The stock market is a dynamic and unpredictable entity, and today's decline in stock prices has left many investors scratching their heads. This article delves into the reasons behind the sudden drop and provides a comprehensive breakdown of the factors at play.

Economic Indicators and Data Releases

One of the primary reasons for today's stock market downturn is the release of economic indicators and data. The Federal Reserve's decision to raise interest rates and the subsequent release of the Consumer Price Index (CPI) have caused investors to reevaluate their positions. Higher interest rates tend to lead to decreased borrowing and slower economic growth, which can negatively impact stock prices.

Geopolitical Tensions

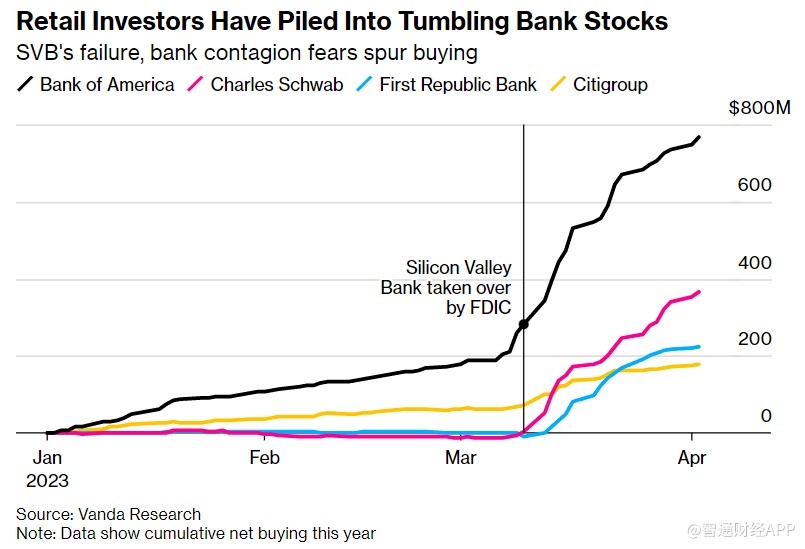

Geopolitical tensions have also played a significant role in today's stock market decline. The ongoing conflict in the Middle East and the potential for a global supply chain disruption have raised concerns among investors. These tensions have led to increased uncertainty and higher volatility in the market, causing many investors to sell off their stocks.

Corporate Earnings Reports

The release of corporate earnings reports has also contributed to today's stock market downturn. Many companies have reported lower-than-expected earnings, which have led to share price declines. Investors are becoming increasingly concerned about the future profitability of these companies, which has led to a broader sell-off in the market.

Technological Advancements and Market Sentiment

Technological advancements have also played a role in today's stock market decline. The rapid pace of innovation has led to increased competition and lower profit margins for many companies. Additionally, market sentiment has been negatively impacted by concerns about job losses and industry disruptions.

Case Studies

Let's take a look at a few specific examples to illustrate these points:

Tech Giant's Stock Plunge: A major tech company reported lower-than-expected earnings, leading to a significant drop in its stock price. This decline was driven by concerns about the company's future growth prospects and increased competition in the industry.

Energy Sector Volatility: The ongoing conflict in the Middle East has caused the energy sector to experience significant volatility. Oil prices have fluctuated wildly, leading to uncertainty among investors and a subsequent drop in stock prices for energy companies.

Consumer Discretionary Sector Sell-off: The release of the CPI data revealed higher-than-expected inflation, leading to a sell-off in the consumer discretionary sector. Investors are concerned that higher prices will lead to lower consumer spending and weaker corporate earnings.

In conclusion, today's stock market downturn can be attributed to a combination of economic indicators, geopolitical tensions, corporate earnings reports, and market sentiment. While these factors may seem daunting, it's important for investors to remain vigilant and stay informed about the latest developments in the market. By understanding the underlying reasons for the decline, investors can make more informed decisions and navigate the market's ups and downs with greater confidence.

MERITAGE HOSPITALITY GROUP INC Stock Standa? Us stocks plummet