Are you considering expanding your investment portfolio to include Canadian stocks? If so, you're not alone. Canada's stock market has been a popular destination for investors looking for opportunities in the North American market. In this article, we'll explore how you can buy stocks in Canada, the benefits of investing in Canadian companies, and some key considerations to keep in mind.

Understanding the Canadian Stock Market

The Canadian stock market is home to many well-known companies across various industries, including energy, technology, finance, and consumer goods. The Toronto Stock Exchange (TSX) and the TSX Venture Exchange are the two main stock exchanges in Canada, where investors can buy and sell shares of publicly-traded companies.

How to Buy Stocks in Canada

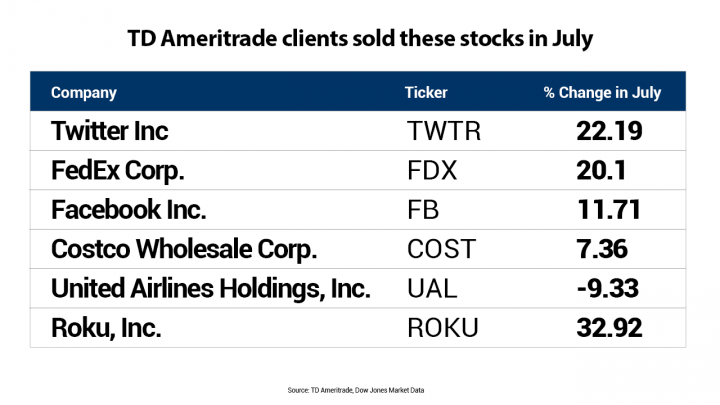

Open a Brokerage Account: To buy stocks in Canada, you'll need a brokerage account. There are many reputable online brokers that offer services to U.S. investors, including TD Ameritrade, E*TRADE, and Charles Schwab.

Research Canadian Stocks: Before investing, it's important to research the Canadian stocks you're interested in. Look for companies with strong fundamentals, a solid track record, and a clear growth strategy.

Determine Your Investment Strategy: Decide whether you want to buy individual stocks, exchange-traded funds (ETFs), or mutual funds. Each option has its own advantages and risks.

Place Your Order: Once you've chosen your investments, you can place your order through your brokerage account. Be sure to understand the fees associated with your purchase, including brokerage commissions and potential currency exchange fees.

Benefits of Investing in Canadian Stocks

Diversification: Investing in Canadian stocks can help diversify your portfolio, reducing exposure to market volatility in the U.S.

Strong Economy: Canada has a stable and growing economy, with a diverse range of industries and a strong focus on innovation.

Quality Companies: Many Canadian companies are global leaders in their respective industries, offering investors access to high-quality businesses.

Key Considerations

Currency Exchange: When investing in Canadian stocks, you'll be dealing with Canadian dollars. Be aware of the potential for currency fluctuations and their impact on your investment returns.

Tax Implications: It's important to understand the tax implications of investing in Canadian stocks, as they may differ from U.S. tax laws.

Regulatory Differences: The Canadian stock market operates under different regulations than the U.S. market, so it's important to familiarize yourself with these differences.

Case Study: Royal Bank of Canada (RBC)

One of the largest banks in Canada, Royal Bank of Canada (RBC) is a popular investment choice for U.S. investors. RBC has a strong presence in both Canada and the U.S., offering a diverse range of financial services. Over the past decade, RBC has delivered consistent growth and has been a reliable performer in the financial sector.

By understanding the Canadian stock market and conducting thorough research, you can make informed decisions about buying stocks in Canada. Whether you're looking to diversify your portfolio or seek out high-quality investments, Canadian stocks can be a valuable addition to your investment strategy.

WNHLF Stock: A Comprehensive Guide to Under? Us stock information