The stock market's breadth is a critical indicator that measures the overall health and participation of the market. As we approach October 2025, it's essential to understand the current trends and potential developments that could impact the US stock market. This article delves into the key factors influencing stock market breadth and offers insights into what investors can expect in the coming months.

Understanding Stock Market Breadth

Stock market breadth is a measure of the overall strength and direction of the market. It compares the number of advancing stocks to the number of declining stocks. A broader market indicates widespread participation and confidence, while a narrow market suggests that only a few stocks are driving the overall performance.

Key Factors Influencing Stock Market Breadth

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in determining stock market breadth. A strong economy typically leads to broader market participation, while a weak economy can narrow the market.

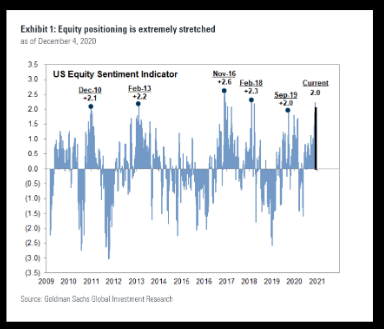

Market Sentiment: Market sentiment, driven by factors such as investor confidence, news, and political events, can significantly impact stock market breadth. Positive sentiment tends to lead to broader market participation, while negative sentiment can narrow the market.

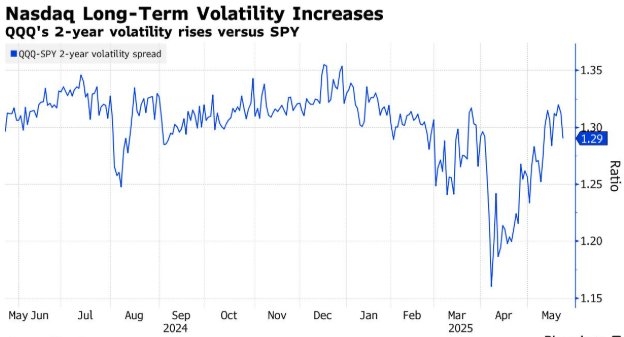

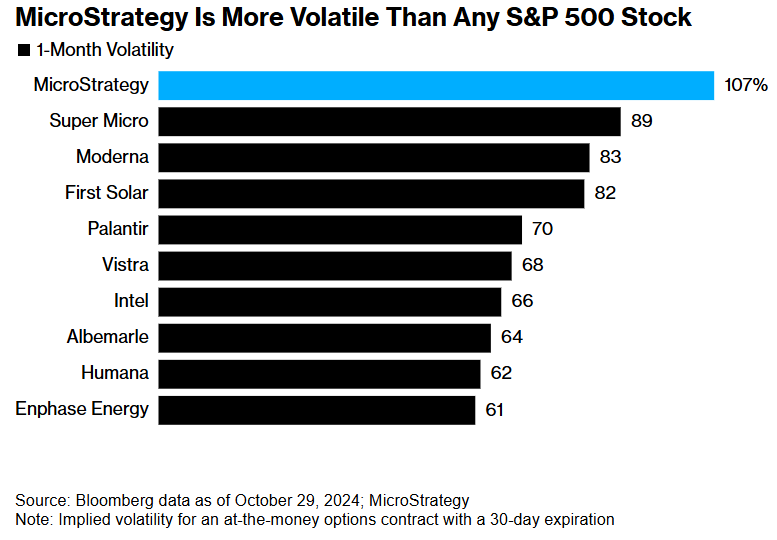

Sector Performance: The performance of different sectors within the market can also influence stock market breadth. When multiple sectors are performing well, it indicates a broader market participation, while a strong performance in only a few sectors can narrow the market.

October 2025 Outlook

As we approach October 2025, several factors are shaping the outlook for the US stock market breadth:

Economic Recovery: The global economy is expected to continue its recovery from the COVID-19 pandemic. This recovery is likely to drive broader market participation and support stock market breadth.

Market Sentiment: Positive market sentiment, driven by factors such as vaccine distribution and economic stimulus measures, is expected to contribute to broader market participation.

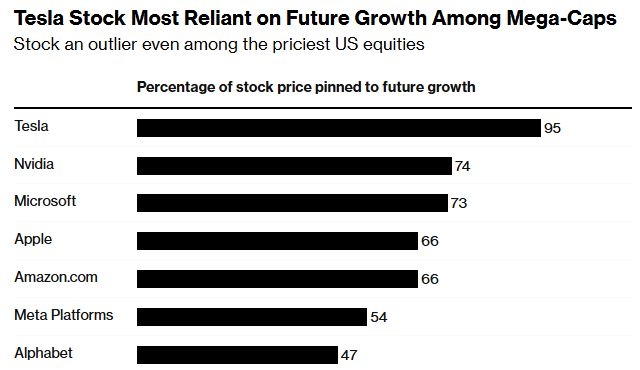

Sector Performance: The technology sector, which has been a major driver of the stock market's performance, is expected to continue its strong performance. However, other sectors, such as financials and consumer discretionary, may also contribute to broader market participation.

Case Study: Technology Sector

The technology sector has been a significant driver of the stock market's performance in recent years. Companies like Apple, Microsoft, and Amazon have seen substantial growth, contributing to broader market participation.

In October 2025, the technology sector is expected to continue its strong performance. This is due to factors such as increasing demand for technology products and services, as well as strong earnings reports from major companies in the sector.

Conclusion

As we approach October 2025, the US stock market breadth is expected to be influenced by a combination of economic indicators, market sentiment, and sector performance. While the technology sector is expected to continue its strong performance, other sectors may also contribute to broader market participation. Investors should stay informed about these factors to make informed decisions in the coming months.

Y.T. REALTY GROUP LTD Stock ADX: Unveiling ? Us stock news