The stock market's performance is often a reflection of the broader economic climate and investor sentiment. If you're wondering why the stock market has fallen today, several factors could be at play. This article delves into the potential reasons behind the market's decline, offering insights into the economic and political landscape that may have contributed to the downturn.

Economic Indicators and Data

One of the primary reasons for a stock market fall is the release of negative economic indicators or data. For instance, if the unemployment rate rises or if inflation is higher than expected, it can lead to a sell-off as investors become concerned about the future of the economy. In recent days, if the stock market has fallen, it could be due to disappointing economic reports or forecasts that suggest slower growth or increased risks.

Political and Geopolitical Factors

Political events and geopolitical tensions can also significantly impact the stock market. For example, if there's a political scandal or a change in government policies that could affect the economy, investors may react by selling off their stocks. Additionally, international conflicts or trade disputes can lead to uncertainty, causing the market to fall.

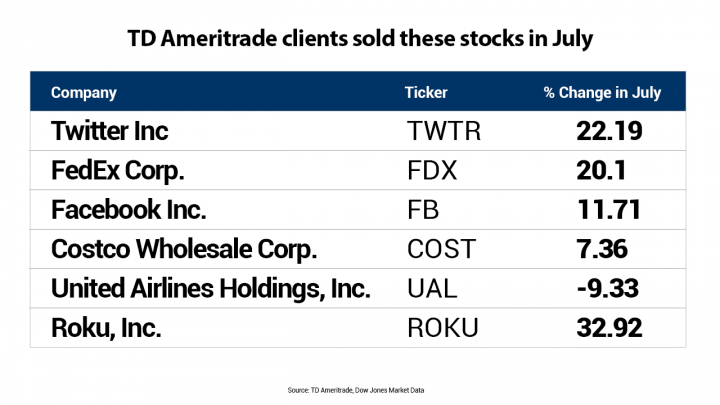

Corporation Earnings Reports

Another reason for a stock market decline could be poor earnings reports from major corporations. If companies are not meeting their financial targets, investors may lose confidence in the market, leading to a sell-off. This can be particularly impactful if the companies in question are part of key sectors that influence the broader market.

Market Speculation and Sentiment

Market speculation and sentiment can also play a significant role in the stock market's performance. If there's a widespread belief that the market is overvalued or that a particular sector is poised to decline, investors may rush to sell off their stocks, leading to a market fall. This can be exacerbated by social media and news outlets that amplify these sentiments.

Technological Issues and Hacking

In some cases, a stock market fall may be due to technological issues or hacking incidents. If there's a significant disruption to trading platforms or if there's evidence of hacking, it can lead to widespread panic and a subsequent fall in the market.

Case Study: The 2020 Stock Market Crash

A prime example of how various factors can contribute to a stock market fall is the 2020 stock market crash. The crash was triggered by a combination of economic indicators, political uncertainty, and the COVID-19 pandemic. The economic impact of the pandemic led to a sharp increase in unemployment and a decrease in consumer spending, which in turn led to a decline in corporate earnings. Additionally, the political uncertainty surrounding the pandemic and the subsequent lockdowns contributed to the market's downward trend.

Conclusion

In conclusion, there are numerous reasons why the stock market may have fallen today. From economic indicators and political events to corporate earnings and market sentiment, these factors can all contribute to a market downturn. Understanding these factors can help investors make informed decisions and navigate the complexities of the stock market.

Abeona Therapeutics Inc. Common Stock: A Gr? Us stocks plummet