Are you an international investor looking to trade US stocks? If so, you've come to the right place. Trading US stocks from abroad can be both exciting and rewarding, but it also requires careful planning and understanding of the regulatory landscape. In this comprehensive guide, we'll explore the ins and outs of trading US stocks from overseas, including the necessary steps, potential challenges, and strategies for success.

Understanding the Basics

Before diving into the details, it's important to understand the basics of trading US stocks from abroad. Essentially, this involves opening a brokerage account with a US-based firm that allows international clients to trade. This account will typically be denominated in US dollars, and you'll need to ensure that your currency can be converted without significant fees or loss.

Choosing a Brokerage Firm

The first step in trading US stocks from abroad is selecting a brokerage firm. It's crucial to choose a reputable and regulated broker that offers services tailored to international clients. Look for a broker with a strong track record, competitive fees, and access to a wide range of US stocks.

Some popular brokers for international clients include TD Ameritrade, E*TRADE, and Charles Schwab. Each of these firms offers a variety of account types, including individual, joint, and corporate accounts, as well as different trading platforms and tools.

Opening an Account

Once you've chosen a brokerage firm, the next step is to open an account. This process typically involves filling out an application, providing identification and address verification, and funding your account. Be prepared to provide proof of identity, such as a passport, and proof of address, such as a utility bill.

Understanding Regulatory Considerations

Trading US stocks from abroad comes with its own set of regulatory considerations. For instance, certain types of investment accounts may not be available to non-US residents, and there may be restrictions on the types of securities you can trade. It's important to familiarize yourself with these regulations to ensure compliance.

Additionally, international investors may be subject to different tax obligations than domestic investors. It's advisable to consult with a tax professional to understand your tax liabilities and ensure you're in compliance with both US and your home country's tax laws.

Strategies for Success

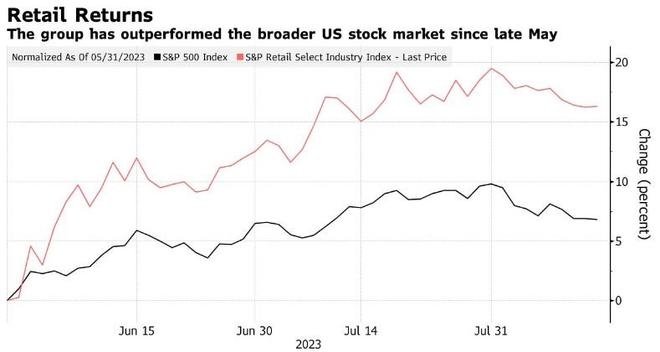

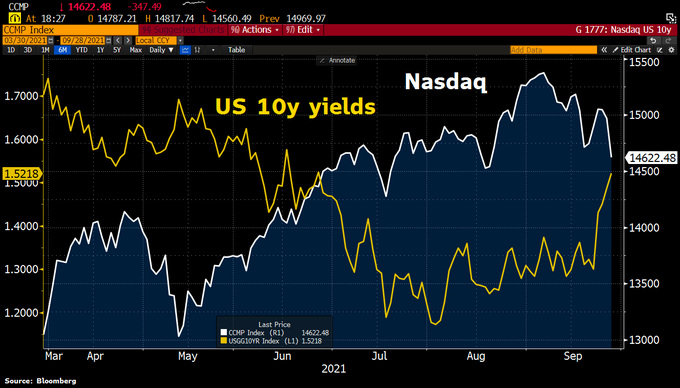

Once you have your brokerage account set up, the next step is to develop a trading strategy. This may involve researching companies, analyzing market trends, and using technical and fundamental analysis to make informed investment decisions.

Here are some strategies to consider:

- Long-Term Investing: Focus on companies with strong fundamentals and a proven track record of growth. This approach can help mitigate short-term market volatility.

- Dividend Stocks: Consider investing in dividend-paying stocks, which can provide a steady stream of income.

- Diversification: Diversify your portfolio across different sectors, industries, and geographic regions to reduce risk.

Case Study: Investing in US Tech Stocks

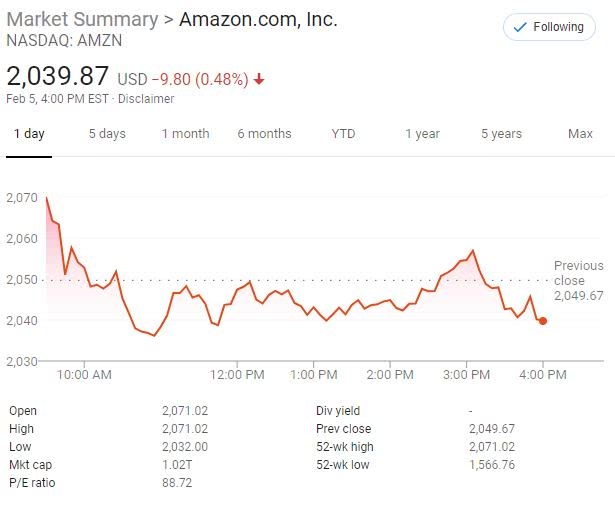

One popular area for international investors is the US tech sector. Companies like Apple, Microsoft, and Amazon have seen significant growth over the years and offer potential for high returns.

Consider an investor from Germany who opened an account with TD Ameritrade to trade US stocks. After thorough research, the investor decides to invest in a mix of tech stocks, including Apple, Microsoft, and Facebook (now Meta). By diversifying and focusing on long-term growth, the investor is able to capitalize on the rising tech industry while managing risk.

Conclusion

Trading US stocks from abroad can be a lucrative opportunity for international investors. By understanding the basics, choosing the right brokerage firm, and developing a sound trading strategy, you can navigate the complexities and achieve success in the US stock market. Remember to stay informed, manage your risks, and seek professional advice when necessary.

CHINA OVERSEAS LD&INV LTD: A Leadin? Us stocks plummet