In today's fast-paced world, the stock market is a key indicator of the economic health of a nation. With the markets experiencing unprecedented volatility, many investors are left scratching their heads, wondering what is going on. This article delves into the current state of the markets, examining the factors contributing to the volatility and offering insights into how investors can navigate this uncertain terrain.

Understanding Market Volatility

Volatility refers to the degree of variation in the price of a financial instrument over a given period of time. In the context of the stock market, volatility can be attributed to various factors, including economic data, geopolitical events, and corporate earnings reports.

Economic Data

One of the primary drivers of market volatility is economic data. When the data is strong, it often indicates that the economy is growing, which can lead to higher stock prices. Conversely, weak economic data can signal a slowdown in economic growth, causing stock prices to fall.

For example, the recent release of the U.S. jobs report showed that the economy added 263,000 jobs in October, which was above the consensus estimate of 200,000. This positive economic data contributed to a rally in the stock market.

Geopolitical Events

Geopolitical events, such as elections, trade disputes, and military conflicts, can also cause significant volatility in the markets. For instance, the ongoing trade tensions between the United States and China have created uncertainty in the markets, leading to volatility.

Corporate Earnings Reports

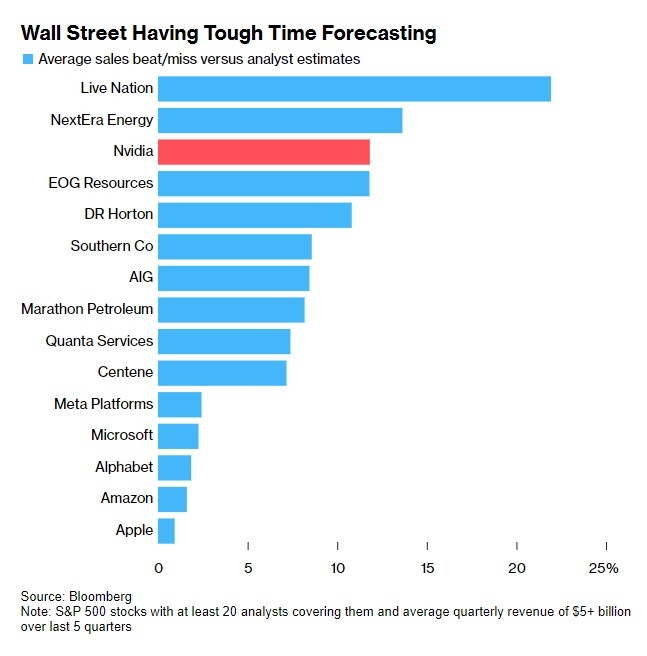

Another major factor contributing to market volatility is corporate earnings reports. When companies report earnings that are better or worse than expected, it can cause significant movement in their stock prices, which can then impact the broader market.

Navigating the Volatile Markets

So, what can investors do to navigate the volatile markets? Here are a few tips:

- Diversify Your Portfolio: Diversification can help reduce the risk of your portfolio by spreading your investments across various asset classes, such as stocks, bonds, and real estate.

- Stay Informed: Keep yourself updated with the latest economic news and market trends. This will help you make informed decisions about your investments.

- Avoid Emotional Investing: Emotional investing can lead to poor decision-making. It's important to stay calm and make rational decisions based on the information available.

- Consider a Long-Term Perspective: While short-term market fluctuations can be unsettling, it's important to remember that the stock market has historically shown long-term growth.

Conclusion

The current state of the markets is characterized by volatility, driven by economic data, geopolitical events, and corporate earnings reports. By understanding the factors contributing to this volatility and taking a disciplined approach to investing, investors can navigate this uncertain terrain and achieve their financial goals.

SAMSUNG EL PFD S/GDR 144A Stock Momentum: A? Us stock news