In the fast-paced world of stock trading, understanding how to move stocks is crucial for both seasoned investors and newcomers alike. Whether you're looking to buy low and sell high or simply want to stay ahead of the market trends, this guide will provide you with the essential knowledge to navigate the stock market effectively.

What Does "Moving Stocks" Mean?

"Moving stocks" refers to the process of buying and selling stocks with the aim of generating profits. It involves analyzing market trends, understanding financial reports, and making informed decisions based on various factors. By moving stocks, investors can capitalize on market fluctuations and achieve their financial goals.

Key Factors to Consider When Moving Stocks

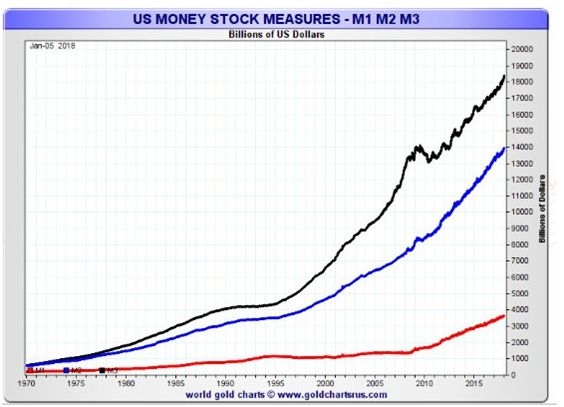

Market Trends: Keeping an eye on market trends is crucial for successful stock trading. By analyzing historical data and current market conditions, investors can identify potential opportunities and make informed decisions.

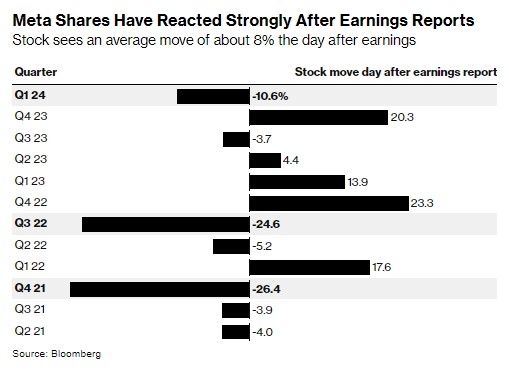

Financial Reports: Companies' financial reports provide valuable insights into their performance and future prospects. By analyzing these reports, investors can gauge a company's financial health and make informed decisions about buying or selling its stocks.

Technical Analysis: Technical analysis involves studying past price movements and trading volumes to predict future stock price movements. By using various indicators and chart patterns, investors can identify potential entry and exit points.

Fundamental Analysis: Fundamental analysis involves evaluating a company's financial statements, business model, and industry position to determine its intrinsic value. This approach helps investors identify undervalued or overvalued stocks.

Risk Management: Risk management is essential when moving stocks. By diversifying their portfolios and setting stop-loss orders, investors can mitigate potential losses and protect their investments.

Real-World Examples of Moving Stocks

Let's consider a hypothetical scenario involving a technology company, Tech Innovations Inc. (TII). Here's how investors might move stocks in this case:

Identifying Market Trends: Investors notice that the technology sector is experiencing a surge in demand due to increasing consumer interest in tech products.

Analyzing Financial Reports: TII's latest quarterly report shows strong revenue growth and a healthy profit margin, indicating a positive outlook for the company.

Technical Analysis: A technical analysis of TII's stock price reveals a bullish trend, with strong support levels and resistance levels. This suggests that the stock is likely to continue rising.

Fundamental Analysis: TII's strong fundamentals, coupled with the market trends and technical analysis, make it an attractive investment opportunity.

Risk Management: Investors decide to buy TII's stock, setting a stop-loss order to limit potential losses if the stock price falls unexpectedly.

By following these steps, investors can effectively move stocks in the context of TII and similar companies.

Conclusion

Understanding how to move stocks is essential for successful stock trading. By considering market trends, financial reports, technical analysis, fundamental analysis, and risk management, investors can make informed decisions and achieve their financial goals. Remember, the key to success in stock trading lies in continuous learning and adapting to changing market conditions.

Atlantic American Corporation Common Stock:? Us stocks plummet