In recent weeks, the stock market has taken a nosedive, leaving many investors questioning why the market is going down. This article delves into the factors contributing to the downturn and explores potential consequences for the economy.

Economic Indicators and Inflation Concerns

One of the primary reasons behind the stock market's decline is rising inflation and economic indicators. The Consumer Price Index (CPI) has been soaring, reflecting higher costs of goods and services. As a result, investors are becoming increasingly concerned about the Federal Reserve's ability to control inflation without causing a recession.

Federal Reserve Rate Hikes

The Federal Reserve has been raising interest rates in an attempt to combat inflation. These rate hikes make borrowing more expensive for businesses and consumers, which can lead to a slowdown in economic activity. As the cost of borrowing increases, investors often pull back from the stock market, causing prices to fall.

Geopolitical Tensions and Supply Chain Disruptions

Another factor contributing to the stock market's downturn is geopolitical tensions and supply chain disruptions. The ongoing conflict in Eastern Europe has raised concerns about energy prices and global economic stability. Additionally, disruptions in the supply chain have led to shortages of goods and services, further contributing to inflationary pressures.

Corporate Profits and Earnings Reports

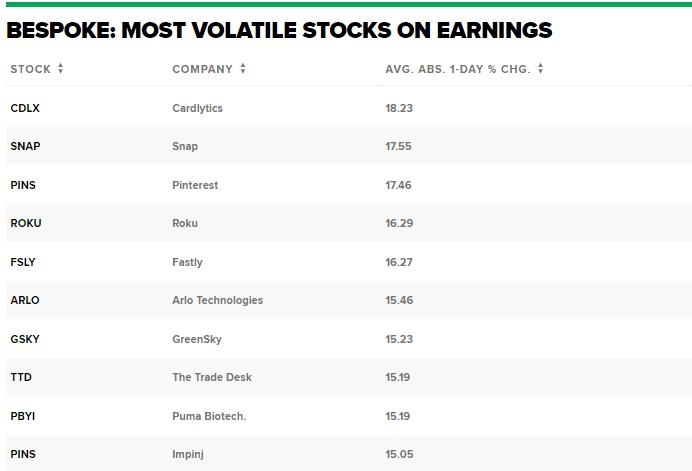

The recent earnings season has also played a role in the stock market's decline. Many companies have reported lower-than-expected profits, largely due to rising costs and supply chain issues. This has caused investors to lose confidence in the market's ability to recover in the near future.

Technological Stock Sell-Off

The technology sector has been particularly hard hit in recent months. Companies like Apple and Amazon have seen their stock prices plummet as investors worry about slowing demand and increasing competition. This sector has been a significant driver of the stock market's growth in recent years, so its downturn has had a substantial impact on the overall market.

Sector-Specific Issues

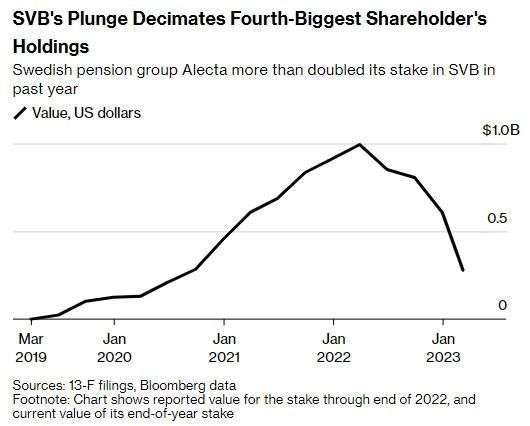

Several sectors have experienced specific issues that have contributed to the overall market's decline. For instance, the energy sector has been affected by the geopolitical tensions in Eastern Europe, while the financial sector has faced challenges due to rising interest rates and inflation.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation have also played a role in the stock market's downturn. Many investors are adopting a more cautious approach, concerned about the market's future. Additionally, speculative trading in certain stocks has contributed to volatility and uncertainty.

Conclusion

In conclusion, the stock market's decline can be attributed to a combination of economic indicators, inflation concerns, geopolitical tensions, and corporate profits. While it's difficult to predict the market's future movements, understanding the factors contributing to the downturn can help investors make more informed decisions. As always, it's essential to keep a long-term perspective and not react impulsively to short-term market fluctuations.

Acadian Asset Management Inc. Common Stock:? America stock market