In today's fast-paced financial world, the term "stock surge" has become a buzzword among investors. It refers to a sudden and significant increase in the value of a stock, often driven by market speculation or positive news about the company. This article delves into the mechanics of stock surges, the factors that contribute to them, and how investors can capitalize on this phenomenon.

Understanding Stock Surges

A stock surge occurs when the price of a stock rises rapidly, often within a short period. This surge can be attributed to various factors, such as strong earnings reports, positive news about the company, or an increase in demand for the stock. It is important for investors to recognize the signs of a potential stock surge to make informed decisions.

Factors Contributing to Stock Surges

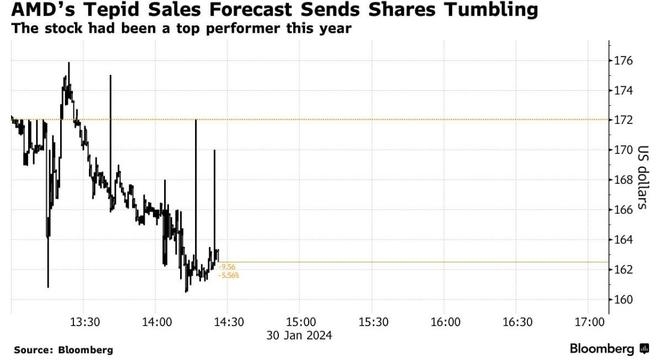

- Strong Earnings Reports: When a company exceeds market expectations with its earnings, it can trigger a stock surge. This is because investors view the company as more profitable and valuable, leading to an increase in demand for its stock.

- Positive News: Any positive news about a company, such as a new product launch, acquisition, or expansion plans, can boost investor confidence and drive up the stock price.

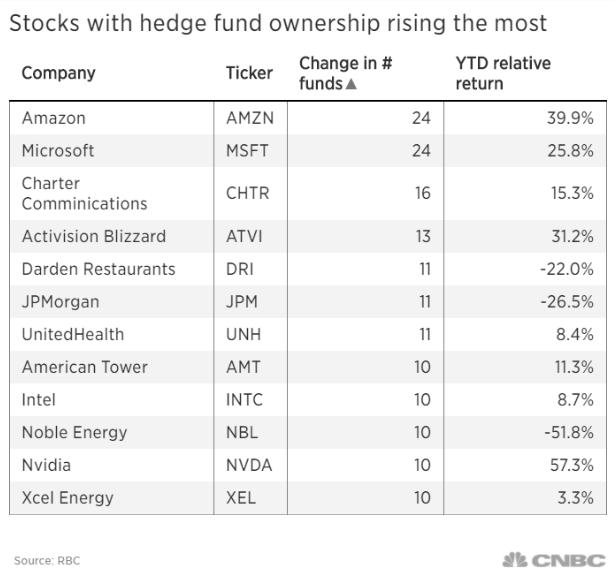

- Market Speculation: Investors often speculate on the potential future growth of a stock, leading to rapid price increases. This speculation can be fueled by rumors, analyst reports, or market sentiment.

- Technological Advancements: Companies that introduce groundbreaking technologies or innovations can experience a significant stock surge as investors anticipate their long-term success.

Capitalizing on Stock Surges

To capitalize on stock surges, investors need to stay informed and vigilant. Here are some strategies:

- Research and Analyze: Before investing in a stock that is experiencing a surge, it is crucial to conduct thorough research. Analyze the company's financial statements, read news reports, and consider market trends.

- Monitor News and Sentiment: Keep an eye on news and market sentiment that could affect the stock's price. This can help you identify potential surges early.

- Diversify Your Portfolio: Investing in a single stock that is experiencing a surge can be risky. Diversify your portfolio by investing in a mix of stocks, bonds, and other assets.

- Use Stop-Loss Orders: A stop-loss order can help limit your potential losses if the stock's price falls sharply after a surge.

Case Studies

- Tesla's Stock Surge: In 2020, Tesla's stock experienced a massive surge following the release of its earnings report. The company's strong performance and commitment to innovation fueled investor optimism, leading to a significant increase in its stock price.

- Amazon's Stock Surge: Over the years, Amazon's stock has experienced multiple surges, driven by its impressive growth and market dominance. Positive news, such as earnings reports or new initiatives, has contributed to these surges.

In conclusion, stock surges can present significant opportunities for investors. By understanding the factors that contribute to these surges and employing sound investment strategies, you can capitalize on this phenomenon and potentially increase your wealth. However, it is important to approach stock surges with caution and conduct thorough research before making any investment decisions.

Applied Optoelectronics Inc. Common Stock: ? America stock market