The US stock market futures represent a crucial aspect of the financial world. These contracts allow investors to speculate on the future price of financial instruments, such as stocks, indexes, and commodities. In this article, we will delve into the basics of US stock market futures, their significance, and how they can impact your investment strategies.

What Are US Stock Market Futures?

US stock market futures are agreements between two parties to buy or sell an asset at a predetermined price on a future date. These contracts are standardized and traded on exchanges, providing liquidity and transparency to the market. They are often used for hedging purposes, but they also offer opportunities for speculative trading.

Key Characteristics of US Stock Market Futures

- Standardization: Futures contracts are standardized in terms of size, quality, and delivery date. This standardization ensures liquidity and ease of trading.

- Leverage: Futures trading allows investors to control a larger amount of the asset with a smaller investment. This leverage can amplify gains but also increase risks.

- Daily Settlement: Futures contracts are settled daily, meaning any gains or losses are settled at the end of each trading day. This feature is known as mark-to-market and requires margin accounts.

- Expiry Date: Each futures contract has an expiry date, after which it is no longer valid. Traders must either close their positions or deliver the underlying asset.

The Importance of US Stock Market Futures

- Hedging: Businesses and investors use futures to protect themselves against adverse price movements. For example, a farmer might use agricultural futures to lock in a price for their crops.

- Speculation: Traders use futures to speculate on the future price movements of assets. They can profit from rising or falling markets without owning the underlying asset.

- Liquidity: The standardized nature of futures contracts makes them highly liquid, allowing traders to enter and exit positions quickly.

- Price Discovery: Futures markets often serve as a barometer for market sentiment and can predict future price movements of the underlying asset.

How to Trade US Stock Market Futures

- Choose a Broker: Select a reputable broker that offers futures trading. Make sure they have competitive fees and a user-friendly platform.

- Understand the Contract Specifications: Familiarize yourself with the contract specifications, including the contract size, tick size, and leverage requirements.

- Develop a Trading Plan: Create a clear trading plan, including your risk tolerance, entry and exit strategies, and position sizing.

- Use Technical and Fundamental Analysis: Analyze market trends, news, and economic indicators to make informed trading decisions.

- Manage Risk: Implement risk management strategies, such as setting stop-loss orders, to protect your investments.

Case Studies

- Agricultural Futures: A farmer may use corn futures to lock in a price for their crop, protecting themselves from falling prices.

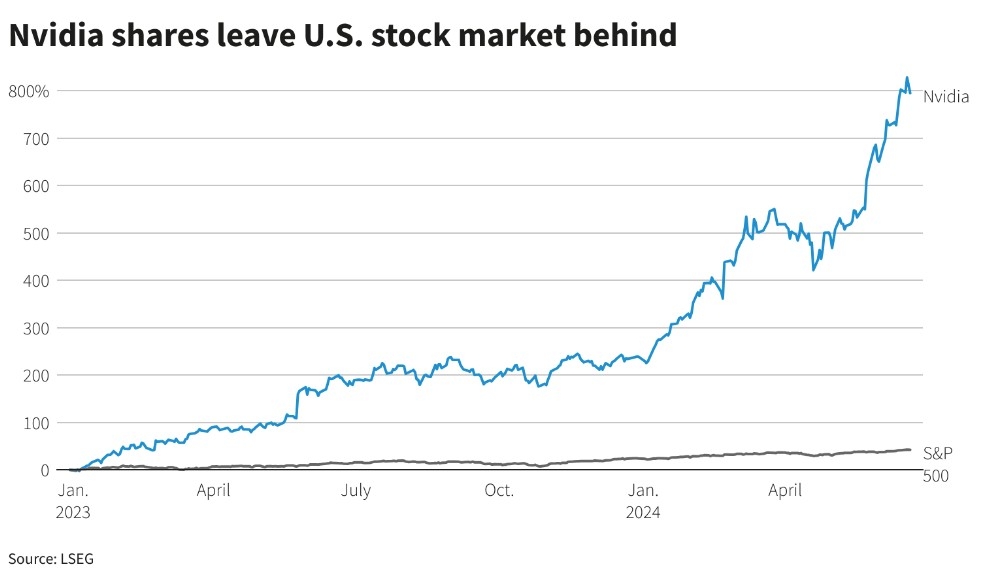

- Stock Index Futures: An investor may use S&P 500 futures to speculate on the future performance of the stock market.

- Commodity Futures: A company may use oil futures to hedge against rising energy costs.

In conclusion, US stock market futures offer a valuable tool for investors and traders. By understanding the basics and developing a solid trading plan, you can leverage the benefits of futures contracts to enhance your investment strategies.

US Large Cap Momentum Stocks: Best Performi? Us stocks plummet