Introduction:

Investing in international stocks can be both exciting and challenging. One popular method for U.S. investors to access foreign companies is through American Depositary Receipts (ADRs). In this article, we will delve into the concept of US ADRs with stock ratios, providing you with a comprehensive guide to help you make informed investment decisions.

What are US ADRs?

An American Depositary Receipt (ADR) is a negotiable certificate issued by a U.S. bank, representing a specified number of shares in a foreign company. ADRs allow U.S. investors to buy and sell shares of non-U.S. companies in U.S. dollars, without having to deal with foreign currency exchanges or other complexities.

Understanding Stock Ratios:

A stock ratio is a financial metric that provides insight into the value of a company's shares. One commonly used stock ratio is the price-to-earnings (P/E) ratio, which compares the price of a company's shares to its earnings per share (EPS). This ratio helps investors gauge the market's valuation of a company and its growth prospects.

US ADRs with Stock Ratios:

When analyzing US ADRs, it is crucial to consider their stock ratios. This information allows investors to compare the valuation and performance of foreign companies with those of their domestic counterparts. Here are some key stock ratios to consider when evaluating US ADRs:

Price-to-Earnings (P/E) Ratio: This ratio compares the current share price to the company's EPS. A higher P/E ratio indicates that investors are willing to pay more for each dollar of earnings, suggesting strong growth prospects or high expectations.

Price-to-Book (P/B) Ratio: The P/B ratio compares the market value of a company's shares to its book value per share. A higher P/B ratio may suggest that the stock is overvalued, while a lower ratio may indicate undervaluation.

Earnings Per Share (EPS): EPS is a measure of a company's profitability, calculated by dividing its net income by the number of outstanding shares. A higher EPS can be a positive sign, indicating improved profitability.

Dividend Yield: Dividend yield is the percentage return on an investment based on the dividend payment. A higher dividend yield can be attractive to income-seeking investors.

Case Study: Apple Inc. (AAPL)

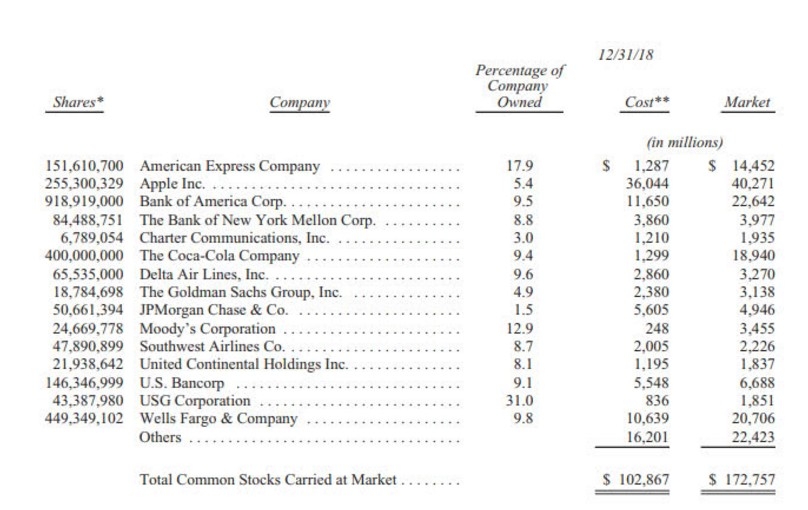

To illustrate the importance of stock ratios, let's take a look at Apple Inc. (AAPL), a U.S. company with a significant presence in the global market. As of this writing, Apple's ADRs have a P/E ratio of 29.5, P/B ratio of 4.8, EPS of $11.57, and a dividend yield of 1.5%.

Comparing these ratios to those of other tech giants like Microsoft (MSFT) and Alphabet (GOOGL), we can see that Apple's P/E ratio is higher than both companies, indicating that investors may be paying a premium for its growth prospects. However, its P/B ratio and EPS are lower than Microsoft and Alphabet, suggesting that Apple may be undervalued compared to its peers.

Conclusion:

Understanding US ADRs with stock ratios is essential for investors looking to expand their portfolios internationally. By analyzing these ratios, investors can gain valuable insights into the valuation and performance of foreign companies, enabling them to make informed investment decisions. Always remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

NBBTF Stock: Unveiling the Potential of a R? Us stock news