Understanding the timing of the US stock market is crucial for investors who want to make informed decisions. The stock market plays a pivotal role in the global financial landscape, and being aware of its opening hours can significantly impact your investment strategy. In this article, we will delve into the opening hours of the US stock market, its historical background, and the impact of these hours on investors.

The Opening Hours of the US Stock Market

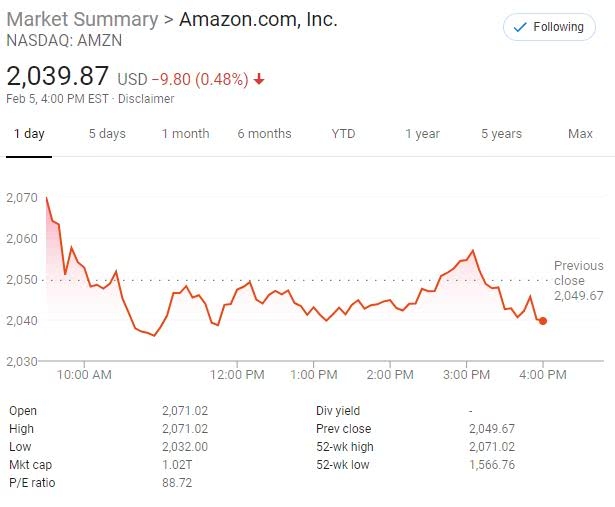

The primary stock exchanges in the United States, including the New York Stock Exchange (NYSE) and the NASDAQ, operate under specific hours. The standard trading hours for these exchanges are from 9:30 AM to 4:00 PM Eastern Time (ET). However, it's important to note that the pre-market and after-hours trading sessions extend beyond these hours.

Pre-Market Trading

Pre-market trading, also known as the "pre-open session," begins at 4:00 AM ET and ends at 9:30 AM ET. During this period, investors can trade stocks before the official market opening. This session is particularly popular among institutional investors and professional traders who want to gain an early advantage.

Regular Trading Hours

The regular trading hours, as mentioned earlier, start at 9:30 AM ET and conclude at 4:00 PM ET. This is when the majority of retail investors engage in trading activities. The NYSE and NASDAQ are the two largest stock exchanges in the United States, and they account for a significant portion of the trading volume.

After-Hours Trading

After-hours trading, also referred to as the "post-market session," commences immediately after the regular trading hours and continues until 8:00 PM ET. This session allows investors to trade stocks outside of the standard trading hours. While it is less popular than pre-market trading, after-hours trading can still provide opportunities for investors who are unable to trade during regular hours.

Historical Background

The US stock market has a rich history that dates back to the early 18th century. The first stock exchange in the United States, the New York Stock and Exchange Board, was established in 1792. Over the years, the stock market has evolved, and its opening hours have been adjusted to accommodate the changing needs of investors.

Impact on Investors

Understanding the opening hours of the US stock market is essential for investors. By being aware of these hours, investors can plan their trading activities accordingly. For example, pre-market trading can provide valuable insights into market trends, while after-hours trading can offer opportunities for investors who are unable to trade during regular hours.

Case Study: Pre-Market Trading

Consider a scenario where an investor wants to trade a particular stock before the market opens. By participating in the pre-market session, the investor can gain an early advantage and potentially capitalize on market movements. This case study highlights the importance of being aware of the opening hours of the US stock market.

In conclusion, understanding the opening hours of the US stock market is crucial for investors who want to make informed decisions. By being aware of the pre-market, regular, and after-hours trading sessions, investors can plan their trading activities effectively and potentially capitalize on market opportunities.

THYCF Stock: A Deep Dive into the Potential? America stock market