Introduction:

In today’s interconnected global market, international investment has become more accessible than ever. One significant trend that has emerged in recent years is the increasing number of Canadians owning US stocks. This article delves into the reasons behind this trend, its implications, and how it has shaped the investment landscape.

The Growing Trend:

Why Are Canadians Investing in US Stocks?

The allure of US stocks for Canadian investors can be attributed to several factors:

- Strong Market Performance: The US stock market has historically demonstrated resilience and growth, attracting investors from across the globe.

- Diversification: Investing in US stocks allows Canadian investors to diversify their portfolio, mitigating risks associated with domestic market fluctuations.

- Currency Fluctuations: The Canadian dollar has been known to fluctuate significantly, and investing in US stocks can provide a hedge against currency risks.

- Access to Leading Companies: The US hosts some of the world’s largest and most successful companies, offering Canadian investors a chance to invest in renowned brands and innovative industries.

The Implications of the Trend:

Impact on the US Stock Market:

The influx of Canadian investors has had several implications for the US stock market:

- Increased Liquidity: Canadian investments have contributed to higher liquidity in the market, making it more attractive for domestic and international investors.

- Diverse Investment Strategies: Canadian investors often bring diverse investment strategies and perspectives, adding depth to the market.

- Potential for Higher Returns: The increased demand for US stocks may lead to higher stock prices, potentially resulting in higher returns for investors.

Challenges and Considerations:

While owning US stocks offers numerous benefits, there are also challenges and considerations that Canadian investors should be aware of:

- Currency Risk: Fluctuations in the exchange rate can impact investment returns.

- Differences in Reporting Standards: Canadian investors need to be familiar with the reporting and disclosure requirements of US companies.

- Taxes: Tax implications can vary depending on the investor’s country of residence.

Case Studies:

To illustrate the impact of Canadian investment in US stocks, let’s consider a few case studies:

- Tesla Inc. (TSLA): Canadian investors have been significant shareholders in Tesla, contributing to its growth and success.

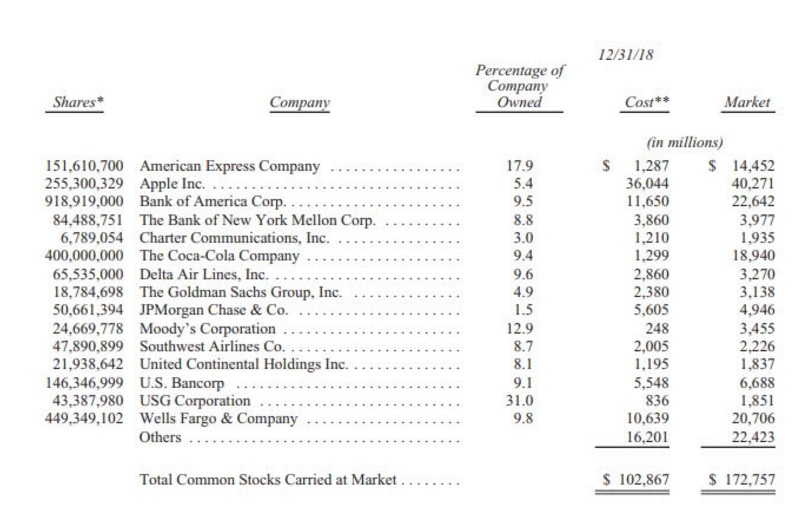

- Apple Inc. (AAPL): Apple has a strong presence in the Canadian market, making it an attractive investment for Canadian investors.

- Microsoft Corporation (MSFT): Microsoft’s global dominance and consistent performance have made it a preferred choice for Canadian investors.

Conclusion:

The increasing number of Canadians owning US stocks is a testament to the global nature of today’s investment landscape. As long as the US market remains attractive, we can expect this trend to continue. For Canadian investors, understanding the implications and challenges of owning US stocks is crucial for making informed investment decisions.

NPRTF Stock: A Deep Dive into the Investmen? Us Stock price