As we delve into the heart of July 2025, the US stock market continues to evolve, shaped by a myriad of economic factors and investor sentiment. This article explores the latest trends, offering insights into the current landscape and potential future directions.

Economic Outlook and Interest Rates

The US economy has shown resilience, with low unemployment rates and steady economic growth. However, the Federal Reserve's monetary policy has been a significant driver of market trends. As of July 2025, the Fed has maintained a cautious stance, with interest rates remaining relatively stable. This has had a positive impact on the stock market, as lower interest rates tend to boost investor confidence and encourage borrowing and spending.

Sector Performance

Technology remains a dominant force in the US stock market, with companies like Apple, Microsoft, and Amazon leading the charge. The tech sector has seen significant growth, driven by innovation and strong earnings reports. On the other hand, sectors like energy and financials have faced challenges, with fluctuating oil prices and regulatory changes impacting their performance.

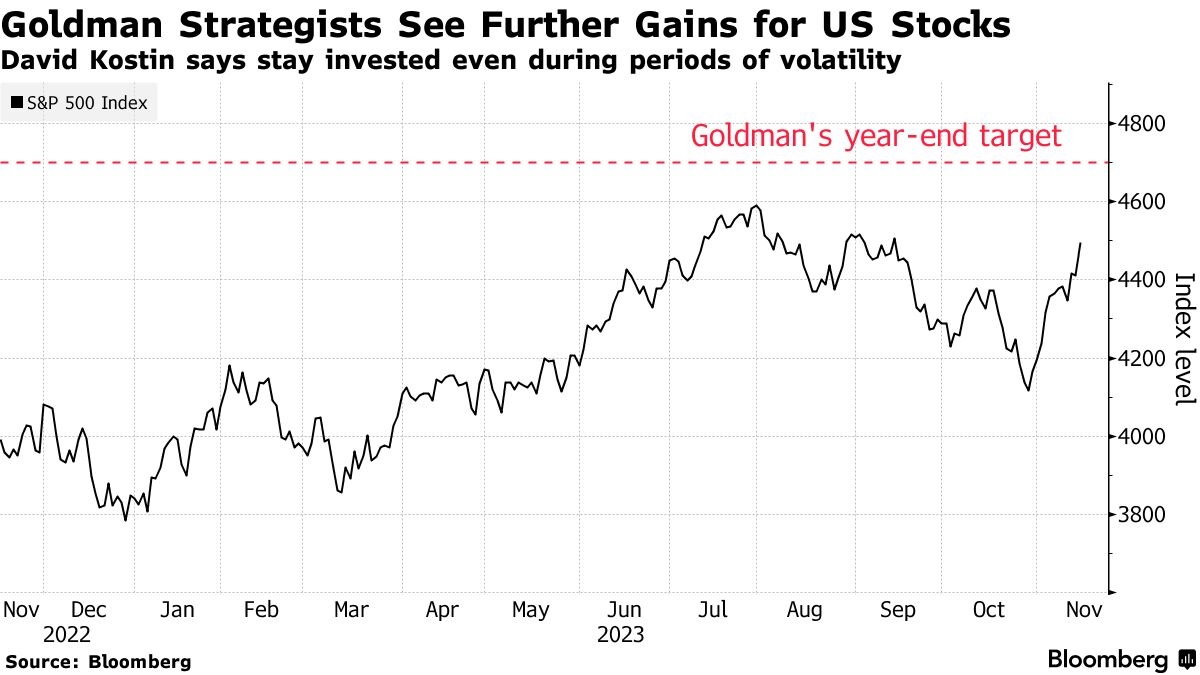

Market Indices

The S&P 500, the benchmark index for the US stock market, has experienced a period of steady growth, with a notable rise in the first half of 2025. The index is currently trading at around 4,200 points, reflecting the strong performance of large-cap companies. Meanwhile, the NASDAQ has also seen substantial growth, driven by tech stocks. The index is currently trading at around 16,000 points.

IPO Activity

Initial Public Offerings (IPOs) have been a key driver of market activity in July 2025. Companies like DoorDash and Instacart have successfully gone public, raising significant capital and boosting investor interest. This trend is expected to continue, with more startups and established companies looking to capitalize on the favorable market conditions.

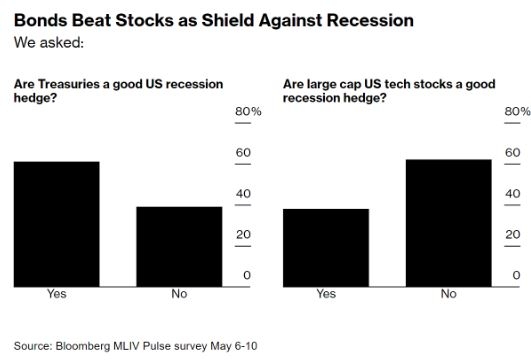

Market Volatility

Despite the overall upward trend, the US stock market has experienced periods of volatility. This is primarily due to global economic uncertainties, including geopolitical tensions and trade disputes. Investors remain cautious, with a focus on diversifying their portfolios and managing risk.

Case Study: Tesla

A notable case study is Tesla, the electric vehicle manufacturer. Despite facing challenges related to production delays and supply chain disruptions, Tesla has managed to maintain its position as a market leader. The company's strong earnings reports and commitment to innovation have helped it navigate through tough times, reinforcing its position as a key player in the tech sector.

Conclusion

The US stock market in July 2025 presents a complex mix of opportunities and challenges. While technology remains a dominant force, sectors like energy and financials have faced challenges. Investors need to remain vigilant, focusing on market trends and economic indicators. With a cautious approach and a focus on diversification, investors can navigate the current landscape and position themselves for future growth.

CHARLESTOWNE PREMIUM BEV Stock DoubleTop: A? Us stock information