In the world of finance, the United States is home to a vast array of stock indexes that serve as benchmarks for investors and traders. These indexes provide a snapshot of the overall performance of the stock market, allowing investors to gauge the health and direction of the economy. But just how many stock indexes are there in the US? Let's dive into the details.

The Major Stock Indexes in the US

The most well-known stock indexes in the US are the Dow Jones Industrial Average (DJIA), the S&P 500, and the NASDAQ Composite Index. Each of these indexes represents a different segment of the market and serves as a vital tool for investors.

Dow Jones Industrial Average (DJIA): This index tracks the performance of 30 large companies that are widely considered to represent the overall economy. The DJIA is often used as a barometer for the health of the stock market and the broader economy.

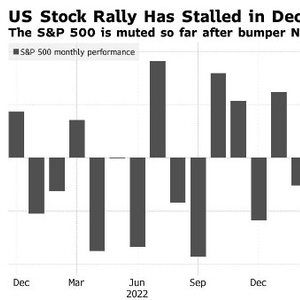

S&P 500: This index consists of 500 large-cap companies from various sectors of the economy. It is widely regarded as the benchmark for the U.S. stock market and is often used to gauge the overall performance of the market.

NASDAQ Composite Index: This index includes all domestic and international common stocks listed on the NASDAQ Stock Market. It is particularly popular among technology companies and is often used to track the performance of the tech sector.

Other Notable Stock Indexes

In addition to the major indexes, there are several other notable stock indexes in the US that cater to specific sectors or regions.

Russell 3000 Index: This index tracks the performance of 3,000 large, mid, and small-cap companies across the U.S. It provides a comprehensive view of the entire market and is often used as a benchmark for diversified portfolios.

Wilshire 5000 Total Market Index: This index includes all U.S. equity securities with readily available price data. It is considered the broadest measure of the U.S. equity market and is often used to track the overall performance of the stock market.

MSCI USA Index: This index tracks the performance of large and mid-cap U.S. companies across various sectors. It is widely used by international investors to gain exposure to the U.S. stock market.

Case Study: The Impact of Stock Indexes on Investment Decisions

Consider an investor who is looking to invest in the U.S. stock market. By analyzing the performance of various stock indexes, the investor can make informed decisions about where to allocate their capital.

For instance, if the S&P 500 is performing well, the investor might decide to invest in a broad-based index fund that tracks the S&P 500. Conversely, if the NASDAQ Composite Index is outperforming, the investor might consider investing in a technology-focused ETF.

Conclusion

In conclusion, the United States is home to a diverse array of stock indexes that cater to different investment strategies and preferences. By understanding the performance of these indexes, investors can make more informed decisions about their investments. Whether you're looking for a benchmark for the overall market or a specific sector, there's an index out there for you.

Artius II Acquisition Inc. Class A Ordinary? Us stock information