Are you considering investing in BYD stock in the United States? As one of the world's leading electric vehicle (EV) manufacturers, BYD (BYD Co., Ltd.) has seen significant growth and has the potential to be a valuable addition to any investor's portfolio. In this article, we will explore everything you need to know about buying BYD stock in the US, including the pros and cons, the investment process, and potential risks.

Understanding BYD

BYD (Build Your Dreams) is a Chinese multinational company that specializes in a wide range of products, including EVs, mobile phones, and energy storage solutions. The company was founded in 1995 and has since grown to become one of the largest and most innovative companies in China. With a focus on sustainable development and green technology, BYD has become a key player in the global EV market.

Pros of Investing in BYD Stock

One of the main advantages of investing in BYD stock is the company's strong growth potential. As the demand for EVs continues to rise, BYD is well-positioned to benefit from this trend. The company has a diverse product portfolio, which allows it to cater to various market segments and geographies.

Another advantage is BYD's commitment to innovation. The company invests heavily in research and development, which has led to several breakthroughs in EV technology. This focus on innovation has helped BYD maintain a competitive edge in the market.

Cons of Investing in BYD Stock

Like any investment, there are potential risks associated with buying BYD stock. One of the main concerns is the company's dependence on the Chinese market. While BYD has made strides in expanding its global footprint, it remains heavily reliant on sales in China.

Additionally, the EV industry is highly competitive, and BYD faces stiff competition from established players like Tesla and emerging competitors from other countries. This competition could impact the company's market share and profitability.

How to Buy BYD Stock in the US

Investing in BYD stock in the US is relatively straightforward. Here's a step-by-step guide:

- Open a Brokerage Account: Before you can buy BYD stock, you'll need to open a brokerage account with a reputable online broker. Many brokers offer commission-free trading, which can help reduce costs.

- Research and Analyze: Conduct thorough research on BYD and the EV industry as a whole. Look at the company's financial statements, market trends, and competitive landscape.

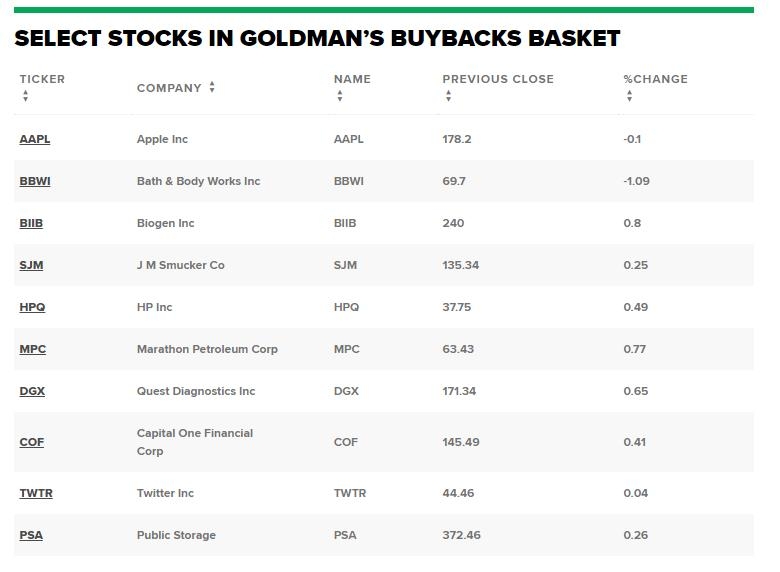

- Place Your Order: Once you're ready, you can place an order to buy BYD stock through your brokerage account. You can choose to buy shares outright or invest in a mutual fund or ETF that holds BYD stock.

- Monitor Your Investment: After purchasing BYD stock, it's important to monitor your investment regularly. Keep an eye on the company's financial performance, industry news, and market trends.

Potential Risks

As mentioned earlier, there are potential risks associated with investing in BYD stock. Here are some of the key risks to consider:

- Economic and Political Risks: Changes in the global economic landscape or political tensions between China and other countries could impact BYD's operations and profitability.

- Competition: The EV industry is highly competitive, and BYD may face challenges in maintaining its market share.

- Regulatory Risks: Changes in regulations related to EVs and environmental protection could impact BYD's business.

Conclusion

Buying BYD stock in the US can be a wise investment decision, especially for those looking to capitalize on the growing EV market. However, it's important to conduct thorough research and understand the potential risks before making a decision. By doing so, you can make an informed investment and potentially benefit from BYD's strong growth potential.

Understanding the Fear Index in Ameris Banc? America stock market