Understanding the Current Landscape

In the world of financial markets, US stock futures often serve as a bellwether for broader economic trends and expectations. The muted rate uncertainty that currently prevails in the market has sparked significant interest among investors. This article delves into the factors influencing this uncertainty and provides insights on how to navigate it effectively.

What is Muted Rate Uncertainty?

Muted rate uncertainty refers to a situation where there is a lack of clear direction or expectation regarding future interest rate changes. This ambiguity can create a cautious sentiment among investors, leading to volatile market conditions. The muted rate uncertainty in the US stock futures market can be attributed to several factors.

1. Central Bank Policies

The Federal Reserve plays a pivotal role in shaping the interest rate environment. With the recent policy changes, the Fed has adopted a more cautious approach to interest rate adjustments. This uncertainty regarding the Fed's future rate decisions contributes to the muted rate environment in US stock futures.

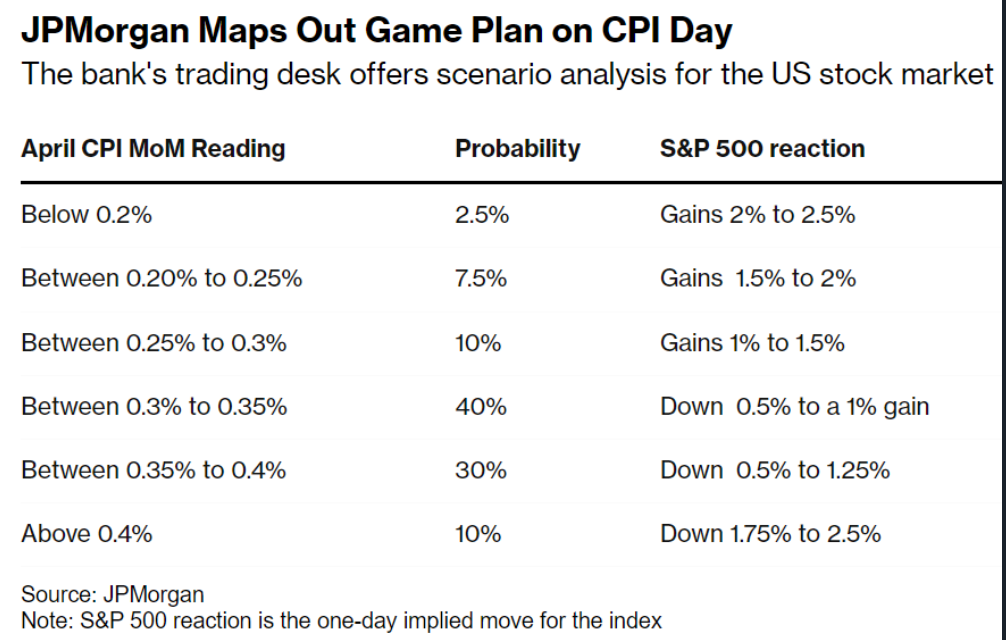

2. Economic Data Fluctuations

Economic data fluctuations, such as employment rates, inflation, and GDP growth, play a crucial role in influencing interest rate expectations. The muted rate uncertainty in the market is often a result of these data points not providing a clear indication of economic health.

3. Global Economic Conditions

The interconnected nature of the global economy means that economic developments in other regions can have a significant impact on the US stock futures market. The muted rate uncertainty can be attributed to global economic conditions, such as trade tensions and geopolitical uncertainties.

Navigating the Muted Rate Uncertainty

To navigate the muted rate uncertainty in US stock futures, investors should consider the following strategies:

1. Diversification

Diversifying your investment portfolio can help mitigate the risks associated with muted rate uncertainty. By allocating your investments across different asset classes and sectors, you can reduce the impact of market volatility.

2. Long-Term Perspective

Maintaining a long-term perspective can help you stay focused on your investment goals despite short-term market fluctuations. This approach allows you to ride out the muted rate uncertainty and benefit from potential long-term gains.

3. Stay Informed

Staying informed about the latest economic data and market trends is crucial for navigating muted rate uncertainty. This includes keeping an eye on central bank policies, global economic conditions, and other relevant factors.

Case Studies

To illustrate the impact of muted rate uncertainty on US stock futures, consider the following case studies:

- Case Study 1: During the period of muted rate uncertainty in 2019, investors who diversified their portfolios and maintained a long-term perspective experienced minimal losses compared to those who were heavily invested in a single sector.

- Case Study 2: In 2020, the muted rate uncertainty was exacerbated by the COVID-19 pandemic. Investors who remained informed and adjusted their strategies accordingly were able to minimize losses and capitalize on opportunities in the market.

Conclusion

Muted rate uncertainty in US stock futures can be challenging for investors, but with a well-defined strategy and a long-term perspective, it is possible to navigate these conditions effectively. By staying informed and diversifying your portfolio, you can mitigate risks and achieve your investment goals despite market uncertainties.

SINGAPORE EXCHANGE LTD Stock Williams%R: A ? Us Stock price