Are you considering investing in US stocks but unsure about the next steps? This comprehensive guide will help you navigate the world of US equities and decide whether it's the right move for your portfolio.

Understanding the US Stock Market

The US stock market is the largest and most developed in the world. It provides a diverse range of investment opportunities across various sectors and industries. Here are some key points to consider before investing:

- Market Size and Liquidity: The US stock market is known for its high liquidity, which means it's easy to buy and sell stocks without significant price changes.

- Diverse Sectors: You can invest in companies across sectors such as technology, healthcare, finance, and energy.

- Access to World-Class Companies: The US market hosts some of the world's largest and most successful companies, offering exposure to global markets.

Pros of Investing in US Stocks

Investing in US stocks comes with several benefits:

- Potential for High Returns: Historically, the US stock market has provided investors with strong returns, often outperforming other asset classes like bonds or cash.

- Dividends: Many US companies pay dividends, which can provide regular income streams.

- Tax Advantages: In the US, qualified dividends are taxed at a lower rate than regular income.

Cons of Investing in US Stocks

Before diving in, it's essential to consider the potential drawbacks:

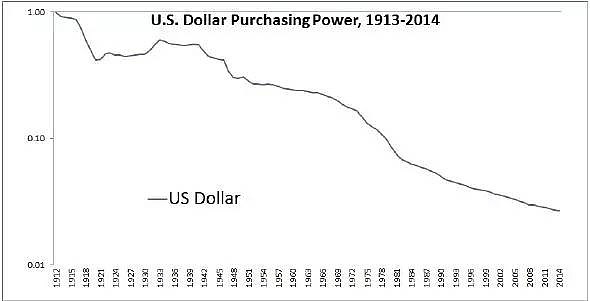

- Market Volatility: The stock market can be volatile, and prices can fluctuate significantly, leading to potential losses.

- Economic Risks: Economic downturns or geopolitical events can impact the US stock market.

- High Fees: Some investment platforms charge fees for trading and management, which can eat into your returns.

How to Invest in US Stocks

To invest in US stocks, you'll need to follow these steps:

- Open a Brokerage Account: Choose a reputable brokerage firm and open an account.

- Research Companies: Conduct thorough research on companies you're interested in, including their financial statements, business models, and growth prospects.

- Diversify Your Portfolio: Consider diversifying your portfolio to spread out risk and invest in different sectors and industries.

- Monitor Your Investments: Keep an eye on your investments and stay informed about market trends and company news.

Case Studies

- Apple (AAPL): Apple has been a top performer in the US stock market, providing strong returns and steady dividend payments.

- Tesla (TSLA): Tesla has experienced significant growth, with its stock price skyrocketing in recent years.

- Microsoft (MSFT): Microsoft is a well-established company with a strong track record of growth and innovation.

Final Thoughts

Investing in US stocks can be a valuable addition to your portfolio. However, it's crucial to do thorough research, understand the risks, and develop a well-diversified investment strategy. By considering the factors outlined in this guide, you'll be better equipped to make an informed decision about your investment in US stocks.

PFSMF Stock: The Ultimate Guide to Understa? Us stock information