The US stock market has always been a barometer of the nation's economic health. However, it's not immune to external shocks, and one of the most significant factors that can impact the market is war. This article delves into the impact of war on the US stock market, exploring how it affects various sectors and the broader market sentiment.

War and Market Volatility

War creates uncertainty and volatility in the stock market. Investors often react to news of conflict by selling off their investments, leading to a decrease in stock prices. This is because war can disrupt supply chains, cause economic instability, and lead to higher inflation and interest rates.

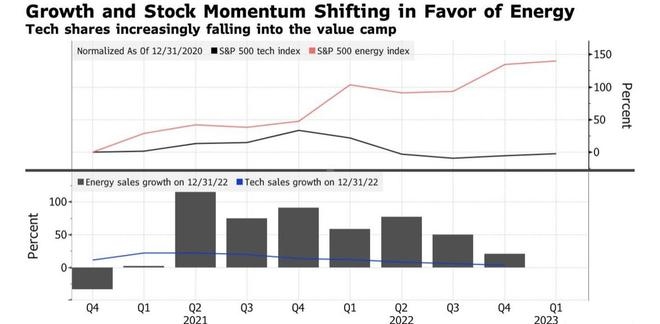

Sector-Specific Impacts

Different sectors are affected differently by war. For instance, the energy sector often benefits from war due to increased demand for oil and gas. On the other hand, the technology sector may suffer due to disruptions in supply chains and reduced consumer spending.

Case Study: The Gulf War

One of the most significant examples of war's impact on the US stock market is the Gulf War in 1990-1991. The market experienced a sharp decline in the weeks leading up to the war, with the S&P 500 falling by about 6%. However, once the war began, the market quickly recovered, and the S&P 500 ended the year with a gain of about 3%.

Long-Term Impacts

While the immediate impact of war on the stock market is often negative, the long-term effects can vary. In some cases, war can lead to increased government spending on defense and infrastructure, which can stimulate economic growth. However, in other cases, the long-term effects of war, such as economic instability and political tensions, can be detrimental to the stock market.

Market Sentiment and War

Market sentiment plays a crucial role in how the stock market reacts to war. If investors believe that the war will have a limited impact on the economy, they may be more willing to hold onto their investments. However, if there is a widespread belief that the war will lead to significant economic disruptions, the market may experience a more pronounced decline.

Conclusion

In conclusion, war can have a significant impact on the US stock market. While the immediate effects are often negative, the long-term effects can vary. Investors need to be aware of the potential risks associated with war and consider how it may affect their investments. By understanding the impact of war on the stock market, investors can make more informed decisions and better manage their portfolios.

Digital Brands Group Inc. Common Stock: A C? Us stock information