In today's dynamic aviation industry, airline stocks have become a hot topic for investors. One such airline that has been making waves is JetBlue, a leading carrier in the United States. This article delves into the current state of JetBlue's stock market performance, factors influencing its stock prices, and potential future trends.

Understanding JetBlue US Airline Stocks

JetBlue (NASDAQ: JBLU) is a major airline based in the United States, known for its innovative approach to customer service and technology integration. The company operates a fleet of over 250 aircraft and serves over 100 destinations across North America, the Caribbean, and Latin America. Its stock performance has been a subject of keen interest, as it reflects the airline's overall health and market positioning.

Historical Performance and Current Status

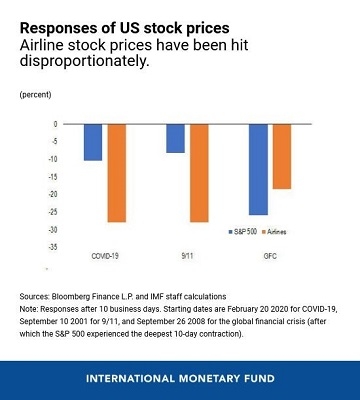

In the past few years, JetBlue's stock has seen significant fluctuations. In 2019, the stock reached an all-time high of $26.70 per share, driven by strong revenue growth and positive earnings reports. However, the outbreak of the COVID-19 pandemic in early 2020 caused a sharp decline in travel demand, leading to a decrease in JetBlue's stock price.

Since then, the stock has shown signs of recovery, driven by a gradual increase in travel demand and the airline's effective cost management. As of the latest available data, JetBlue's stock is trading around $16 per share, indicating a moderate recovery from the pandemic-induced lows.

Factors Influencing JetBlue's Stock Prices

Several factors influence JetBlue's stock prices, including:

- Revenue Growth: Strong revenue growth is a key driver of JetBlue's stock prices. The airline's focus on leisure and premium travel has helped it maintain solid revenue growth even during challenging times.

- Cost Management: Effective cost management is crucial for JetBlue's profitability. The company has taken several measures to control costs, including optimizing its fleet and negotiating better fuel contracts.

- Economic Factors: The overall economic environment plays a significant role in JetBlue's stock performance. Factors such as inflation, interest rates, and consumer spending can impact the airline's revenue and profitability.

- Competition: The level of competition in the aviation industry can also affect JetBlue's stock prices. Increased competition from low-cost carriers and other major airlines can put pressure on the company's market share and profitability.

Potential Future Trends

Looking ahead, several trends could impact JetBlue's stock performance:

- Travel Demand Recovery: As travel demand continues to recover, JetBlue's revenue is likely to grow, driving its stock price higher.

- Innovation and Technology: JetBlue's focus on innovation and technology is expected to help the company differentiate itself from competitors and drive growth.

- Expansion into New Markets: JetBlue's plans to expand into new markets and introduce new routes could further boost its stock performance.

Conclusion

JetBlue's US airline stocks have seen significant fluctuations in recent years, but the company's strong fundamentals and strategic initiatives position it well for future growth. As travel demand continues to recover and the airline industry evolves, JetBlue's stock is likely to remain a key focus for investors.

Artius II Acquisition Inc. Class A Ordinary? Us Stock data