Are you looking to expand your investment portfolio beyond the United States? Investing in stocks outside the US can offer a range of benefits, including diversification and access to different markets. However, navigating the complexities of international stock trading can be challenging. In this article, we will guide you through the process of buying and selling stocks outside the US, providing you with the knowledge and tools to make informed decisions.

Understanding the Basics

Before diving into international stock trading, it's essential to understand the basics. The first step is to open a brokerage account that allows you to trade stocks in foreign markets. Many online brokers offer international trading capabilities, but it's crucial to choose one that is reputable and regulated.

Choosing a Brokerage Account

When selecting a brokerage account, consider the following factors:

- Regulation: Ensure that the brokerage firm is regulated by a recognized financial authority in the country where you plan to trade.

- Fees: Compare the fees charged by different brokers, including transaction fees, currency conversion fees, and account maintenance fees.

- Platform: Look for a platform that is user-friendly and offers the necessary tools for research and analysis.

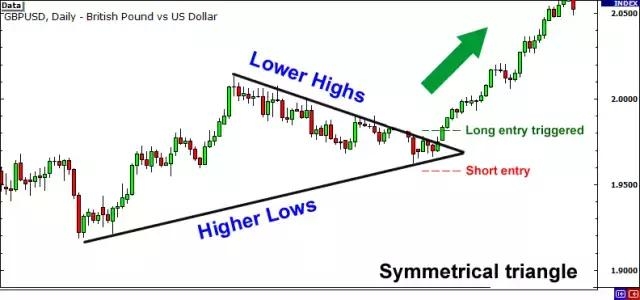

Researching and Selecting Stocks

Once you have a brokerage account, the next step is to research and select stocks. Here are some tips for finding potential investments:

- Market Research: Familiarize yourself with the different markets you're interested in, including their economic and political landscapes.

- Dividends: Consider companies with strong dividend histories, as they can provide a steady income stream.

- Growth Potential: Look for companies with strong growth prospects and a solid business model.

Buying Stocks Outside the US

To buy stocks outside the US, you'll need to follow these steps:

- Open a Currency Account: Depending on the country, you may need to open a currency account to hold the local currency required for trading.

- Place a Trade: Use your brokerage account to place a trade for the desired number of shares.

- Currency Conversion: Be aware of currency conversion fees and exchange rates when buying stocks outside the US.

Selling Stocks Outside the US

Selling stocks outside the US is similar to selling stocks within the US. Here's what you need to do:

- Place a Sell Order: Use your brokerage account to place a sell order for the desired number of shares.

- Currency Conversion: Once the sale is complete, you'll need to convert the proceeds back to your home currency.

- Tax Considerations: Be aware of any tax implications associated with selling stocks outside the US.

Case Study: Investing in European Stocks

Let's say you're interested in investing in European stocks. You open a brokerage account with a firm that offers international trading capabilities. After conducting thorough research, you decide to invest in a German pharmaceutical company with a strong dividend history and growth potential.

You open a currency account in euros and place a trade for 100 shares of the company. A few months later, the stock price increases, and you decide to sell your shares. The proceeds are converted back to US dollars, and you receive the funds in your brokerage account.

Conclusion

Investing in stocks outside the US can be a rewarding experience, but it requires careful planning and research. By following the steps outlined in this article, you can navigate the complexities of international stock trading and expand your investment portfolio. Remember to choose a reputable brokerage firm, conduct thorough research, and stay informed about market trends and economic conditions.

Applied Optoelectronics Inc. Common Stock: ? America stock market