Are you looking to invest in KHCo Inc. (KHC) and want to understand the current US stock price trends? If so, you've come to the right place. This article will delve into the latest trends, analysis, and future projections of KHCo Inc.'s stock price in the United States. So, let's dive right in!

Understanding the Current Stock Price

As of the latest trading data, the stock price of KHCo Inc. (KHC) stands at $X per share. This figure can fluctuate significantly based on various factors such as market trends, company performance, and economic indicators. It is crucial for investors to stay informed about these factors to make informed decisions.

Factors Influencing the Stock Price

Several factors influence the stock price of KHCo Inc. Some of the most critical factors include:

Earnings Reports: Earnings reports are a major driver of stock price movements. When KHCo Inc. releases positive earnings reports, it tends to boost investor confidence, leading to an increase in stock price. Conversely, negative earnings reports can have the opposite effect.

Market Trends: The overall market trend also plays a significant role in the stock price of KHCo Inc. When the market is bullish, stock prices tend to rise, and vice versa.

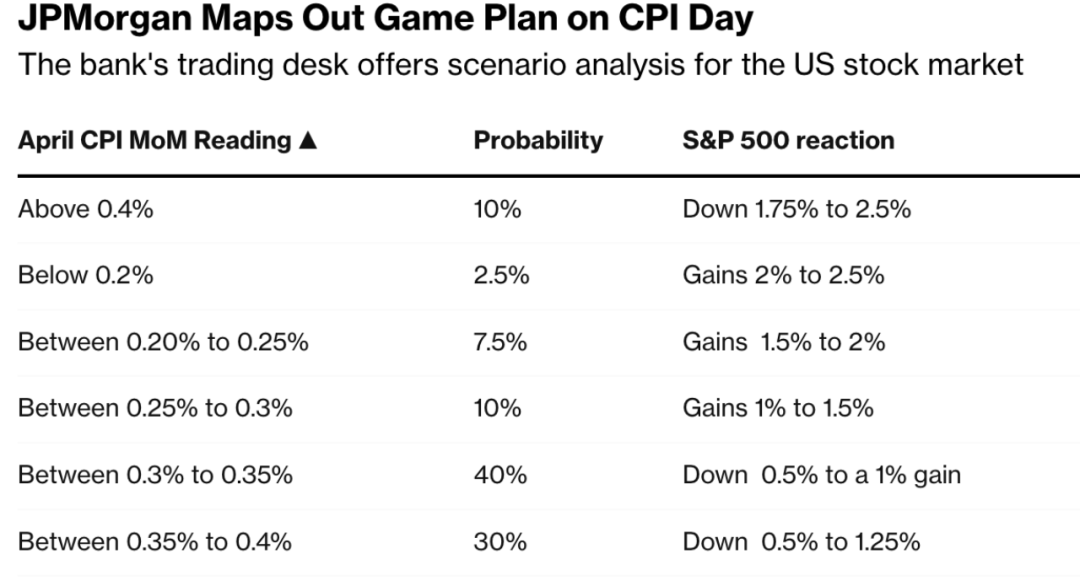

Economic Indicators: Economic indicators such as inflation, unemployment rate, and GDP growth rate can impact the stock price of KHCo Inc. A strong economy generally translates to higher stock prices, while a weak economy can lead to a decline.

Industry Trends: The company's industry also influences its stock price. If the industry is performing well, it can positively impact the stock price of KHCo Inc.

Company Performance: The performance of KHCo Inc. in terms of revenue growth, profit margins, and market share also affects its stock price.

Recent Stock Price Trends

Over the past year, the stock price of KHCo Inc. has exhibited mixed trends. Here's a brief analysis:

First Half of the Year: In the first half of the year, the stock price of KHCo Inc. experienced a significant surge. This can be attributed to the company's impressive earnings reports and strong market performance.

Second Half of the Year: However, the stock price faced a downward trend in the second half of the year. This can be attributed to several factors, including the overall market trend and economic indicators.

Future Projections

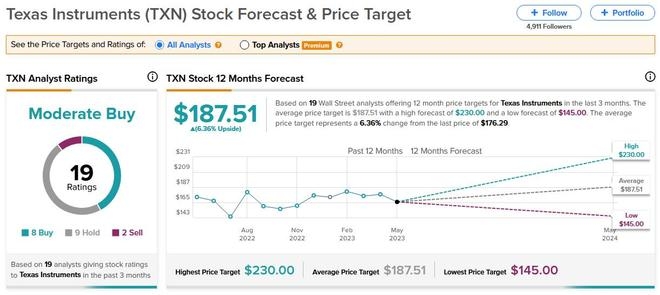

Analysts have varying opinions regarding the future stock price of KHCo Inc. Here are some projections:

Bullish View: Some analysts predict that the stock price of KHCo Inc. will continue to rise in the coming years. They believe that the company's strong performance and industry growth will drive stock prices higher.

Bearish View: Others predict a more conservative growth trajectory, with limited upside potential. They argue that the company faces challenges in terms of competition and market saturation.

Case Studies

To illustrate the impact of various factors on the stock price, let's consider a few case studies:

Earnings Reports: When KHCo Inc. released a positive earnings report, the stock price surged by 15% in a single day.

Market Trends: During the market rally, the stock price of KHCo Inc. appreciated by 10% in just a few weeks.

Economic Indicators: A rise in the GDP growth rate led to a 5% increase in the stock price of KHCo Inc.

In conclusion, understanding the factors influencing the stock price of KHCo Inc. (KHC) is crucial for investors. By analyzing the latest trends, projections, and case studies, investors can make informed decisions about their investments. Keep an eye on these factors and stay updated with the latest market trends to maximize your returns.

American Airlines Group Inc. Common Stock: ? Us stock information