In the vast world of finance, the stock market plays a pivotal role in the economy. For investors, understanding various stock symbols is crucial for making informed decisions. One such symbol that often catches the attention of investors is the "US currency stock symbol." But what exactly does this symbol represent? In this article, we delve into the intricacies of the US currency stock symbol, its significance, and how it impacts the financial market.

What is the US Currency Stock Symbol?

The US currency stock symbol, often represented as "USD," stands for the United States Dollar. It is the official currency of the United States and is widely used in international trade and finance. The USD is considered a major global currency and is often used as a benchmark for other currencies.

The Significance of USD in the Stock Market

The USD plays a crucial role in the stock market, and understanding its stock symbol is essential for investors. Here are a few key reasons why the USD is significant:

- Global Currency Benchmark: As a major global currency, the USD is often used as a benchmark for other currencies. This makes it an important factor in international trade and investment.

- Market Liquidity: The USD is one of the most liquid currencies in the world, which means it can be easily bought and sold without significantly impacting its value. This liquidity is crucial for the stock market, as it ensures that investors can enter and exit positions without causing major disruptions.

- Currency Conversion: When investing in foreign stocks, investors often need to convert their USD into the local currency. Understanding the USD stock symbol is essential for accurately tracking and converting currency values.

How the USD Affects the Stock Market

The USD can have a significant impact on the stock market in several ways:

- Exchange Rates: Fluctuations in the USD's value can affect the prices of stocks, especially those with significant international exposure. For example, if the USD strengthens, it can make imports cheaper, which may benefit companies that rely on imported goods.

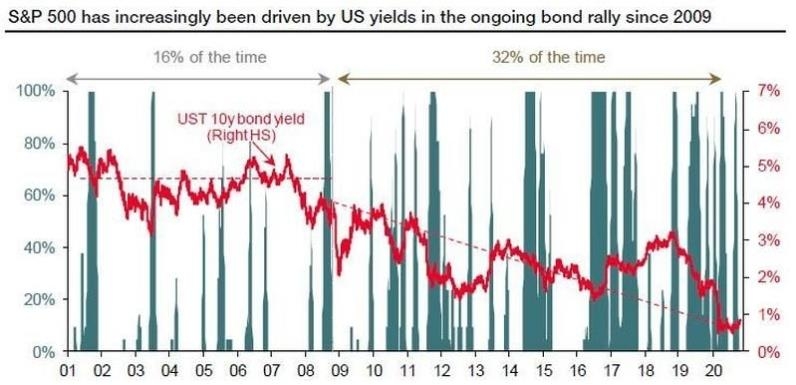

- Inflation and Interest Rates: The USD's value is closely tied to inflation and interest rates. Changes in these factors can influence the stock market, as they can affect corporate earnings and investment returns.

- Currency Hedging: Companies often use currency hedging strategies to protect themselves against fluctuations in the USD's value. This can impact their financial performance and, consequently, their stock prices.

Case Study: Impact of USD on the Stock Market

Consider a hypothetical scenario where the USD strengthens significantly. This could lead to the following outcomes:

- Export-Driven Companies: Companies that rely on exports may see their profits decline, as the stronger USD makes their products more expensive in foreign markets.

- Import-Driven Companies: On the other hand, companies that import goods may benefit from lower costs, which could boost their profits and stock prices.

- Multinational Corporations: Multinational corporations with significant operations in the USD may see their earnings decline due to the stronger currency.

In summary, the US currency stock symbol, represented as "USD," is a crucial aspect of the stock market. Understanding its significance and how it impacts the market can help investors make informed decisions and navigate the complexities of the financial world.

AA Mission Acquisition Corp. Class A Ordina? Us Stock price