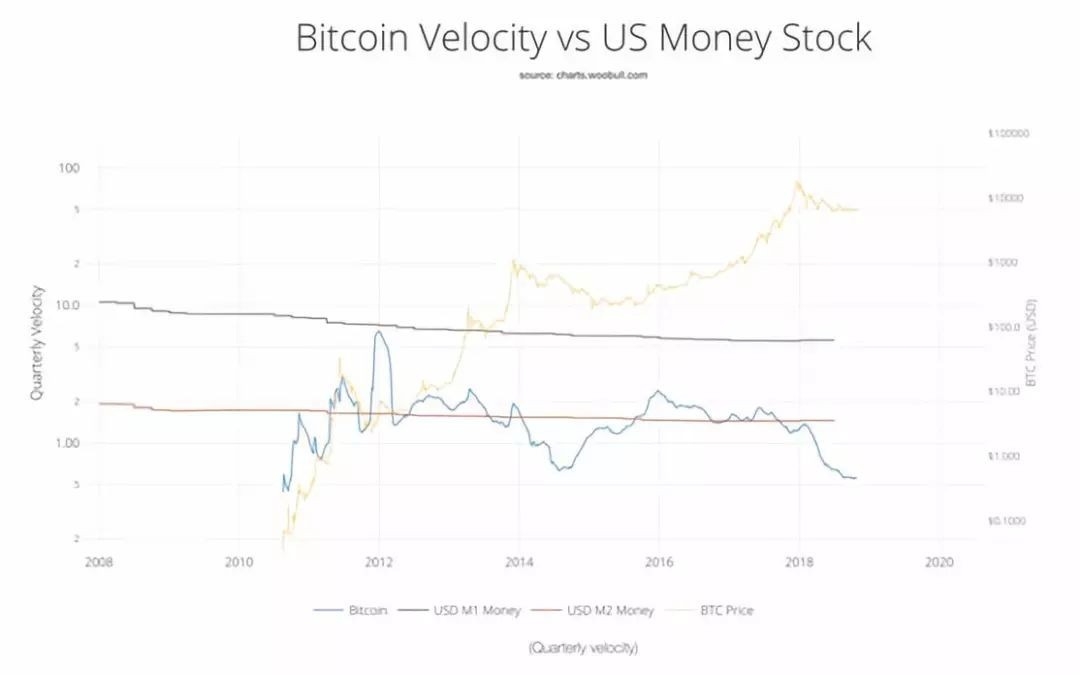

Financial Technology (FinTech): The rise of FinTech is transforming the financial industry. Companies offering digital banking, mobile payments, and financial management solutions are likely to benefit from increased adoption.

Key Factors Influencing the Stock Market

Interest Rates: Central banks' policies on interest rates will remain a key factor influencing the stock market. Higher interest rates can lead to increased borrowing costs and a slowdown in economic growth.

Global Trade Policies: Trade tensions between major economies could impact global supply chains and market stability.

Political Stability: Political instability in key economies can lead to uncertainty and volatility in the stock market.

Case Studies

Tesla (TSLA): Tesla, a leading electric vehicle manufacturer, is expected to continue its growth trajectory in 2025. The company's expansion into new markets and the launch of new models are likely to drive investor interest.

Amazon (AMZN): Amazon, the e-commerce giant, is expected to benefit from the increasing demand for online shopping. The company's investment in logistics and cloud computing services could further enhance its market position.

Bristol Myers Squibb (BMY): Bristol Myers Squibb, a pharmaceutical company, is likely to see growth due to its pipeline of innovative drugs and biologics.

Conclusion

The stock market in January 2025 presents a mix of opportunities and challenges. Investors should stay informed about economic indicators, market trends, and key factors that could influence market movements. By diversifying their portfolios and focusing on sectors with strong growth potential, investors can navigate the market and achieve their financial goals.

Asbury Automotive Group Inc Common Stock: P? Us stocks plummet